VIDEO: Why plan for taxes on startup equity and startup stock options? From the Secret Keys of Startup Equity Series

If you're reading my blog and I'm talking about taxes for startup equity or startup stock options, I can understand that you might be thinking "blah, blah, blah, blah blah." Here's why it matters :)

Joining a startup? Here’s why startup hires plan for taxes on their startup stock options, restricted stock and RSUs. It’s not just “blah, blah, blah,” I promise.

If you're reading my blog and I'm talking about taxes for startup equity, I can understand that you might be thinking "blah, blah, blah, blah blah." Here's why it matters :)

Startup hires, even very sophisticated people, can miss out on the upside of joining a startup if they lose track the big picture themes of startup equity. This series - The Secret Keys of Startup Equity - is designed to outline the basic principles of startup equity to help you see the big picture and not get lost in all the fine print details of startup restricted stock, startup stock option and startup RSUs. You can consider this sort of the secret key to my blogs and my courses. If want to watch the whole series as one video, it’s here for your viewing pleasure.

Startup Compensation Data Sources

Here’s some links to helpful market data for startup equity offers. Individuals negotiating a startup offer often struggle to find good resources for startup compensation data since the key data sources are only available on the company side.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Published February 2023. Updated regularly.

Market Data Sources

Individuals often struggle to find good resources for startup compensation data since subscriptions to the primary startup compensation data sources are only available on the company side. Companies are using Pave (including the classic Advanced-HR Venture Capital Executive Compensation Survey, now owned by Pave), Radford and Mercer. The information imbalance is challenging to say the least.

October 2024 update: Pave is currently the most highly-respected data source for startups, so that is the gold standard right now for startups making offers. However, Pave has the least access available to individuals. If you’re at Pave and want to help rectify this, let me know :). Carta has the most access for individuals (see below re Friends of Carta), but it’s numbers skew very low in my experience.

Here’s some links that readers have found helpful:

March 2025, Betts Recruiting’s Enterprise Compensation Guide. It drills down on cash comp and quotas for every level of the enterprise sales team.

Levels.fyi, which, according to YC is “directionally correct (self-reported, and stronger on engineering roles).”

January 2025, Venture5 Media’s VC Salary Survey for salary + carry data for compensation within VC firms (not to be confused with data for VC-funded companies) including analysts, associates, senior associates, platform roles, VPs/principals, and investmetn partners.

Bett's Recruiting’s Comp Engine, for Sales, Marketing and Customer Success compensation insights.

January 2025, Carta on startup advisor equity grants.

November 2024, Carta’s update on 1st 10 hires equity comp info.

September 2024, Carta’s Peter Walker with data on director-level roles at startups with $50M valuation v. $500M valuation. Includes salary benchmarks for director of customer success, director of sales, director of operations, director of marketing, director of HR, director of design, director of product, director of data, and director of engineering.

September 2024, Alejandro Cremades of Panthera Advisors on distributing equity among founders and early employees.

August 2024, venture capitalist Heidi Roizen’s podcast on “How to Think About Dilution,” with helpful thoughts on distributing equity among founders and why founders, executives and employees should not expect to maintain their equity percentage over time.

July 2024, Carta’s Start of Startup Compensation Report for Q1 2024, including downloadable addendum with further data on employees, board members, and advisors.

July 2024, Carta’s Peter Walker’s Salary Gap by Company Valuation, finding that “salaries jump about 20% between companies worth $25 million and companies worth $250 million." He asks the $10 million dollar question: “does the expected value of the equity increase over that same valuation span justify the reduced salary?”

July 2024, General Catalyst’s 2024 Equity Refresh Survey.

June 2024, Betts’ Recruiting 2024 Compensation Guide for cash compensation for all levels of sales and marketing roles.

May 2024, Charlie Franklin’s post on the nuances of AI engineering compensation including the “growing spread between the AI median and 75th percentile.”

April 2024, Carta’s post on equity refreshes at startups. Still, in my experience the lion’s share (I’d say 90%) of equity at startups is in the initial grant, so that’s where the action is on negotiating equity at startups.

April 2024, Betts Recruiting published their 2024 Executive Comp Guide for salaries for exec roles (including fractional) from Seed through Series D.

April 2024, Levels.fyi’s co-founder published some commentary and data links on compensation for AI talent on LinkedIn.

April 2024, Pave CEO published data on founding and non-founding startup CEO compensation on LinkedIn.

March 2024, Carta published their State of Startup Compensation for H2 2023.

March 2024, Carta published an addendum to the above with data for early stage companies including: median advisor equity for pre-seed, seed, and Series A companies, median equity grants for a startup’s first 10 employees and median equity grants for startup board members at the early stages.

March 2024, Betts Recruiting published compensation discussion on Enterprise Account Executive role and comp.

February 2024, Betts Recruiting published their 2024 Compensation Guide. Includes great insights about variations in today’s market for Sales, Customer Success and Marketing roles.

February 2024, Betts recruiting published their How Much Money Can You Make in Tech Sales for 2024.

January 2024, Carta’s posting on startup advisor compensation on LinkedIn. Careful these numbers seem low for a lot of people called “advisors” who Carta categorizes as something else.

January 2024, Betts Recruiting published their Top Account Executive Compensation Trends in Tech for 2024.

January 2024, Betts Recruiting published their Top Sales Development Representative Compensation Trends in Tech for 2024.

January 2024, FairOffer.ai launched an innovative data-science based comp tool with searches available to individuals. I’m still testing to see if it’s in line with other more established services, but seems like an exciting offering.

EOY 2023, Levels published its 2023 Pay Report showing median total yearly compensation for various job families and levels: “While new graduate and entry level roles have been significantly affected this year, the most competitive opportunities still continue to compensate significantly for top talent.”

On November 14, 2023, Compa published a data-centered analysis on the difference in compensation between SWE and AI Eng: AI Eng pays 2x higher than SWE- Salaries have ~10-15% premium, but new hire grants have ~100%+ premium.

As of October 20, 2023, Carta has offered a “Friends of Carta” program where they have offered to provide their compensation data to individuals on a one-off basis. More here.

On October 10, 2023, Betts Recruiting published its Top Director Compensation Trends, highlighting various salary and benefit trends for the top Director and department Head titles at startups.

Carta’s Startup Comp Report H1 2023 offered trends in salaries and equity grants in this unique time in the market.

Wellfound (previously Angel List Talent) on salary and equity benchmarks for early stage startups.

Q4 2023 update on VP level salary ranges from Betts Recruiting’s blog.

September 2023, General Catalyst’s survey on startup advisor compensation.

July 2023, Carta’s Data Minute published median founder equity splits data in their newsletter.

One founder: 100%

Two founders: 55%/45%

Three founders: 47%/33%/17%

Four founders: 40%/27%/18%/10%

Five founders: 35%/22%/17%/12%/9%

Salaries, OTE, etc. for sales roles from RepVue.

Roger Lee of Layoffs.io fame launched Comprehensive.IO to track salary range listings.

Bett's Recruiting’s 2023 2H Compensation Guide with market data for cash compensation at all levels within Sales, Customer Success and Marketing by geographic location.

Betts Recruiting’s 2023 Executive Compensation Guide with market data for cash compensation for many C-suite and VP roles at startups by company stage including C-level, VPs, directors, fractional and advisors!

Carta’s State of Startup Compensation report Q1 2023 including median equity grants for a startup’s first 10 hires. These numbers seemed really low to me, and I asked some questions of the writer to figure out why. These numbers exclude any grant over 5%, so it skews low. They’ve classified any grant over 5% as a founder not an employee. So if these seem low to you, that’s why!

Carta’s State of Startup Compensation report Q1 2023 including median advisor grants by company stage pre-seed, seed and Series A, geographic adjustments, and median salaries for 9 functions (engineering, data, product, legal, research, design, strategy, sales, finance, HR/recruiting, marketing, project management, customer success, operations, accounting, support and administrative). One quick-take: "10% of pre-seed advisors receive 1% or more equity.”

Carta’s September 2022 shockingly comprehensive Salary & Equity Data for New York City for all levels within engineering, product and customer success. Thank you, Peter Walker @ Carta.

Betts Recruiting’s 2022 Equity Guide with market data for equity and cash offers for all levels on the sales team, directors and advisors at seed (by %), Series A (by %), Series B (by %), and Series C through IPO (by dollar value)

Matt Schulman of Pave (a company-side startup compensation data service) 2023 Medium post titled How much comp should the first engineer at a venture backed startup get — cash, equity, and title? Pave also publishes an Equity Guide, designed to help companies approach equity data including the difference between new hire benchmarks and total equity benchmarks. Linking here in case individuals might find it helpful.

Startup Legal Stuff’s guide for employers with recommended equity percentages for equity grants following a Series A for C-suite, board members, lead engineer, senior engineer, and junior engineer.

Carta’s Average salary ranges in NYC: Engineering, product, customer success including specific salary data for companies with $100-250M post-money valuation for engineer senior manager, engineering director, product senior manager, product director, customer success senior manager and customer success director.

In 2018, Business Insider published a database of startup executive compensation data leaked from Andreessen Horowitz. The cash numbers are likely outdated, but the equity numbers are likely still “in the range.”

Good luck! Please send along anything you’d like me to include on this list.

How to Use Market Data

And here’s some good links on how to use market data. They are written for companies, but helpful to any individual’s thoughtful approach to this topic.

April 2024, Charlie Franklin of Compa’s discussion of leveling as “at least twice as important as market percentile.” I wholeheartedly agree.

February 2024, Heidi Roizen’s podcast commentary on startup advisors.

Carta’s State of Startup Compensation H1 2023 re market trends on salary and equity benchmarks.

Leveling Guide from Carta.

Why peer group selection is as important as market percentile from Charlie Franklin.

Why not to use pay range disclosures as a guide to market comp from Charlie Franklin: “[U]sing pay range disclosures to price jobs is problematic. The jobs aren’t leveled and matched, the ranges are broad (and it’s hard to know where companies actually pay in the range, or if they’re disclosing the real range), and of course you can only see base salary, a small part of the story.”

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Startup Double Trigger Acceleration Clause Fine Print Details

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Double Trigger Acceleration Clauses

Startup founders, executives and key hires often negotiate for Double Trigger Acceleration to protect their unvested shares in the event of a change of control or acquisition. This is the smart move, as otherwise the value of the unvested shares can be lost in the event of a successful acquisition. For example, an executive with a 1% equity interest could end up with $0 if the company is acquired within the first year of service and the grant did not include a Double Trigger Acceleration clause.

Not all Double Trigger Acceleration Clauses are created equal, though. That same executive with a half-hearted Double Trigger Acceleration Clause could end up with $0 as well. The devil is in the details.

Ideal Double Trigger Acceleration Clause

The ideal Double Trigger Acceleration Clause would include the following:

Full acceleration so that a qualifying termination at any time after change of control accelerates 100% of unvested shares;

Application to a qualifying termination in anticipation of, or for a certain protective period of time prior to, change of control;

Application to terminated by the company for Cause (narrowly defined, not to include arguable performance terms);

Application to a resignation by the individual for Good Reason (defined broadly to include a change in cash compensation, a reduction in duties or reporting structure, a geographic change, and anything else that would amount to constructive termination for the individual);

A broad definition of change of control including both (i) a transfer of voting control and (ii) a sale or lease of substantially all the company’s assets; and

Immediate vesting at closing of the change of control if unvested shares would otherwise be cancelled without payment under a Cancellation Plan term.

Weirdness in Double Trigger Acceleration Clauses

Recently, I’ve seen three weird patterns in the fine print of Double Trigger Acceleration Clauses in offer letters for startup hires.

Absurdly Narrow Definition of Change of Control

First, I’ve seen definitions of Change of Control that are so narrow that they would very rarely apply. For example, “an acquisition of 100% of the company or a complete dissolution of the company.”

This would not include some of the common deal structures that are used in startup M&A deals and that would be included in the standard “change in control” definitions used as part of Double Trigger Acceleration Clauses such as the definition Treas. Reg. section 1.409A-3(i)(5):

(5) Change in the ownership or effective control of a corporation, or a change in the ownership of a substantial portion of the assets of a corporation—(i) In general. Pursuant to section 409A(a)(2)(A)(v), a plan may permit a payment upon the occurrence of a change in the ownership of the corporation (as defined in paragraph (i)(5)(v) of this section), a change in effective control of the corporation (as defined in paragraph (i)(5)(vi) of this section), or a change in the ownership of a substantial portion of the assets of the corporation (as defined in paragraph (i)(5)(vii) of this section) (collectively referred to as a change in control event). …

If the first trigger of the double trigger acceleration clause is so narrowly drafted as to be impractical to achieve, the clause itself would not effectively protect unvested shares. In that case, in evaluating such a startup equity offer, a hire can expect the potential upside only on the shares that will vest prior to an acquisition. That changes the cost/benefit analysis of a startup equity offer.

This can be addressed by revising the definition of Change of Control that applies to the Double Trigger Acceleration Clause. This would be negotiated in the startup hire’s offer letter and then flow through to the final grant documents / Carta vesting schedule.

Cancellation of Unvested Shares at Closing

Second, I’ve seen Double Trigger Acceleration Clauses that leave room for the company to cancel unvested shares - without payment or substitution - at a closing of a Change of Control. If there are no shares left after closing, and before the second trigger would be met through a termination of employment, there are no shares left to accelerate at such second trigger.

More on this here from Cooley:

Often overlooked, however, is that in order for double-trigger acceleration to be meaningful, the option grant or equity award must actually be assumed or continued by the acquiror in the transaction. This will not always be the case in a transaction – aquirors often have their own plans and ideas for incentivizing their employees. If an unvested option or equity award terminates in connection with a transaction, then technically, there will be no unvested options or awards to accelerate if the second trigger (i.e., the qualifying termination) occurs after the transaction.

This can be addressed by either:

Including in the double trigger acceleration clause immediate acceleration of unvested shares at closing if those shares would otherwise be cancelled without payment or substitution (best solution); or

Including in the definition of Good Reason (if applicable) such a cancellation of unvested shares at closing (not as good, but okay).

This would be negotiated in the startup hire’s Offer Letter and then flow through to the final grant documents / Carta vesting schedule.

Carta Does Not Match Offer Letter

Finally, I’ve recently seen a few Carta grants that do not include the Double Trigger Acceleration Clause language negotiated in the Offer Letter. Since the Carta grants include an integration clause invalidating any previously-negotiated terms not included therein, the absence of the Offer Letter’s double trigger language in the Carta vesting schedule could be read as forfeiting those rights.

Negotiating a Double Trigger Acceleration Clause

Like all startup equity offer negotiation points, evaluating and negotiating a robust and useful Double Trigger Acceleration Clause starts with the startup hire learning and understanding the fundamentals of startup stock. If you’ve read and grasped this post, you’re well on your way!

The time to include these terms is at hire, as the decision-makers at the time of an acquisition are not incentivized to (and could be prohibited by their fiduciary duties from) solving these problems for executives once the deal is on the table.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Joining an Early Stage Startup? Negotiate Your Startup Equity and Salary with Stock Option Counsel Tips

Startup equity negotiation tips for early stage founders, executives, employees, consultants and advisors.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Startup Equity @ Early Stage Startups

"Hey baby, what's your employee number?" A low employee number at a famous startup is a sign of great riches. But you can't start today and be Employee #1 at OpenAI, Discord, or one of the other most valuable startups on Earth. Instead you'll have to join an early-stage startup, negotiate a great equity package and hope for the company’s success. This post walks through the negotiation issues in joining a pre-Series A / seed-funded / very-early-stage startup.

Q: Isn't startup equity a sure thing? They have funding!

No. Raising small amounts from seed stage investors or friends and family is not the same sign of success and value as a multi-million dollar Series A funding by venture capitalists.

Carta’s data team published an update in December of 2023 showing the “graduation rates” from Series Seed to Series A within 2 years. They affirm that it’s not a sure thing to graduate from Series Seed to Series A and, therefore, even have the chance to make it all the way to a successful acquisition or IPO. In hot years of 2021-2022, the graduation rate hovered around 30% across all industries. In 2023, it ranged from:

23% for FinTech

20% for HealthTech

19% for Consumer

17% for SaaS

16% for Biotech

Here's an illustration from Dustin Moskovitz's presentation, Why to Start a Startup from Y Combinator's Startup School on the chances so "making it" for a startup that has already raised seed funding. These 2nd Round “graduation” numbers are higher than Carta’s numbers, as this data was from 2017 (a hot hot time for startup funding).

Q: How do you negotiate equity for a startup? How many shares of startup equity should I get?

Don't think in terms of number of shares or the valuation of shares when you join an early-stage startup. Think of yourself as a late-stage founder and negotiate for a specific percentage ownership in the company. You should base this percentage on your anticipated contribution to the company's growth in value.

Early-stage companies expect to dramatically increase in value between founding and Series A. For example, a common pre-money valuation at a VC financing is $8 million. And no company can become an $8 million company without a great team.

Imagine, for instance, that the company tries to sell you on the offer by insisting that they will someday be worth $1B and, therefore, your equity worth, say, $1M. The obvious question would be: Does it feel fair to you to make a significant contribution to the creation of $1B in value in exchange for $1M? For most people, the answer would be “no.”

Or, consider that the company is insisting that an offer of 1% is “worth” $1M because the company expects to raise a Series A - based in part on your efforts - at a $100M pre-money valuation. Leaving aside the wisdom (or lack thereof) of evaluating the offer based on its future value, you would want to ask yourself: Does it feel fair to you to make a significant contribution to the creation of $100M in value in exchange for $1M in equity (which would presumably be only partially vested as of the Series A)?

That would depend, of course, on how significant your contribution would be. And it would depend on the salary component of the offer. If the cash compensation is already close to market level, that might seem more than fair. If the cash offer is a fraction of your opportunity cost, you would be investing that opportunity cost to earn the equity. The potential upside would need to be great enough to balance the risk of that investment.

Q: Is 1% equity in a startup good?

The classic 1% for the first employee may make sense for a key employee joining after a Series A financing, but do not make the mistake of thinking that an early-stage employee is the same as a post-Series A employee.

First, your ownership percentage will be significantly diluted at the Series A financing. When the Series A VC buys approximately 20% of the company, you will own approximately 20% less of the company.

Second, there is a huge risk that the company will never raise a VC financing or survive past the seed stage. According to CB Insights, about 39.4% of companies with legitimate seed funding go on to raise follow-on financing. And the number is far lower for seed deals in which big name VCs are not participating.

Don't be fooled by promises that the company is "raising money" or "about to close a financing." Founders are notoriously delusional about these matters. If they haven't closed the deal and put millions of dollars in the bank, the risk is high that the company will run out of money and no longer be able to pay you a salary. Since your risk is higher than a post-Series A employee, your equity percentage should be higher as well.

Q: What is typical equity for startup? How should I think about market data for startup equity?

Data sets on employee and executive offer percentages for early stage startups can be misleading and encourage companies to make unrealistically low offers to early hires. There’s two reasons for this. First, these data sets are for employees who are earning something like market level salaries along with equity. Second, these data sets exclude anyone classified as a “founder” from the data set for employees. They keep different data sets for founders! So the gray area between the two classifications makes the use of data tricky. Who is a founder for purposes of the data set? Depends on the data set. Carta, for instance, excludes anyone with 5% or more from the employee/executive data set and classifies them as founders! Even if they are earning market-level cash from their start date.

Here’s the bottom line:

If you are joining before you are being paid startup-phase-market-level cash salary, you are a late stage founder. You should evaluate your equity percentage relative to the other founders within the company or within the market data set.

If you are joining for a combination of cash and equity at an early stage startup, the offer should make sense to you. Simply pointing to market data for the right % ownership is not enough. You’ll want to consider the market data for % ownership in conjunction with the dollar value of the equity based on how investors have most recently valued the company.

Q: How should early-stage startups calculate my percentage ownership?

You'll be negotiating your equity as a percentage of the company's "Fully Diluted Capital." Fully Diluted Capital = the number of shares issued to founders ("Founder Stock") + the number of shares reserved for employees ("Employee Pool") + the number of shares issued to other investors (“preferred shares”). There may also be warrants outstanding, which should also be included. Your Number of Shares / Fully Diluted Capital = Your Percentage Ownership.

Careful, though, because most startups do not issue preferred stock when they take their seed investment funds from their seed investors. Instead, they issue convertible notes or SAFEs. These convert into shares of preferred stock in the next round of funding. So if you negotiate for 1% of a seed stage startup funded with notes or SAFEs, the fully diluted capital number used as the denominator of that calculation does not include the shares to be issued for those seed funds.

How can you address this? First, make sure you know what’s included. You can ask:

How many shares are outstanding on a fully diluted basis? Does this include the full option pool? Are there any shares yet to be issued for investments in the company, such as on SAFEs or convertible notes? How many shares do you expect to issue upon their conversion?

If you are comparing your offer to other seed stage offers or to market data for seed stage offers, you would want to take that into consideration. The number the company provides is only an estimate, of course, but it’s a way to address this in your evaluation.

Q: Is there anything tricky I should look out for in my startup equity documents?

Yes. Look for repurchase rights for vested shares.

If so, you may forfeit your vested shares if you leave the company for any reason prior to an acquisition or IPO. In other words, you have infinite vesting as you don't really own the shares even after they vest. This can be called "vested share repurchase rights," "clawbacks” or "non-competition restrictions on equity.”

Most employees who will be subject to this don't know about it until they are leaving the company (either willingly or after being fired) or waiting to get paid out in a merger that is never going to pay them out. That means they have been working to earn equity that does not have the value they think it does while they could have been working somewhere else for real equity.

According to equity expert Bruce Brumberg, "You must read your whole grant agreement and understand all of its terms, even if you have little ability to negotiate changes. In addition, do not ignore new grant agreements on the assumption that these are always going to be the same." When you are exchanging some form of cash compensation or making some other investment such as time for the equity, it makes sense to have an attorney review the documents before committing to the investment.

Q: What is fair for vesting of startup equity?

The standard vesting is monthly vesting over four years with a one year cliff. This means that you earn 1/4 of the shares after one year and 1/48 of the shares every month thereafter. But vesting should make sense. If your role at the company is not expected to extend for four years, consider negotiating for a vesting schedule that matches that expectation.

Q: Should I agree to milestone or performance metrics for my vesting schedule for startup equity?

No. This is a double risk. Not only is there a high risk that the company will not be successful (and the equity worthless), there is a high risk that the milestones will not be met. This is very often outside the control of the employee or even the founders. More on this issue here. The standard is four-year vesting with a one-year cliff. Anything else is off-market and is a sign that the founders are trying to be too creative and reinvent the wheel.

Q: Should I have protection for my unvested shares of startup equity in the event of an acquisition?

Yes. When you negotiate for an equity package in anticipation of a valuable exit, you would hope that you would have the opportunity to earn the full number of shares in the offer so long as you are willing to stay through the vesting schedule.

If you do not have protection for your unvested shares in the stock documents, unvested shares may be cancelled at the time of an acquisition. I call this a “Cancellation Plan.”

Executives and key hires negotiate for “double trigger acceleration upon change of control.” This protects the right to earn the full block of shares, as the shares would immediately become vested if both of the following are met: (1st trigger) an acquisition occurs before the award is fully vested; and (2nd trigger) the employee is terminated after closing before they are fully vested.

There’s plenty of variation in the fine print of double trigger clauses, though. Learn more here.

Q: The company says they will decide the exercise price of my stock options. Can I negotiate that?

A well-advised company will set the exercise price at the fair market value ("FMV") on the date the board grants the options to you. This price is not negotiable, but to protect your interests you want to be sure that they grant you the options ASAP.

Let the company know that this is important to you and follow up on it after you start. If they delay granting you the options until after a financing or other important event, the FMV and the exercise price will go up. This would reduce the value of your stock options.

Early-stage startups very commonly delay making grants. They shrug this off as due to "bandwidth" or other nonsense. But it is really just carelessness about giving their employees what they have been promised.

The timing and, therefore, price of grants does not matter much if the company is a failure. But if the company has great success within its first years, it is a huge problem for individual employees. I have seen individuals stuck with exercise prices in the hundreds of thousands of dollars when they were promised exercise prices in the hundreds of dollars.

Q: What salary can I negotiate as an early-stage employee?

When you join an early-stage startup, you may have to accept a below market salary. But a startup is not a non-profit. You should be up to market salary as soon as the company raises real money. And you should be rewarded for any loss of salary (and the risk that you will be earning $0 salary in a few months if the company does not raise money) in a significant equity award when you join the company.

When you join the company, you may want to come to agreement on your market rate and agree that you will receive a raise to that amount at the time of the financing.

I sometimes see people ask at hire to receive a bonus at the time of the financing to make up for working at below-market rates in the early stages. This is a gamble, of course, because only a small percent of seed-stage startups would ever make it to Series A and be able to pay that bonus. Therefore, it makes far more sense to negotiate for a substantial equity offer instead.

Q: What form of startup equity should I receive? What are the tax consequences of the form?

[Please do not rely on these as tax advice to your particular situation, as they are based on many, many assumptions about an individual's tax situation and the company's compliance with the law. For example, if the company incorrectly designs the structure or the details of your grants, you can be faced with penalty taxes of up to 70%. Or if there are price fluctuations in the year of sale, your tax treatment may be different. Or if the company makes certain choices at acquisition, your tax treatment may be different. Or ... you get the idea that this is complicated.]

These are the most tax advantaged forms of equity compensation for an early-stage employee in order of best to worst:

1. [Tie] Restricted Stock. You buy the shares for their fair market value at the date of grant and file an 83(b) election with the IRS within 30 days. Since you own the shares, your capital gains holding period begins immediately. You avoid being taxed when you receive the stock and avoid ordinary income tax rates at sale of stock. But you take the risk that the stock will become worthless or will be worth less than the price you paid to buy it.

1. [Tie] Non-Qualified Stock Options (Immediately Early Exercised). You early exercise the stock options immediately and file an 83(b) election with the IRS within 30 days. There is no spread between the fair market value of the stock and the exercise price of the options, so you avoid any taxes (even AMT) at exercise. You immediately own the shares (subject to vesting), so you avoid ordinary income tax rates at sale of stock and your capital gains holding period begins immediately. But you take the investment risk that the stock will become worthless or will be worth less than the price you paid to exercise it.

3. Incentive Stock Options ("ISOs"): You will not be taxed when the options are granted, and you will not have ordinary income when you exercise your options. However, you may have to pay Alternative Minimum Tax ("AMT") when you exercise your options on the spread between the fair market value ("FMV") on the date of exercise and the exercise price. You will also get capital gains treatment when you sell the stock so long as you sell your stock at least (1) one year after exercise AND (2) two years after the ISOs are granted.

Q: Who will guide me if I have more questions on startup equity?

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Am I an Employee or Founder???

"The difference between a founder and an early employee is gray, not black and white."

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Originally published April 23, 2013. Updated August 3, 2023 and November 1, 2023.

Quora Question:

Why do startups have an exponential drop-off in equity for employees? I've never heard a reasonable explanation of why there should be exponential drop-off in equity compensation based on joining time in a startup (vs. linear, for example). Obviously you need some time function to push prospective employees to make the jump when they are earning below-market salary, but is there a good reason why the drop-off is often exponential?

November 2023 Update: Great info on this point for technical co-founders / early employees from YC in this video called How Not to Get Screwed Over as a Software Engineer.

Stock Option Counsel Answer:

The Gray Area -- Revealed!

This is a great question because it reveals a truth: The difference between a founder and an early employee is gray, not black and white. There is not a true difference that would allow an exponential difference to be appropriate.

A Thinking Trick

It is very useful for an employee to reverse the exponential drop logic the company may use -- how much more than zero should this "employee" receive -- to acknowledge the gray area by thinking along the lines of "How much less than a founder should I receive?" While it is unlikely for an employee to come in at close to founder level, that should be ideal starting point to work from in your mental calculation of what is appropriate and will inspire you to perform at a founder level.

Founder Delusions

And remember that founders are notoriously delusional about how soon they will be funded, so don't drink the Kool-Aid. I see companies try to grant employee-level equity before a funding on the promise that they are "just about to be funded." They promise salaries that will be "deferred" until funding and try to bring on "first employees." If you're not getting paid a startup-phase-market-level salary today, you are not at an employee's level of risk. Be sure you are granted founder-level equity if you have founder-level risk.

Data Sets

Data sets on employee and executive offer percentages for early stage startups can be misleading and encourage companies to make unrealistically low offers to early hires. There’s two reasons for this. First, these data sets are for employees who are earning something like market level salaries along with equity. Second, these data sets exclude anyone classified as a “founder” from the data set for employees. They keep different data sets for founders! So the gray area between the two classifications makes the use of data tricky. Who is a founder for purposes of the data set? Depends on the data set. Carta, for instance, excludes anyone with 5% or more from the employee/executive data set and classifies them as founders! Even if they are earning market-level cash from their start date.

How to Think About This

Here’s the bottom line:

If you are joining before you are being paid startup-phase-market-level cash salary, you are a late stage founder. You should evaluate your equity percentage relative to the other founders within the company or within the market data set.

If you are joining for a combination of cash and equity at an early stage startup, the offer should make sense to you. Simply pointing to market data for the right % ownership is not enough. You’ll want to consider the market data for % ownership in conjunction with the dollar value of the equity based on how investors have most recently valued the company.

More here.

Link to Quora Q&A: https://www.quora.com/Startups/Why-do-startups-have-an-exponential-drop-off-in-equity-for-employees .

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

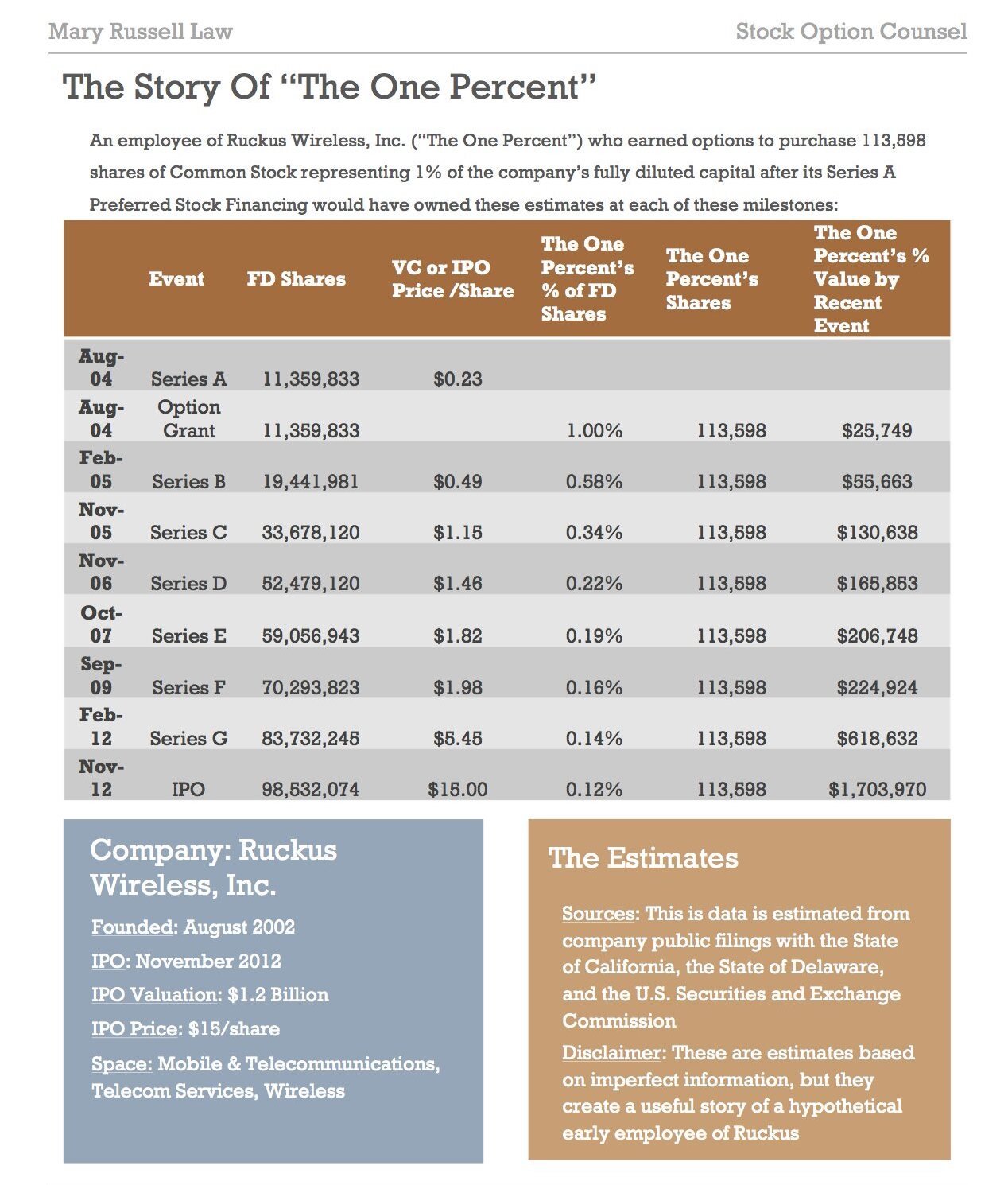

The One Percent: How 1% of Ruckus Wireless at Series A Became $1.7 million at IPO

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Originally published February 27, 2013. Updated August 30, 2023.

The biggest question I get about dilution is this:

What can I add to the fine print of my documents to protect me from dilution, or ensure I will get more shares later as I am diluted.

The answer is easy (but hard for people to accept):

Negotiate for enough shares up-front to ensure that you will have a sufficient stake by the time of an exit event to meet your goals.

Employees do not get anti-dilution protection, and if a company were to offer such protection that in itself would be a red flag.

90% of the equity people get in a startup is in their original offer, so future grants should not be the expectation no matter what a company promises during the offer negotiation stage.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Risk/Reward of Startup Employee Stock

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Startup employee equity should reward the risk you take in joining the company. Here's some ways to understand equity value so you can decide if your equity meets this standard.

For more information on joining an early stage startup before there is a VC valuation, see Joining An Early Stage Startup? Negotiate Your Salary and Equity with Stock Option Counsel Tips.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Startup Negotiations: How Preferred Stock Makes Employee Stock Less Valuable

Originally published February 13, 2014. Updated August 30, 2023.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Common Stock v. Preferred Stock

Startup employees and executives get Common Stock (as options, RSUs or restricted stock). When venture capitalists invest in startups, they receive Preferred Stock.

Preferred Stock comes with the right to preferential treatment in merger payouts, voting rights, and dividends. If the company / founders have caved and given venture capitalists a lot of preferred rights - like a 3X Liquidation Preference or Participating Preferred Stock , those rights will dramatically reduce the payouts to Common Stock in an acquisition. An individual who holds 1% in common stock would be curious, therefore, about the preferred stock’s rights to know if their 1% would really be 1% in an acquisition.

Is Preferred Stock Negotiable for Employees and Executives?

No. Preferred Stock is not negotiable for employees and executives (other than perhaps founders preferred stock which relates not to acquisition payout amounts but to liquidity rights and voting rights). The key is to understand if the investors’ Preferred Stock has unusual, off-market liquidation preferences. If so, that would weigh in favor of negotiating for more shares, more cash compensation or - less often but occasionally - management retention plan terms to make up for uninspiring Common Stock rights.

Liquidation Preference & How It Affects Common Stock Payouts

One Preferred Stock right is a "Liquidation Preference." Without a Liquidation Preference, each stockholder – preferred or common – would receive a percentage of the acquisition price equal to the stockholder's percentage ownership in the company. If the company were acquired for $15 million, and an employee owned 1% of the company, the employee would be paid out $150,000.

With a Liquidation Preference, preferred stockholders are guaranteed to be paid a set dollar amount of the acquisition price, even if that guaranteed payout is greater than their percentage ownership in the company.

Here’s an example of the difference. An investor buys 5 million shares of Preferred Stock for $1 per share for a total of $5 million. After the financing, there are 20 million shares of common stock and 5 million shares of Preferred Stock outstanding. The company is then acquired for $15 million.

Without a Liquidation Preference, each stockholder (common or preferred) would receive $0.60 per share. That’s $15 million / 25 million shares. A hypothetical employee who held 1% of the company or 250000 shares) would receive $150,000 (that’s 1% of $15 million).

If the preferred stockholders had a 1X Liquidation Preference and Non-Participating Preferred Stock, they would receive 1X their investment ($5 million) before any Common Stock is paid in an acquisition. They would receive the first $5 million of the acquisition price, and the remaining $10 million would be divided among the 20 million shares of common stock outstanding ($10 million / 20 million shares of common stock). Each common stockholder would be paid $0.50 per share, and hypothetical employee who held 1% of the company would receive $125,000.

In an up-round acquisition, though, this 1X non-participating preference would not affect common stock payouts. In an acquisition at $100 million valuation, the investors would choose the higher of:

Their $5M liquidation preference and

Their percentage of the company valuation. If they had 20% of the company’s shares, they would of course here choose $20M in payouts. And all common stockholders would also receive their percentage payout.

Ugly, Non-Standard Rights That Diminish Employee Stock Value

The standard Liquidation Preference is 1X. This makes sense, as the investors expect to receive their investment dollars back before employees and founders are rewarded for creating value. But some company founders give preferred stockholders multiple Liquidation Preferences or Participation Rights that cut more dramatically into employee stock payouts in an acquisition.

If preferred stockholders had a 3X Liquidation Preference, they would be paid 3X their original investment before common stock was paid out. In this example, preferred would be paid 3X their $5 million investment for a total of $15 million, and the common stockholders would receive $0. ($15 million acquisition price – $15 million Liquidation Preference = $0 paid to common stockholders)

Preferred stock may also have "Participation Rights," which would change our first example above to give preferred stockholders an even larger portion of the acquisition price.

Without Participation Rights, Preferred Stockholders must choose to either receive their Liquidation Preference or participate in the division of the full acquisition price among the all stockholders. In the first example above, the preferred stockholders held 20% of the company and had a $5 million Liquidation Preference. When the company was acquired for $15 million, the preferred stockholders had the choice to receive their $5 million liquidation preference or to participate in an equal distribution of the proceeds to all stockholders. The equal distribution would have given them $3 million (20% of $15 million acquisition price), so they chose to take their $5 million liquidation preference, and the remaining $10 million was divided among 20 million shares of common stock.

If the Preferred Stock also had Participation Rights, (which is called Participating Preferred Stock), they would receive their Liquidation Preference and participate in the distribution of the remaining proceeds.

In our example with a 1X Liquidation Preference but adding a Participation Right, the Participating Preferred Stock would receive their $5 million Liquidation Preference AND a portion of the remaining $10 million of the acquisition price equal to their % ownership in the company.

$5 million Liquidation Preference + ((5 million shares / 25 million shares outstanding) * $10 million) = $7 million

Common stockholders would receive (20 million shares common stock / 25 million shares outstanding) * $10 million = $8 million.

Our hypothetical employee who held 1% of the company would receive $100,000 (.01 * $10 million) or 0.67% of the acquisition price.

Employee Focus – Quick and Dirty Analysis

These calculations are complicated, so most candidates who are evaluating a startup job offer keep it simple in considering the effects of preferred stock. The quick and dirty way to know if preferred stock is an issue in evaluating an equity offer is to find out:

Do preferred stock investors have any liquidation preferences beyond the standard 1X non-participating preference?

If not, it’s not an issue in any up-round acquisition (and so most startup hires would not be concerned about the preferences at hire).

Founder Focus – Negotiating Your Acquisition Payout

If you are a founder and are negotiating with an acquiror, consider renegotiating your investors’ Liquidation Preference payout. Everything is negotiable in an acquisition, including the division of the acquisition price among founders, investors and employees. Do not get pushed around by your investors here, as their rights in the documents do not have to determine their payout.

If your investors are pushing to receive the full Liquidation Preference and leaving you and/or your employees with a small cut of the payout, address this with your investment bankers. They may be able to help you play your acquiror against the investors so that you are not cut out of the wealth of the deal, as most acquirors want the founders and employees to receive enough of the acquisition price to inspire them to stay with the company after acquisition.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Thanks to investment banker Michael Barker for his comments on founder merger negotiations. Michael is a Managing Director at Shea & Company, LLC, a technology-focused investment bank and leading strategic advisor to the software industry.

Double Trigger Acceleration and Other Change of Control Terms for Startup Stock, Options and RSUs

What does double trigger acceleration mean? It protects unvested shares from cancellation in a change of control by immediately accelerating those shares if the individual is terminated as part of the change of control. Founders, executives and key hires, including employee-level hires at early stage startups, negotiate for Double Trigger Acceleration in their equity grant documents at the offer letter stage.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Originally published June 5, 2018. Updated July 27, 2023.

Change of Control Terms for Startup Stock, Options and RSUs

Startup stock, options and RSUs vest over time. Since they vest over time, some may not be vested when the company has a change of control (aka merger or acquisition). What happens to the unvested shares at change of control? It depends on the fine print in your equity documents.

Founders, executives and key hires, including employee-level hires at early stage startups, often negotiate for Double Trigger Acceleration to protect their unvested shares. Advisors and some founders and rare executives may negotiate for Single Trigger Acceleration so that their shares immediately vest at acquisition. However, these protections are not often negotiable for employee-level hires except at very early stage companies. Their equity will be governed by the general terms of the Plan, which will likely be either an unfavorable Cancellation Plan.

Single Trigger Acceleration

The ideal change of control acceleration term is Single Trigger Acceleration - so that 100% of unvested shares vest immediately upon change of control. Investors and companies often argue against this term because the company may be an unappealing acquisition target if its key talent will not be incentivized to stay after closing. This is especially true for technical talent at a technology company.

Advisors, some founders and rare executives may negotiate for Single Trigger Acceleration if they can make the case that their role will not be needed after change of control. For example, advisors naturally negotiate for Single Trigger Acceleration because their primary role is to advise a company at the startup stage. They would not be necessary after an acquisition as they’ve fulfilled their purpose by that time. Founders and executives sometimes argue for Single Trigger Acceleration based on aligning incentives. For example, I’ve worked with a CFO who negotiated for 50% Single Trigger Acceleration because he was hired with the express purpose of improving the company’s financial position to achieve an acquisition. Those with similar arguments may even negotiate for Single Trigger Acceleration to apply at IPO, which would be a very unusual term but a logical incentive for certain hires.

Double Trigger Acceleration

The next best term is Double Trigger Acceleration, in which unvested equity immediately vests if both of two triggers are met. First, the company closes a change of control. Second, the individual’s service is terminated for certain reasons (most often a terminated by the company without Cause or a voluntary resignation by the individual for Good Reason).

Founders, executives and key hires, including employee-level hires at early stage startups, negotiate for Double Trigger Acceleration in their equity grant documents at the offer letter stage.

The key argument for Double Trigger Acceleration is based on risk. If an individual at any level of the organization is taking a significant risk to join the company, such as sacrificing significant cash or other compensation elsewhere to join, they advocate for Double Trigger Acceleration to protect their upside in the event that the equity becomes valuable. A grant of 1% with Double Trigger Acceleration is more valuable because of that protection of the upside. A second key argument for this term is based on “aligning incentives.” If individuals on the team could lose valuable unvested equity by achieving a prompt acquisition, their incentives would not be aligned with the company’s goals of closing that deal. Double Trigger Acceleration rights bring the individuals' incentives in alignment with the company's goals.

This Double Trigger Acceleration protection is negotiated at the offer letter stage and included in the final equity grant documents. The key negotiable terms in this clause are:

Full acceleration so that a qualifying termination at any time after acquisition accelerates 100% of unvested shares;

Application to a qualifying termination in anticipation of, or for a certain protective period of time prior to, change of control;

Application to terminated by the company for Cause (narrowly defined, not to include arguable performance terms);

Application to a resignation by the individual for Good Reason (defined broadly to include a change in cash compensation, a reduction in duties or reporting structure, a geographic change, and anything else that would amount to constructive termination for the individual);

A broad definition of change of control including a sale of substantially all the company’s assets;

Immediate vesting at closing of the change of control if unvested shares would otherwise be cancelled without payment under a Cancellation Plan term. More on this here from Cooley:

Often overlooked, however, is that in order for double-trigger acceleration to be meaningful, the option grant or equity award must actually be assumed or continued by the acquiror in the transaction. This will not always be the case in a transaction – aquirors often have their own plans and ideas for incentivizing their employees. If an unvested option or equity award terminates in connection with a transaction, then technically, there will be no unvested options or awards to accelerate if the second trigger (i.e., the qualifying termination) occurs after the transaction.

Continuation Plan

If the startup’s Equity Incentive Plan includes a continuation term, the value of the unvested shares continue to vest after change of control so long as the individual stays in service after the closing. We’ll call this style of plan a Continuation Plan. The unvested shares are likely to be converted into another form, such as RSUs in the acquiring company or cash deal consideration. But the value is protected so that the deal value per share paid to vested shares at closing will be paid to these unvested shares on each subsequent vesting date. If the individual is terminated or resigns for any reason, they would not be paid out. If the deal does not provide for such continuation or substitution, unvested equity will be accelerated so that it becomes 100% vested and paid at closing.

If an employee's total number of shares was worth $200,000 at the acquisition price, and only 50% had vested at the acquisition, the employee would be paid $100,000 at closing. But the unvested shares would be replaced with a substitution or continuation award in exchange for the $100,000 in unvested value. That might be in the form of cash to vest over time, continuing awards in the original company, or new equity in the acquiring company's equity. Whatever the form, it would continue to vest over the remaining portion of the original vesting schedule.

Without the Double or Single Trigger Acceleration protections described below, the individual could be terminated for any reason, at any time, and would lose the unvested shares. However, those who stay at the acquiring company under a Continuation Plan will continue to earn the deal consideration for their unvested shares. (But beware. Those with unvested equity under a Continuation Plan may also be asked to sign new employment agreements forfeiting these rights as part of the acquisition, since the company’s leverage of termination is significant).

Cancellation Plan

Most startup Equity Incentive Plans allow the company to cancel unvested shares without payment in an acquisition. We’ll call this type of plan a Cancellation Plan. Under a Cancellation Plan, unvested equity can be cancelled and replaced with $0, even if the unvested shares had significant value at the time of the acquisition. For example, if an employee's total number of shares was worth $200,000 at the acquisition price, and only 50% had vested at the acquisition, the employee would be paid $100,000 at closing. The unvested value of $100,000 could be cancelled without payment even if the employee stayed on as an employee after the acquisition. In another example, if the employee was within the first year of service and had a one-year cliff vesting schedule, 100% of the grant could be cancelled without payment even if it was immensely valuable based on the deal price/share.

The distinction between a Cancellation Plan and the more protective Continuation Plan is not usually a negotiable term. The exception to this would be at a startup with employee-friendly founders and executives who are willing to advocate for changes to their Plan with the board and stockholders. When startup candidates encounter this term in their offer negotiation document review, their best course of action is likely to be to negotiate for Single Trigger Acceleration or Double Trigger Acceleration for their individual grants.

Negotiating Change of Control Terms

The availability of Single Trigger Protection or Double Trigger Protection and/or the distinction between a Cancellation Plan and a Continuation Plan is a factor in assessing the risk of joining a startup. If the fine print protects 100% of the unvested shares, the shares have a higher potential upside for the employee or executive. Without these protections, it may make sense to negotiate for a higher cash package or a higher number of shares to balance risk. Check out more on my blog about market data for startup equity offers and other key terms that affect the risk of startup equity including clawbacks and tax planning for stock options.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

RSUs - Restricted Stock Units - Evaluating an RSU Offer at a Startup

Working for a startup? Here’s how to think about Restricted Stock Units or RSUs.

Originally published February 10, 2014. Updated March 27, 2017 and July 5, 2023.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Working for a startup? Here’s how to think about RSUs.

What are RSUs?

Restricted Stock Units ("RSUs") are not stock. They are not restricted stock. They are not stock options. RSUs are a company's promise to give you shares of the company's stock (or the cash value of the company's stock) at some time in the future.

How Many Shares Do I Have?

One RSU is equivalent to one share of stock. The number of RSUs in your grant determines how many shares of stock (or the number of shares of stock used to determine your cash payment) you will receive when they are "settled" on the Settlement Date.

You’ll receive one share of stock (or the cash value of one share of stock) for every vested RSU on the Settlement Date. For startup (private company) RSUs, the Settlement Date is usually a company Liquidity Event. A company Liquidity Event might include (i) a Change of Control (aka Merger or Acquisition); (ii) after an IPO, when post-IPO lockup on employee sales expires or (iii) a company choice to have an early settlement in shares.

When are Startup RSUs Taxed?

Most startup RSUs are structured elegantly to defer taxes until after the shares can be sold to cover the taxes. That’s achieved with a two-tier vesting schedule. Before the RSUs fully vest (so they can be “settled” in shares or cash on the Settlement Date), two triggers must be met:

Time-Based Vesting AND

Liquidity-Event-Based Vesting

Time-based vesting is the classic vesting concept. You will meet the time-based vesting requirement over a set period of time of service (called the "Vesting Period"). The most common time- vesting period is quarterly vesting over four years with a 1-year cliff.

The liquidity-event vesting requirement is the tax-deferral concept. The shares will not be settled / fully vested for tax purposes until the company has a Liquidity Event. A company Liquidity Event might include (i) a Change of Control (aka Merger or Acquisition); (ii) after an IPO, when post-IPO lockup on employee sales expires or (iii) a company choice to have an early settlement in shares.

Without this liquidity-event vesting requirement, RSUs could become vested for tax purposes before there is a market to sell the shares (or even before shares are officially received in exchange for the RSUs at settlement). That would be very unappealing for startup employees and executives, as they would need to pay taxes out of their own funds based on the FMV on the vesting date.

[Careful! This two-tier vesting structure (sometimes called double trigger vesting) is a tax deferral mechanism. It is not the same thing as double trigger acceleration upon change of control! Those are often confused so be careful there.]

Do Startup RSUs Expire?

Yes! There’s two issues to watch out for w/r/t expiration / forfeiture of startup RSUs.

All startup RSUs include a deadline, so that if the Liquidity Event is not achieved by a certain date, all RSUs will be forfeited without payment. That is usually 5 or 7 years from the date of grant. Therefore, most RSUs are designed to be forfeited if the company does not go public or get acquired within 5 or 7 years of the employee or executive’s start date even if the RSUs have already time-vested by that date. Unfortunately, this term is not negotiable as it is a tax-driven deadline. The RSUs must be designed with a substantial risk of forfeiture in order to defer taxation.

In addition to this tax-driven deadline, some RSUs include a forfeiture clause. This is similar to the dreaded clawback for vested shares, even though it is technically part of the vesting schedule. Here’s how it works. If an employee or executive leaves the company, they forfeit any time-vested RSUs that have not yet been settled / vested at a Liquidity Event. In other words, the employee or executive has to survive all the way through a Liquidity Event to get anything for their time-vested RSUs. This type of forfeiture term greatly reduces the value of an RSU grant because it is not really "earned" even after the time-based vesting period.

Will I Receive Annual Refresh Grants of Startup RSUs?

Probably not! Most private companies do not make substantial refresh grants either annually or at the time of future financings. In my experience, approximately 90% of the equity individuals receive at startups is in their original, at-hire grant. This likely would be refreshed only after it is close to meeting its full time-vesting requirements.

This is usually a surprise to employees and executives coming from public companies, where regular refreshes are the norm. The reason for the difference is that startups are hoping for huge increases in valuation. If that happens, the original grant would be sufficiently valuable to retain employees and executives. If you are evaluating a job offer, there is a big difference in the value of your offer between a company that grants RSUs only at hire (and after they have vested) and a company that plans to make additional refresh grants regularly.

How Do I Value Startup RSUs?

There is no precise "value" for startup RSUs since they are not liquid (aka easily sold). But employees and executives who are evaluating startup RSUs offers do think about value when their considering how much equity makes sense for their role.

When evaluating the number of RSUs in an RSU grant, employees and executives use one or both of these approaches:

Current Valuation Method (Fact-Based): For startup stock, most hires use the price per share paid by venture capitalists for one share of preferred stock in the most recent financing as a proxy for the value of their RSUs. This is the closest number you can find for today's value. It tells you that X Venture Capitalist paid $Y for one share of the company's stock on Z date. The usefulness of this approach is somewhat limited for stale valuations, especially in the 2022-2023 market. For more on this approach, see Venture Hacks' post on startup job offers.

Percentage Ownership: Executive hires also consider their percentage ownership compared to market for their role at this stage of company. Individuals often struggle to find good resources for startup compensation data since subscriptions to the primary startup compensation data sources are only available on the company side. Here’s a blog post with publicly-available startup compensation data links that readers have found helpful.

Future Valuation Method (Guesstimate Based): To look forward and define a future payout for your RSUs, you have to do some guesswork. If you could guess the startup's value at exit and dilution prior to exit, you would know how much the stock will be worth when you receive it at settlement/post-IPO. Be careful, though, not to use price/share in isolation as stock splits would affect that in unpredictable ways.

Employees and executives often consider these facts to build those approaches of analysis:

Recent VC price per share of preferred stock

Current number of fully diluted shares in the company or the offered percentage ownership in the company

Possibilities around expected dilution, exit scenarios, exit timing and future valuation?

Need More Info?

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

VIDEO Startup Stock Options: Startup Valuation

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Startup Stock Options | Post Termination Exercise Period | Examples of Good Startup Equity Design by Company Stage

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Originally published August 11, 2017. Updated March 17, 2023.

It’s helpful for startup employees to understand early expiration of stock options and the possible solution of a full 10 year post-termination exercise period. But the full 10 year term stock option is not the right design for every startup equity grant! In some cases it would be the wrong ask, and pushing for it can can lead to embarrassment or a disadvantageous design.

Examples of Good Startup Equity Design by Company Stage

I work with individual clients to balance their priorities for investment timing, tax timing, tax rates and value structure. These are some examples of how the trade-offs are made at each stage. You can also read more about option exercise strategies here in the Menu of Stock Option Exercise Strategies.

1. Earliest Stage - Startup Restricted Stock Purchase

While a startup is in its early stages and its Fair Market Value (FMV) is quite low, consider purchase of Restricted Stock for founders and early employees. This is the model used for Founders’ Stock at startups, and it is also ideal for executives and employees who are willing to pay the FMV of the common stock up-front for their shares. With the use of an 83(b) election with the IRS, Restricted Stock purchase provides for tax deferral until sale of stock, favorable capital gains tax rates at sale of stock, and fewer tax penalties than stock options in the event the IRS determines the FMV was underpriced for the shares.

2. Early to Mid-Stage - Early Exercise of Startup Stock Options

For those who are willing to take early investment risks for tax deferral and lower tax rates, consider early exercise of stock options. This is an obvious choice for early-stage startup hires who can afford the stock purchase price at hire. For example, at a very early stage startup an employee’s total exercise price might be less than $1,000. Early exercise may also be a good choice for some individuals at mid-stage startups with somewhat higher exercise prices or even later stage startups with high growth potential, as an early investment may be worth it for future tax savings and/or tax deferral.

Early exercise stock options can be exercised before vesting. If they are exercised before the FMV rises above the exercise price, tax payments are deferred until sale of stock by use of a Section 83(b) election at the time of purchase.

However, the investment risk is real, as the purchase price is delivered up-front and shares are held as an investment. If the shares were to become worthless, the investment amount would be lost for both vested and unvested shares.

Early exercise stock options are preferable to restricted stock if the employee is not sure about making the investment up-front. Unlike the purchase of restricted stock, the choice to exercise stock options (even with early exercise rights) can be deferred for some time. However, if the exercise or early exercise is made after the FMV has gone up, the exercise will lead to taxable income.

The early exercise structure can be combined with an extended exercise period (see below under #3 or more here on the blog), so that the employee has the choice between early exercising to minimize tax rates or deferring exercise until any time within the full 10 year term.

Note that the right to early exercise can be a disadvantage for stock option grants with an exercise price greater than $100,000 if they are not early exercised. Any amounts over $100,000 would be ineligible for ISO status due to the ISO rules’ $100,000 limitation.

3. Early to Mid-Stage - Stock Options with Full 10-Year Exercise Period

While there is still potential for high growth in value, stock options are an advantage for employees. However, a high exercise price or a high tax bill at exercise can make it impossible for employees to take advantage of the value of stock options. This is because stock options have traditionally been granted with a disadvantageous early expiration term requiring exercise within three months of an optionee’s termination date. Therefore, stock options are most advantageous where they are granted with a full 10 year term to exercise regardless of the date of termination. This allows the optionee to defer the investment decision and the associated tax bill for exercise.

Additional consideration: Optionees who take advantage of an extended exercise period (exercise their options after 90 days from last employment) lose their Incentive Stock Option (ISO) tax treatment. Shares exercised after 90 days from last employment will be treated as Non-Qualified Stock Options (NQSOs) and generally come with a higher tax rate. However, with this extended exercise design, optionees can choose to exercise within 90 days and keep their ISO classification, or wait to exercise and accept the NQSO classification. This flexibility is key in rewarding optionees of all types and financial circumstance.

4. Later Stage - Restricted Stock Units

Employees may prefer RSUs to stock options at later stage companies for both tax deferral and offer value purposes. Well-designed RSUs defer taxes until liquidity so long as it is within a certain time frame (such as 7 years from the date of grant). RSUs are less advantageous for tax rates, though, as the value of the shares is taxed as ordinary income at settlement. RSUs are advantageous from an investment perspective because there is no investment risk as there would be in a stock option exercise prior to liquidity. RSUs also give the employee the full value of the shares at liquidity as there is no purchase price to pay for the stock as there would be with a stock option exercise price. For this reason, a grant of RSUs generally consists of fewer shares than a grant of stock options at a company of the same stage.

Wrapping Up

This is Part 3 of a 3-part series on the startup scene’s debate about early expiration stock options. See Early Expiration of Startup Stock Options - Part 1 - The $1 Million Problem for more information on the issue and Early Expiration of Startup Stock Options - Part 2 - The Full 10-Year Term Solution for more information on the full 10-year term solution.

Thank you to attorney Augie Rakow, a partner at Orrick who advises startups and investors, for sharing his creative solution to this problem in Early Expiration of Startup Stock Options - Part 2 - The Full 10-Year Term Solution.

Thank you to JD McCullough for edits to this post. JD is a health tech entrepreneur, interested in connecting and improving businesses, products, and people.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Startup Stock Options | Post Termination Exercise Period | The Full 10-Year Term Solution

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Originally published March 28, 2017. Updated March 17, 2023.

Startup Stock Options and the $1M Problem

The startup scene is debating this question: Should employees have a full 10 years from the date of grant to exercise vested startup stock options or should their rights to exercise expire early if they leave the company before an IPO or acquisition?

This is Part 2 of a 3-part series. See Early Expiration of Startup Stock Options - Part 1 - The $1 Million Problem for more information on the issue and Early Expiration of Startup Stock Options - Part 3 - Examples of Good Startup Equity Design by Company Stage.

Full 10-Year Term Solution

Some companies are saving their optionees from the $1 million problem of early expiration startup stock options by granting stock options that have a full 10 year term and do not expire early at termination. The law does not require an early expiration period for stock options. Ten years from date of grant is usually the maximum exercise period, as the legal landscape for stock options makes anything beyond a 10 year exercise period impractical in most cases. The 10 year exercise window (without an early exercise period) enables employees to wait for a liquidity event (IPO or acquisition) to pay their exercise price and the associated taxes. This extended structure is designed to compensate employees in a way that makes sense for them.

Startups who choose a full 10-year term in place of early expiration may do so because their recruits or founders have faced the problem of early expiration at prior companies and become disillusioned with stock options as a benefit. Or their recruits may have read about the issue and asked for it as part of their negotiation. Or their founders may have designed their equity plan to be as favorable to employees as possible as a matter of principle or as a recruiting tool.

Other companies are extending their early expiration period for existing stock options. One example of this is Pinterest, which extended the term in some cases to 7 years from the date of grant. This move was in response to their valuation and extreme transfer restrictions that made the early expiration period burdensome for option holders.