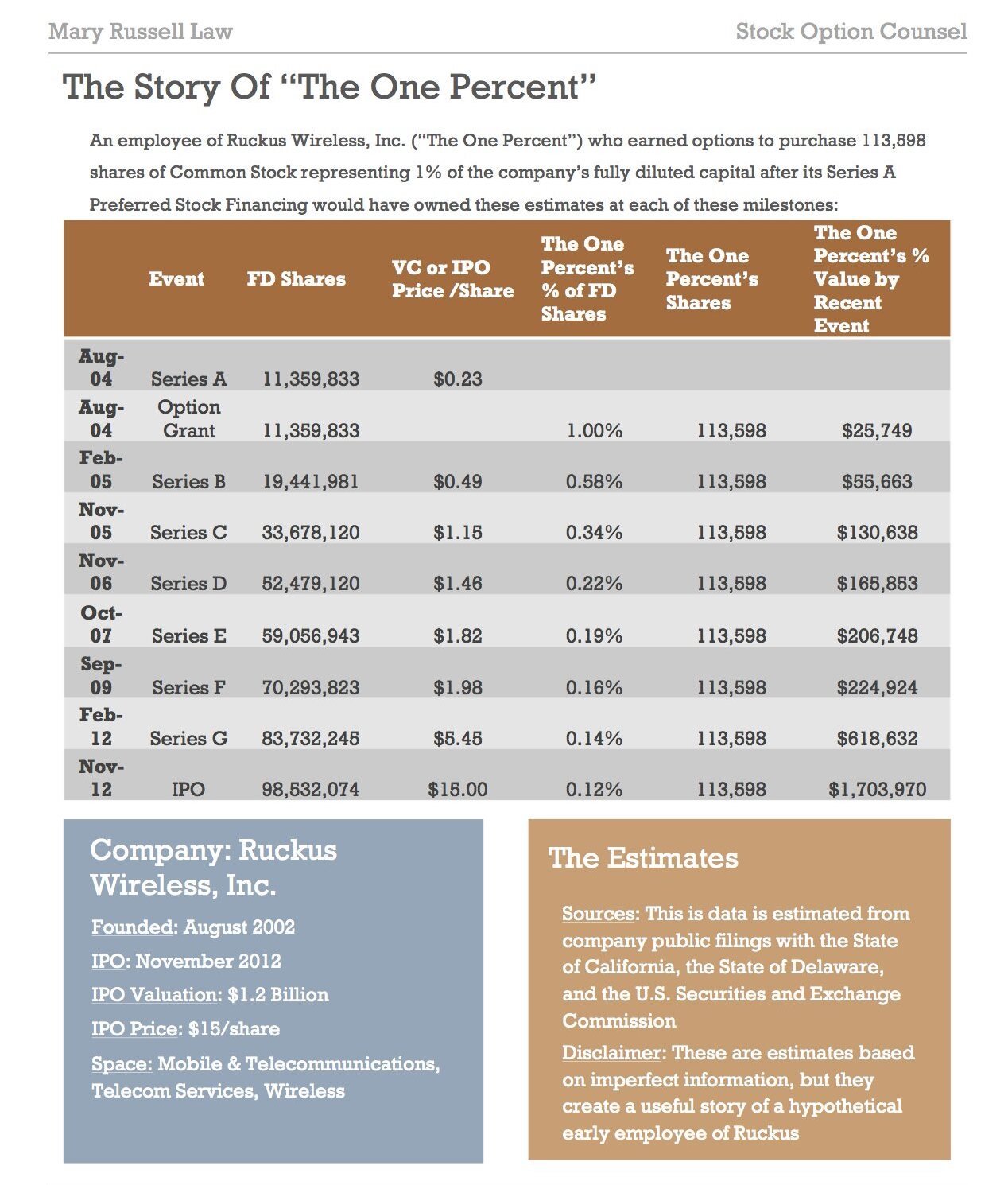

The One Percent: How 1% of Ruckus Wireless at Series A Became $1.7 million at IPO

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Originally published February 27, 2013. Updated August 30, 2023.

The biggest question I get about dilution is this:

What can I add to the fine print of my documents to protect me from dilution, or ensure I will get more shares later as I am diluted.

The answer is easy (but hard for people to accept):

Negotiate for enough shares up-front to ensure that you will have a sufficient stake by the time of an exit event to meet your goals.

Employees do not get anti-dilution protection, and if a company were to offer such protection that in itself would be a red flag.

90% of the equity people get in a startup is in their original offer, so future grants should not be the expectation no matter what a company promises during the offer negotiation stage.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.