Joining an Early Stage Startup? Negotiate Your Startup Equity and Salary with Stock Option Counsel Tips

Startup equity negotiation tips for early stage founders, executives, employees, consultants and advisors.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Startup Equity @ Early Stage Startups

"Hey baby, what's your employee number?" A low employee number at a famous startup is a sign of great riches. But you can't start today and be Employee #1 at OpenAI, Discord, or one of the other most valuable startups on Earth. Instead you'll have to join an early-stage startup, negotiate a great equity package and hope for the company’s success. This post walks through the negotiation issues in joining a pre-Series A / seed-funded / very-early-stage startup.

Q: Isn't startup equity a sure thing? They have funding!

No. Raising small amounts from seed stage investors or friends and family is not the same sign of success and value as a multi-million dollar Series A funding by venture capitalists.

Carta’s data team published an update in December of 2023 showing the “graduation rates” from Series Seed to Series A within 2 years. They affirm that it’s not a sure thing to graduate from Series Seed to Series A and, therefore, even have the chance to make it all the way to a successful acquisition or IPO. In hot years of 2021-2022, the graduation rate hovered around 30% across all industries. In 2023, it ranged from:

23% for FinTech

20% for HealthTech

19% for Consumer

17% for SaaS

16% for Biotech

Here's an illustration from Dustin Moskovitz's presentation, Why to Start a Startup from Y Combinator's Startup School on the chances so "making it" for a startup that has already raised seed funding. These 2nd Round “graduation” numbers are higher than Carta’s numbers, as this data was from 2017 (a hot hot time for startup funding).

Q: How do you negotiate equity for a startup? How many shares of startup equity should I get?

Don't think in terms of number of shares or the valuation of shares when you join an early-stage startup. Think of yourself as a late-stage founder and negotiate for a specific percentage ownership in the company. You should base this percentage on your anticipated contribution to the company's growth in value.

Early-stage companies expect to dramatically increase in value between founding and Series A. For example, a common pre-money valuation at a VC financing is $8 million. And no company can become an $8 million company without a great team.

Imagine, for instance, that the company tries to sell you on the offer by insisting that they will someday be worth $1B and, therefore, your equity worth, say, $1M. The obvious question would be: Does it feel fair to you to make a significant contribution to the creation of $1B in value in exchange for $1M? For most people, the answer would be “no.”

Or, consider that the company is insisting that an offer of 1% is “worth” $1M because the company expects to raise a Series A - based in part on your efforts - at a $100M pre-money valuation. Leaving aside the wisdom (or lack thereof) of evaluating the offer based on its future value, you would want to ask yourself: Does it feel fair to you to make a significant contribution to the creation of $100M in value in exchange for $1M in equity (which would presumably be only partially vested as of the Series A)?

That would depend, of course, on how significant your contribution would be. And it would depend on the salary component of the offer. If the cash compensation is already close to market level, that might seem more than fair. If the cash offer is a fraction of your opportunity cost, you would be investing that opportunity cost to earn the equity. The potential upside would need to be great enough to balance the risk of that investment.

Q: Is 1% equity in a startup good?

The classic 1% for the first employee may make sense for a key employee joining after a Series A financing, but do not make the mistake of thinking that an early-stage employee is the same as a post-Series A employee.

First, your ownership percentage will be significantly diluted at the Series A financing. When the Series A VC buys approximately 20% of the company, you will own approximately 20% less of the company.

Second, there is a huge risk that the company will never raise a VC financing or survive past the seed stage. According to CB Insights, about 39.4% of companies with legitimate seed funding go on to raise follow-on financing. And the number is far lower for seed deals in which big name VCs are not participating.

Don't be fooled by promises that the company is "raising money" or "about to close a financing." Founders are notoriously delusional about these matters. If they haven't closed the deal and put millions of dollars in the bank, the risk is high that the company will run out of money and no longer be able to pay you a salary. Since your risk is higher than a post-Series A employee, your equity percentage should be higher as well.

Q: What is typical equity for startup? How should I think about market data for startup equity?

Data sets on employee and executive offer percentages for early stage startups can be misleading and encourage companies to make unrealistically low offers to early hires. There’s two reasons for this. First, these data sets are for employees who are earning something like market level salaries along with equity. Second, these data sets exclude anyone classified as a “founder” from the data set for employees. They keep different data sets for founders! So the gray area between the two classifications makes the use of data tricky. Who is a founder for purposes of the data set? Depends on the data set. Carta, for instance, excludes anyone with 5% or more from the employee/executive data set and classifies them as founders! Even if they are earning market-level cash from their start date.

Here’s the bottom line:

If you are joining before you are being paid startup-phase-market-level cash salary, you are a late stage founder. You should evaluate your equity percentage relative to the other founders within the company or within the market data set.

If you are joining for a combination of cash and equity at an early stage startup, the offer should make sense to you. Simply pointing to market data for the right % ownership is not enough. You’ll want to consider the market data for % ownership in conjunction with the dollar value of the equity based on how investors have most recently valued the company.

Q: How should early-stage startups calculate my percentage ownership?

You'll be negotiating your equity as a percentage of the company's "Fully Diluted Capital." Fully Diluted Capital = the number of shares issued to founders ("Founder Stock") + the number of shares reserved for employees ("Employee Pool") + the number of shares issued to other investors (“preferred shares”). There may also be warrants outstanding, which should also be included. Your Number of Shares / Fully Diluted Capital = Your Percentage Ownership.

Careful, though, because most startups do not issue preferred stock when they take their seed investment funds from their seed investors. Instead, they issue convertible notes or SAFEs. These convert into shares of preferred stock in the next round of funding. So if you negotiate for 1% of a seed stage startup funded with notes or SAFEs, the fully diluted capital number used as the denominator of that calculation does not include the shares to be issued for those seed funds.

How can you address this? First, make sure you know what’s included. You can ask:

How many shares are outstanding on a fully diluted basis? Does this include the full option pool? Are there any shares yet to be issued for investments in the company, such as on SAFEs or convertible notes? How many shares do you expect to issue upon their conversion?

If you are comparing your offer to other seed stage offers or to market data for seed stage offers, you would want to take that into consideration. The number the company provides is only an estimate, of course, but it’s a way to address this in your evaluation.

Q: Is there anything tricky I should look out for in my startup equity documents?

Yes. Look for repurchase rights for vested shares.

If so, you may forfeit your vested shares if you leave the company for any reason prior to an acquisition or IPO. In other words, you have infinite vesting as you don't really own the shares even after they vest. This can be called "vested share repurchase rights," "clawbacks” or "non-competition restrictions on equity.”

Most employees who will be subject to this don't know about it until they are leaving the company (either willingly or after being fired) or waiting to get paid out in a merger that is never going to pay them out. That means they have been working to earn equity that does not have the value they think it does while they could have been working somewhere else for real equity.

According to equity expert Bruce Brumberg, "You must read your whole grant agreement and understand all of its terms, even if you have little ability to negotiate changes. In addition, do not ignore new grant agreements on the assumption that these are always going to be the same." When you are exchanging some form of cash compensation or making some other investment such as time for the equity, it makes sense to have an attorney review the documents before committing to the investment.

Q: What is fair for vesting of startup equity?

The standard vesting is monthly vesting over four years with a one year cliff. This means that you earn 1/4 of the shares after one year and 1/48 of the shares every month thereafter. But vesting should make sense. If your role at the company is not expected to extend for four years, consider negotiating for a vesting schedule that matches that expectation.

Q: Should I agree to milestone or performance metrics for my vesting schedule for startup equity?

No. This is a double risk. Not only is there a high risk that the company will not be successful (and the equity worthless), there is a high risk that the milestones will not be met. This is very often outside the control of the employee or even the founders. More on this issue here. The standard is four-year vesting with a one-year cliff. Anything else is off-market and is a sign that the founders are trying to be too creative and reinvent the wheel.

Q: Should I have protection for my unvested shares of startup equity in the event of an acquisition?

Yes. When you negotiate for an equity package in anticipation of a valuable exit, you would hope that you would have the opportunity to earn the full number of shares in the offer so long as you are willing to stay through the vesting schedule.

If you do not have protection for your unvested shares in the stock documents, unvested shares may be cancelled at the time of an acquisition. I call this a “Cancellation Plan.”

Executives and key hires negotiate for “double trigger acceleration upon change of control.” This protects the right to earn the full block of shares, as the shares would immediately become vested if both of the following are met: (1st trigger) an acquisition occurs before the award is fully vested; and (2nd trigger) the employee is terminated after closing before they are fully vested.

There’s plenty of variation in the fine print of double trigger clauses, though. Learn more here.

Q: The company says they will decide the exercise price of my stock options. Can I negotiate that?

A well-advised company will set the exercise price at the fair market value ("FMV") on the date the board grants the options to you. This price is not negotiable, but to protect your interests you want to be sure that they grant you the options ASAP.

Let the company know that this is important to you and follow up on it after you start. If they delay granting you the options until after a financing or other important event, the FMV and the exercise price will go up. This would reduce the value of your stock options.

Early-stage startups very commonly delay making grants. They shrug this off as due to "bandwidth" or other nonsense. But it is really just carelessness about giving their employees what they have been promised.

The timing and, therefore, price of grants does not matter much if the company is a failure. But if the company has great success within its first years, it is a huge problem for individual employees. I have seen individuals stuck with exercise prices in the hundreds of thousands of dollars when they were promised exercise prices in the hundreds of dollars.

Q: What salary can I negotiate as an early-stage employee?

When you join an early-stage startup, you may have to accept a below market salary. But a startup is not a non-profit. You should be up to market salary as soon as the company raises real money. And you should be rewarded for any loss of salary (and the risk that you will be earning $0 salary in a few months if the company does not raise money) in a significant equity award when you join the company.

When you join the company, you may want to come to agreement on your market rate and agree that you will receive a raise to that amount at the time of the financing.

I sometimes see people ask at hire to receive a bonus at the time of the financing to make up for working at below-market rates in the early stages. This is a gamble, of course, because only a small percent of seed-stage startups would ever make it to Series A and be able to pay that bonus. Therefore, it makes far more sense to negotiate for a substantial equity offer instead.

Q: What form of startup equity should I receive? What are the tax consequences of the form?

[Please do not rely on these as tax advice to your particular situation, as they are based on many, many assumptions about an individual's tax situation and the company's compliance with the law. For example, if the company incorrectly designs the structure or the details of your grants, you can be faced with penalty taxes of up to 70%. Or if there are price fluctuations in the year of sale, your tax treatment may be different. Or if the company makes certain choices at acquisition, your tax treatment may be different. Or ... you get the idea that this is complicated.]

These are the most tax advantaged forms of equity compensation for an early-stage employee in order of best to worst:

1. [Tie] Restricted Stock. You buy the shares for their fair market value at the date of grant and file an 83(b) election with the IRS within 30 days. Since you own the shares, your capital gains holding period begins immediately. You avoid being taxed when you receive the stock and avoid ordinary income tax rates at sale of stock. But you take the risk that the stock will become worthless or will be worth less than the price you paid to buy it.

1. [Tie] Non-Qualified Stock Options (Immediately Early Exercised). You early exercise the stock options immediately and file an 83(b) election with the IRS within 30 days. There is no spread between the fair market value of the stock and the exercise price of the options, so you avoid any taxes (even AMT) at exercise. You immediately own the shares (subject to vesting), so you avoid ordinary income tax rates at sale of stock and your capital gains holding period begins immediately. But you take the investment risk that the stock will become worthless or will be worth less than the price you paid to exercise it.

3. Incentive Stock Options ("ISOs"): You will not be taxed when the options are granted, and you will not have ordinary income when you exercise your options. However, you may have to pay Alternative Minimum Tax ("AMT") when you exercise your options on the spread between the fair market value ("FMV") on the date of exercise and the exercise price. You will also get capital gains treatment when you sell the stock so long as you sell your stock at least (1) one year after exercise AND (2) two years after the ISOs are granted.

Q: Who will guide me if I have more questions on startup equity?

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

VIDEO Startup Stock Options: Negotiate the Right Startup Stock Option Offer

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Clawback Clause for Startup Stock - Can I Keep What I think I Own?

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Updated October 19, 2020 for a recent clawback event in the news.

Everyone loves a gold rush story about startup hires making millions on startup equity. But not all startup equity is created equal. If a startup adds a repurchase rights for vested shares (a.k.a. a clawback clause or clawback provision) to its agreements, individuals may lose the value of their vested equity because a company can force them to sell their shares back to the company in certain situations, such as if they leave their jobs or are fired prior to IPO or acquisition. Other examples of a clawback clause are forfeiture (rather than repurchase) of vested shares or options at termination of employment or for violation of IP agreements or non-competes.

Image from Babak Nivi of Venture Hacks, who warns startup founders and hires to “run screaming from” startup offers with a clawback clause for vested shares: “Founders and employees should not agree to this provision under any circumstances. Read your option plan carefully.”

How a Clawback Clause Limits Startup Equity Value

In a true startup equity plan, executives and employees earn shares, which they continue to own when they leave the company. There are special rules about vesting and requirements for exercising options, but once the shares are earned (and options exercised), these stockholders have true ownership rights.

But for startups with a clawback clause, individuals earn shares they don’t really own. In the case of repurchase rights for vested shares, the company can purchase the shares upon certain events, most commonly after the individual leaves or is terminated by the company. If the individual is still at the company at the time of an IPO or acquisition, they get the full value of the shares. If not, the company can buy back the shares at a discounted price, called the “fair market value” of the common stock (“FMV”) on the date of termination of employment or other triggering event.

Most hires do not know about the clawback clause when they negotiate an offer, join a company or exercise their stock options. This means they are earning equity and purchasing shares but do not have a true sense of its value or their ownership rights (or lack thereof).

Clawback Clause “Horrible” for Employees - Sam Altman of Y Combinator

In some cases a stockholder would be happy to sell their shares back to the company. But repurchase rights are not designed with the individual’s interests in mind. They allow the company to buy the shares back against the stockholder’s will and at a discounted price per share known as the “fair market value” or “FMV” of the common stock. As Sam Altman (now CEO of OpenAI) wrote when he was the head of Y Combinator, “It’s fine if the company wants to offer to repurchase the shares, but it’s horrible for the company to be able to demand this.”

The FMV paid by the company for the shares is not the true value for two reasons. First, the true value of common stock is close to the preferred stock price per share (the price that is paid by investors for stock and which is used to define the valuation of the startup), but the buyback FMV is far lower than this valuation. Second, the real value of owning startup stock comes at the exit event - IPO or acquisition. This early buyback prevents the stockholder realizing that growth or “pop” in value.

What is an Example of a Clawback Clause?

Famous Example - Skype Shares Worth $0 in $8.5 Billion Acquisition by Microsoft

In 2011, when Microsoft bought Skype for $8.5 billion (that’s a B), some former employees and executives were outraged when they found that their equity was worth $0 because of a clawback in their equity documents. Their shock followed a period of disbelief, during which they insisted that they owned the shares. They couldn’t lose something they owned, right?

One former employee who received $0 in the acquisition said that while the fine print of the legal documents did set forth this company right, he was not aware of it when he joined. “I would have never gone to work there had I known,” he told Bloomberg. According to Bloomberg, “The only mention that the company had the right to buy if he left in less than five years came in a single sentence toward the end of the document that referred him to yet another document, which he never bothered to read.”

Both Skype and the investors who implemented the clawbacks, Silver Lake Partners, were called out in the press as “evil,” the startup community’s indignation did not change the legal status of the employees and executives who were cut out of millions of dollars of value in the deal.

Recent Example - Tanium, funded by Salesforce Ventures and Andreessen Horowitz, claws back employee shares

More recently, Business Insider reported that Tanium, funded by Salesforce Ventures and Andreessen Horowitz, has forced employees to sell their shares back to the company at FMV after their employment is terminated.

The employees interviewed by Business Insider were not aware of that their contract included this clawback when they accepted their offers. “'Surprised' was my initial reaction," one such employee said. "I had not heard of that happening before. To me it felt like a gut punch. One of the reasons for working for the company is dangling the carrot of eventually going public or eventually getting acquired so employees would monetarily benefit from that.”

How Does a Clawback Provision Work?

Hypothetical Example #1 - Company Does NOT Have Clawback Clause for Vested Shares - Share Value: $1.7 Million

Here’s an example of how an individual would earn the value of startup stock without repurchase rights or clawbacks. In the case of an early hire of Ruckus Wireless, Inc., the value would have grown as shown below.

This is an example of a hypothetical early hire of Ruckus Wireless, which went public in 2012. It assumes that the company did not restrict executive or employee equity with repurchase rights or other clawbacks for vested shares. This person would have had the right to hold the shares until IPO and earn $1.7 million.

This is an example of a hypothetical early hire of Ruckus Wireless, which went public in 2012. It assumes that the company did not restrict executive or employee equity with repurchase rights or other clawbacks for vested shares. This person would have had the right to hold the shares until IPO and earn $1.7 million. If you want to see the working calculations, see this Google Sheet.

These calculations were estimated from company public filings with the State of California, the State of Delaware, and the Securities and Exchange Commission. For more on these calculations, see The One Percent: How 1% of Ruckus Wireless at Series A Became $1.7 million at IPO.

Hypothetical Example #2 - Company Has Clawback Clause for Vested Shares - Share Value: $68,916

If the company had the right to repurchase the shares at FMV at the individual’s departure, and they left after four years of service when the shares were fully vested, the forced buyout price would have been $68,916 (estimated). This would have caused the stockholder to forfeit $1,635,054 in value.

In this hypothetical, the individual would have lost $1,635,054 in value if the shares were repurchased at their termination. If you want to see the working calculations, see this Google Sheet.

No Surprises - Identifying a Clawback Clause During Negotiation

As you can see, clawbacks dramatically affect the value of startup stock. For some clients, this term is a deal breaker when they are negotiating a startup offer. For others, it makes cash compensation more important in their negotiation. Either way, it’s essential to know about this term when evaluating and negotiating an offer, or in considering the value of equity after joining a startup.

Unfortunately this term is not likely to be spelled out in an offer letter. It can appear in any number of documents such as stock option agreements, stockholders agreements, bylaws, IP agreements or non-compete agreements. These are not usually offered to a recruit before they sign the offer letter and joining the company. But they can be requested and reviewed during the negotiation stage to discover and renegotiate clawbacks and other red-flag terms.

What is a Typical Clawback Clause?

For examples of typical clawback clause language, see Part 2 - Examples of Clawbacks for Startup Stock.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Negotiation Rhythms #2: Best Alternative to Negotiated Agreement

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

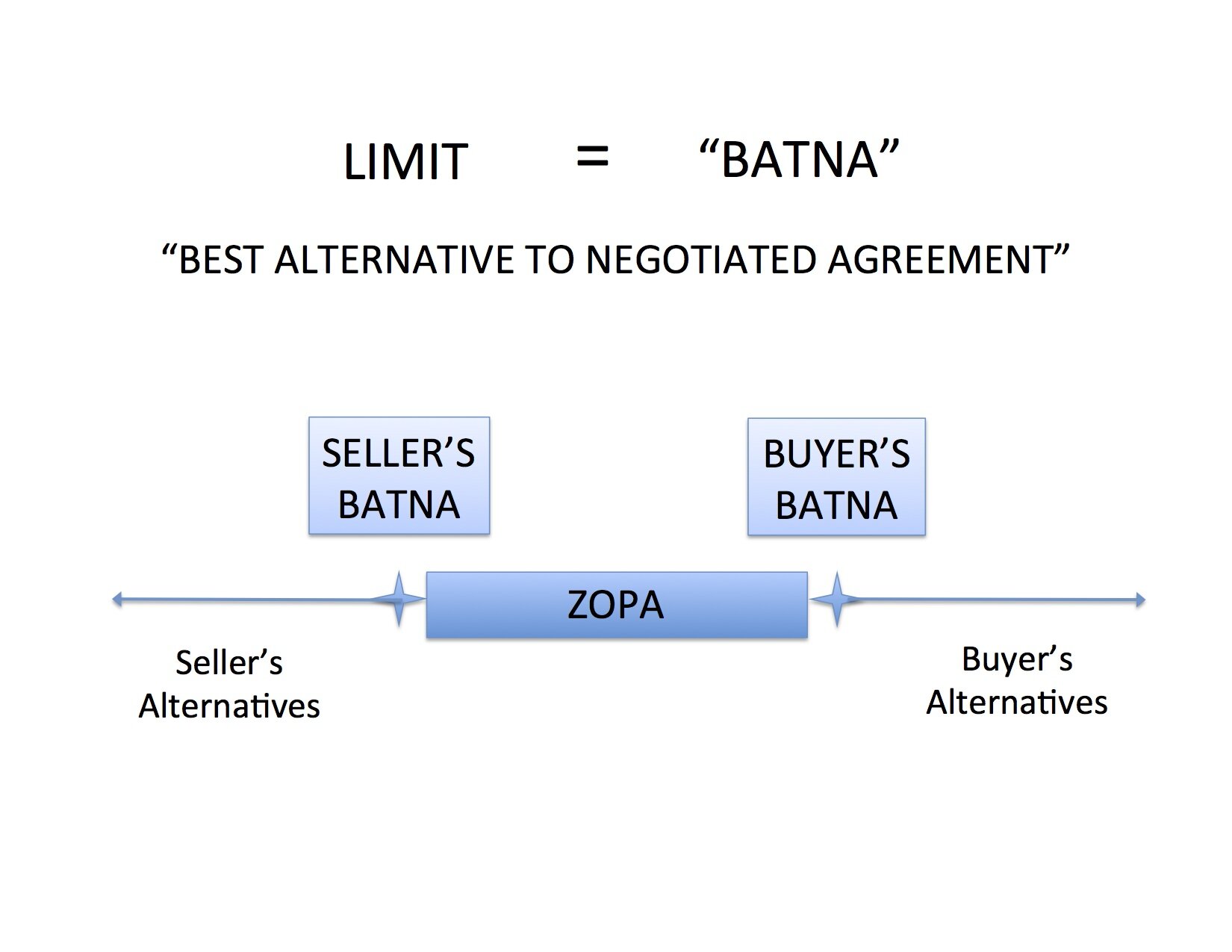

We know we want to push beyond our limits to capture as much value as possible in a negotiation. But how do we define those limits? It takes a five-word phrase to bring this concept into focus: Best Alternative to Negotiated Agreement (“BATNA”).

The BATNA for a car buyer might be the same car at a nearby dealership for $20,000. The BATNA for a home seller might be an offer from another party for $1 million. The BATNA for a child trading baseball cards might be to hold onto his favorite cards and enjoy looking at them rather than to trade them away.

Any agreement below (or, for a maximum limit, above) a BATNA would leave the negotiator worse off than in the absence of that particular agreement. Said another way, the negotiator would be better off with some other option – their BATNA – than accepting an agreement on those terms.

To properly identify a BATNA, we must do a lot of calculating, daydreaming, and going out in the world to test alternatives. But this creative process is necessary. When we believe that the only alternative is the one at hand, our negotiation position is dangerously weak. It is also dangerously ineffective because it leads to an arrangement that does not, in fact, make the negotiator better off than without it. And any deal that is not in both parties’ best interests is unstable and likely to collapse after it is made.

Countless factors go into naming and ranking one’s alternatives to arrive at a BATNA, and even then it is impossible to do so clearly as those factors cannot all be outlined in numerical format. A better offer might be less certain of being completed, so it might be more advantageous to make an agreement on less favorable terms today. For example, the other job offer might not be certain even though it appears it would be more advantageous if it were finalized. This is the old saying that a bird in the hand is better than two in the bush, and this can be dangerous for those who optimistically negotiate as if their imaginary alternatives are already in the hand. In the other extreme, this is very limiting for those who are very fearful of uncertainty, as they will accept disadvantageous terms for the simple purpose of having certain terms when a bit of risk in pursuit of a better alternative could have led to greater results.

Timing is important in other ways as well, as a negotiator with more time to come to an agreement will have more chances to find alternatives to the agreement at hand. "Wait and see" becomes a BATNA in itself. The opposite of this would be a party who must have resolution today, which would, of course, limit the alternatives.

Beyond hard limits on time, some people do not enjoy the back and forth process of negotiating. They might prefer to take this deal, and even to accept much less of the middle than is possible to capture, than to continue to seek alternatives or negotiate deals. For these people, the process itself inhibits the growth of BATNAs.

We’ll see in the next post – Negotiation Rhythms #3: Sales & Threats – how brainstorming or eliminating BATNAs changes the ZOPA and improves or weakens our force in negotiation.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Negotiation Rhythms

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

We’ve all heard plenty of advice about negotiating.

The business world directs us to stay rationally focused, rely on exhaustive preparation, think through alternatives, spend less time talking and more time listening and asking questions, and let the other side make the first offer.[1]

The psych world counsels us to listen first, sit down, find common ground, move in, keep cool, be brief, forget neutrality, avoid empty threats, and don’t yield.[2]

These tips don’t have much meaning without knowing the underlying principles of negotiations, and studying tips alone is about as meaningful as learning dance steps without ever hearing the music.

The following three-part series presents the rhythm of negotiations as described in the Harvard Negotiation Project’s Getting to Yes: Negotiating Agreement Without Giving In.[3] It should be useful for those first learning to hear this rhythm and for those who have been dancing since the bazaars of their youth who may need to go back to basics to learn some tricky new steps.

Read on!

#1: Zone of Possible Agreement

#2: Best Alternatives to Negotiated Agreement

#3: Sales & Threats

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

[1] Take It Or Leave It: The Only Guide to Negotiating You Will Ever Need http://www.inc.com/magazine/20030801/negotiation.html via @Inc

[2] The Art of Negotiation | Psychology Today http://www.psychologytoday.com/articles/200701/the-art-negotiation

[3] Roger Fisher, William Ury and Bruce Patton, Getting to Yes: Negotiating Agreement Without Giving In.