Joining an Early Stage Startup? Negotiate Your Startup Equity and Salary with Stock Option Counsel Tips

Startup equity negotiation tips for early stage founders, executives, employees, consultants and advisors.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Startup Equity @ Early Stage Startups

"Hey baby, what's your employee number?" A low employee number at a famous startup is a sign of great riches. But you can't start today and be Employee #1 at OpenAI, Discord, or one of the other most valuable startups on Earth. Instead you'll have to join an early-stage startup, negotiate a great equity package and hope for the company’s success. This post walks through the negotiation issues in joining a pre-Series A / seed-funded / very-early-stage startup.

Q: Isn't startup equity a sure thing? They have funding!

No. Raising small amounts from seed stage investors or friends and family is not the same sign of success and value as a multi-million dollar Series A funding by venture capitalists.

Carta’s data team published an update in December of 2023 showing the “graduation rates” from Series Seed to Series A within 2 years. They affirm that it’s not a sure thing to graduate from Series Seed to Series A and, therefore, even have the chance to make it all the way to a successful acquisition or IPO. In hot years of 2021-2022, the graduation rate hovered around 30% across all industries. In 2023, it ranged from:

23% for FinTech

20% for HealthTech

19% for Consumer

17% for SaaS

16% for Biotech

Here's an illustration from Dustin Moskovitz's presentation, Why to Start a Startup from Y Combinator's Startup School on the chances so "making it" for a startup that has already raised seed funding. These 2nd Round “graduation” numbers are higher than Carta’s numbers, as this data was from 2017 (a hot hot time for startup funding).

Q: How do you negotiate equity for a startup? How many shares of startup equity should I get?

Don't think in terms of number of shares or the valuation of shares when you join an early-stage startup. Think of yourself as a late-stage founder and negotiate for a specific percentage ownership in the company. You should base this percentage on your anticipated contribution to the company's growth in value.

Early-stage companies expect to dramatically increase in value between founding and Series A. For example, a common pre-money valuation at a VC financing is $8 million. And no company can become an $8 million company without a great team.

Imagine, for instance, that the company tries to sell you on the offer by insisting that they will someday be worth $1B and, therefore, your equity worth, say, $1M. The obvious question would be: Does it feel fair to you to make a significant contribution to the creation of $1B in value in exchange for $1M? For most people, the answer would be “no.”

Or, consider that the company is insisting that an offer of 1% is “worth” $1M because the company expects to raise a Series A - based in part on your efforts - at a $100M pre-money valuation. Leaving aside the wisdom (or lack thereof) of evaluating the offer based on its future value, you would want to ask yourself: Does it feel fair to you to make a significant contribution to the creation of $100M in value in exchange for $1M in equity (which would presumably be only partially vested as of the Series A)?

That would depend, of course, on how significant your contribution would be. And it would depend on the salary component of the offer. If the cash compensation is already close to market level, that might seem more than fair. If the cash offer is a fraction of your opportunity cost, you would be investing that opportunity cost to earn the equity. The potential upside would need to be great enough to balance the risk of that investment.

Q: Is 1% equity in a startup good?

The classic 1% for the first employee may make sense for a key employee joining after a Series A financing, but do not make the mistake of thinking that an early-stage employee is the same as a post-Series A employee.

First, your ownership percentage will be significantly diluted at the Series A financing. When the Series A VC buys approximately 20% of the company, you will own approximately 20% less of the company.

Second, there is a huge risk that the company will never raise a VC financing or survive past the seed stage. According to CB Insights, about 39.4% of companies with legitimate seed funding go on to raise follow-on financing. And the number is far lower for seed deals in which big name VCs are not participating.

Don't be fooled by promises that the company is "raising money" or "about to close a financing." Founders are notoriously delusional about these matters. If they haven't closed the deal and put millions of dollars in the bank, the risk is high that the company will run out of money and no longer be able to pay you a salary. Since your risk is higher than a post-Series A employee, your equity percentage should be higher as well.

Q: What is typical equity for startup? How should I think about market data for startup equity?

Data sets on employee and executive offer percentages for early stage startups can be misleading and encourage companies to make unrealistically low offers to early hires. There’s two reasons for this. First, these data sets are for employees who are earning something like market level salaries along with equity. Second, these data sets exclude anyone classified as a “founder” from the data set for employees. They keep different data sets for founders! So the gray area between the two classifications makes the use of data tricky. Who is a founder for purposes of the data set? Depends on the data set. Carta, for instance, excludes anyone with 5% or more from the employee/executive data set and classifies them as founders! Even if they are earning market-level cash from their start date.

Here’s the bottom line:

If you are joining before you are being paid startup-phase-market-level cash salary, you are a late stage founder. You should evaluate your equity percentage relative to the other founders within the company or within the market data set.

If you are joining for a combination of cash and equity at an early stage startup, the offer should make sense to you. Simply pointing to market data for the right % ownership is not enough. You’ll want to consider the market data for % ownership in conjunction with the dollar value of the equity based on how investors have most recently valued the company.

Q: How should early-stage startups calculate my percentage ownership?

You'll be negotiating your equity as a percentage of the company's "Fully Diluted Capital." Fully Diluted Capital = the number of shares issued to founders ("Founder Stock") + the number of shares reserved for employees ("Employee Pool") + the number of shares issued to other investors (“preferred shares”). There may also be warrants outstanding, which should also be included. Your Number of Shares / Fully Diluted Capital = Your Percentage Ownership.

Careful, though, because most startups do not issue preferred stock when they take their seed investment funds from their seed investors. Instead, they issue convertible notes or SAFEs. These convert into shares of preferred stock in the next round of funding. So if you negotiate for 1% of a seed stage startup funded with notes or SAFEs, the fully diluted capital number used as the denominator of that calculation does not include the shares to be issued for those seed funds.

How can you address this? First, make sure you know what’s included. You can ask:

How many shares are outstanding on a fully diluted basis? Does this include the full option pool? Are there any shares yet to be issued for investments in the company, such as on SAFEs or convertible notes? How many shares do you expect to issue upon their conversion?

If you are comparing your offer to other seed stage offers or to market data for seed stage offers, you would want to take that into consideration. The number the company provides is only an estimate, of course, but it’s a way to address this in your evaluation.

Q: Is there anything tricky I should look out for in my startup equity documents?

Yes. Look for repurchase rights for vested shares.

If so, you may forfeit your vested shares if you leave the company for any reason prior to an acquisition or IPO. In other words, you have infinite vesting as you don't really own the shares even after they vest. This can be called "vested share repurchase rights," "clawbacks” or "non-competition restrictions on equity.”

Most employees who will be subject to this don't know about it until they are leaving the company (either willingly or after being fired) or waiting to get paid out in a merger that is never going to pay them out. That means they have been working to earn equity that does not have the value they think it does while they could have been working somewhere else for real equity.

According to equity expert Bruce Brumberg, "You must read your whole grant agreement and understand all of its terms, even if you have little ability to negotiate changes. In addition, do not ignore new grant agreements on the assumption that these are always going to be the same." When you are exchanging some form of cash compensation or making some other investment such as time for the equity, it makes sense to have an attorney review the documents before committing to the investment.

Q: What is fair for vesting of startup equity?

The standard vesting is monthly vesting over four years with a one year cliff. This means that you earn 1/4 of the shares after one year and 1/48 of the shares every month thereafter. But vesting should make sense. If your role at the company is not expected to extend for four years, consider negotiating for a vesting schedule that matches that expectation.

Q: Should I agree to milestone or performance metrics for my vesting schedule for startup equity?

No. This is a double risk. Not only is there a high risk that the company will not be successful (and the equity worthless), there is a high risk that the milestones will not be met. This is very often outside the control of the employee or even the founders. More on this issue here. The standard is four-year vesting with a one-year cliff. Anything else is off-market and is a sign that the founders are trying to be too creative and reinvent the wheel.

Q: Should I have protection for my unvested shares of startup equity in the event of an acquisition?

Yes. When you negotiate for an equity package in anticipation of a valuable exit, you would hope that you would have the opportunity to earn the full number of shares in the offer so long as you are willing to stay through the vesting schedule.

If you do not have protection for your unvested shares in the stock documents, unvested shares may be cancelled at the time of an acquisition. I call this a “Cancellation Plan.”

Executives and key hires negotiate for “double trigger acceleration upon change of control.” This protects the right to earn the full block of shares, as the shares would immediately become vested if both of the following are met: (1st trigger) an acquisition occurs before the award is fully vested; and (2nd trigger) the employee is terminated after closing before they are fully vested.

There’s plenty of variation in the fine print of double trigger clauses, though. Learn more here.

Q: The company says they will decide the exercise price of my stock options. Can I negotiate that?

A well-advised company will set the exercise price at the fair market value ("FMV") on the date the board grants the options to you. This price is not negotiable, but to protect your interests you want to be sure that they grant you the options ASAP.

Let the company know that this is important to you and follow up on it after you start. If they delay granting you the options until after a financing or other important event, the FMV and the exercise price will go up. This would reduce the value of your stock options.

Early-stage startups very commonly delay making grants. They shrug this off as due to "bandwidth" or other nonsense. But it is really just carelessness about giving their employees what they have been promised.

The timing and, therefore, price of grants does not matter much if the company is a failure. But if the company has great success within its first years, it is a huge problem for individual employees. I have seen individuals stuck with exercise prices in the hundreds of thousands of dollars when they were promised exercise prices in the hundreds of dollars.

Q: What salary can I negotiate as an early-stage employee?

When you join an early-stage startup, you may have to accept a below market salary. But a startup is not a non-profit. You should be up to market salary as soon as the company raises real money. And you should be rewarded for any loss of salary (and the risk that you will be earning $0 salary in a few months if the company does not raise money) in a significant equity award when you join the company.

When you join the company, you may want to come to agreement on your market rate and agree that you will receive a raise to that amount at the time of the financing.

I sometimes see people ask at hire to receive a bonus at the time of the financing to make up for working at below-market rates in the early stages. This is a gamble, of course, because only a small percent of seed-stage startups would ever make it to Series A and be able to pay that bonus. Therefore, it makes far more sense to negotiate for a substantial equity offer instead.

Q: What form of startup equity should I receive? What are the tax consequences of the form?

[Please do not rely on these as tax advice to your particular situation, as they are based on many, many assumptions about an individual's tax situation and the company's compliance with the law. For example, if the company incorrectly designs the structure or the details of your grants, you can be faced with penalty taxes of up to 70%. Or if there are price fluctuations in the year of sale, your tax treatment may be different. Or if the company makes certain choices at acquisition, your tax treatment may be different. Or ... you get the idea that this is complicated.]

These are the most tax advantaged forms of equity compensation for an early-stage employee in order of best to worst:

1. [Tie] Restricted Stock. You buy the shares for their fair market value at the date of grant and file an 83(b) election with the IRS within 30 days. Since you own the shares, your capital gains holding period begins immediately. You avoid being taxed when you receive the stock and avoid ordinary income tax rates at sale of stock. But you take the risk that the stock will become worthless or will be worth less than the price you paid to buy it.

1. [Tie] Non-Qualified Stock Options (Immediately Early Exercised). You early exercise the stock options immediately and file an 83(b) election with the IRS within 30 days. There is no spread between the fair market value of the stock and the exercise price of the options, so you avoid any taxes (even AMT) at exercise. You immediately own the shares (subject to vesting), so you avoid ordinary income tax rates at sale of stock and your capital gains holding period begins immediately. But you take the investment risk that the stock will become worthless or will be worth less than the price you paid to exercise it.

3. Incentive Stock Options ("ISOs"): You will not be taxed when the options are granted, and you will not have ordinary income when you exercise your options. However, you may have to pay Alternative Minimum Tax ("AMT") when you exercise your options on the spread between the fair market value ("FMV") on the date of exercise and the exercise price. You will also get capital gains treatment when you sell the stock so long as you sell your stock at least (1) one year after exercise AND (2) two years after the ISOs are granted.

Q: Who will guide me if I have more questions on startup equity?

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

VIDEO Startup Stock Options: Negotiate the Right Startup Stock Option Offer

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Company-Side Education Programs on Startup Equity - Feedback from Newsletter Subscribers

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

I asked my newsletter subscribers to share their experiences with startup company employee equity education programs. Thank you for all your responses! I love being in touch and hearing your feedback.

See below under My Takeaways for a quick primer on how employees can empower themselves by taking the initiative to learn about startup equity and ask their companies for the information they need to make informed decisions.

Individuals reported these company programs they found very helpful:

Company all-hands meetings followed by both (1) smaller working groups led by the CEO/CFO using real world tangible scenarios to explain and provide context and (2) one-on-ones with senior management.

Training sessions with the company’s CFO.

Carta, including blog content, presentations, Equity 101 posts, and online calculators. “Very good interface with clear information.”

Individuals reported these company programs they found somewhat helpful:

Company-wide information meeting on stock options, but not provided until years after the employee joined the company.

Carta as stock administrator. This allows employees to “have more access and run the calculator more frequently. But it doesn’t speak to the non-price issues like post-termination exercise periods, forced share repurchase,” etc. Also, “Carta maximizes for startup friendliness, and here employee friendliness runs counter to that goal.”

ShareWorks as stock administrator. The “account includes the value of your options based on the latest valuation. From a user experience, [though,] it is clunky like most financial software products.”

Individuals reported these company programs they found not helpful or harmful:

Company education program on stock option exercise by a stock broker who was “in it for himself and not the employees. … The education they were offering was to inform the newly wealthy employees how to “invest” their new found cash. It is not a good strategy to use someone like that for that purpose … I lost about $1M of the money I earned from the startup. It was disastrous. If companies host an individual, make sure they are fiduciaries and not brokers.”

Company-wide information meeting with general information and many disclaimers, which was “not that helpful for making actionable decisions. … I think the presentations backfired because most either didn’t understand options any better than they did prior to the meeting and those that did realized their options weren’t that valuable (which was the opposite motivation of the CEO).”

In a geographic area where “most employees aren’t stock option aware …, although we granted stock options to all employees, most ignored them because they were difficult to understand. And HR was unable to answer any questions about options because they didn’t understand them. … In the case of recruiting and offers -- the lore was more important than the facts.”

Recruiters who “fail to disclose the material issues, and sometimes state that the equity situation is more favorable than it actually is.”

Individuals reported these wish-list items they had not yet seen:

“If this were my project, I would use a framework of virtual recorded introductory education sessions that give the basics of the compensation program, and a one-on-one follow up to cover any lingering questions. I would build out a self-help knowledge base that covers common lingering questions and/or use that info to improve the education sessions.”

“I like the idea of a 3rd party to provide the trainings, mixed with key staff or founder interaction to build trust.”

Examples, simplicity, transparency and opportunities for lots of Q&A in small groups. A library of content that addresses common questions, concerns and misconceptions would also be very valuable.

“It would be great if our law firm had established programs to walk us through the process.”

“What employees really want to know is -- what is the value of my options under various realistic scenarios. One approach might be several if-then scenarios and then employees can decide which one of those hypothetical scenarios most applies to them.”

“Options seem to be presented as a commodity component to most offerings with a presumed windfall. … It’s important to manage expectations of what the value is and how to think about that; how to act, when, why.”

An educational program would need to provide an “overview, some tools for employees to calculate future sums/ exit projections (dream a bit), and cover common tax issues, maybe an overview of company/venture process (what the near future could mean for equity holders), and gotchas like: what happens to my vested equity if I have to leave the company.”

Services providers reported these as service offerings they had available to companies:

Note: If you are a service provider in this area with an offering I have not included, please send me an email with a description of your services so I can add it to the list.

Dan Walter, FutureSense. Dan advises companies on executive pay, equity compensation, incentive compensation, and pay for performance. He says that employee education “is a normal piece of our deliverables for nearly every company we work with.” I’ve seen him speak on these topics and he has, as promised, “a unique ability to help anyone understand even the most complex and technical details in ways that are approachable and memorable.”

Bruce Brumberg, myStockOptions.com. Bruce’s site, myStockOptions.com, is the “premier source of web-based educational content and tools on stock compensation for plan participants, financial advisors, companies, and stock plan providers.” They license their educational resources to companies for their programs.

Tom Bondi, CPA, Armanino, LLP. Tom offers company-side employee stock/equity training programs to companies with from 25-500 employees, where the companies wish to give back to their employees with knowledge they are not able to offer.

Financial Advisors who are available to companies in the run-up to an IPO or acquisition to educate the company’s employees.

Carta’s Tax Advisory. Updated February 2023: This add-on to Carta’s cap table service allows startups to help their employees make tax decisions around their equity. Employees of subscribing companies have access to one-on-ones with tax advisors such as: Ask a Quick Question (15 minutes), Understand Equity Tax Basics (30 minutes), Create Tax Scenarios (45 minutes) and Discuss Tender Offer Participation (30 minutes).

My takeaways:

Some company-side education programs are helpful to employees in navigating their equity. However, it is up to individual employees to empower themselves by taking the initiative to learn about startup equity and ask their companies for the information they need to make informed decisions.

Here’s a quick primer on how individuals can do this (based on this blog post):

Number of Shares. The offer letter may include the number of shares, but this number is certainly not all you need to evaluate and negotiate the offer. I encourage candidates to ask questions about the equity package and number of shares until they have the information they need to make an informed decision. More on evaluating the number of shares in an offer letter here.

Equity Grant Form Documents. The equity incentive plan and form stock option agreement contain important details about the equity grant, so it makes sense to request and review them before signing the offer letter. These agreements may give the company clawback rights for vested shares or other terms that may dramatically limit the value of the equity offer. If these red flags appear in the form documents, it makes sense to negotiate to remove them from your individual grant or add additional compensation to make up for that loss in value.

Tax Structure. The right tax structure for an option or RSU offer will balance your interests in total value, low tax rates, tax deferral and investment deferral. This balance is different for each individual and at each company stage. You will want to have a tax strategy in mind before accepting the offer letter, so you can negotiate any necessary terms to enable that strategy as part of the offer letter itself.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Newsletter! Request for Feedback: What Makes a Great Company Education Program on Startup Employee Equity

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Hello Startup Community!

Here’s your quarterly update on startup equity from Stock Option Counsel, P.C. Thanks for a great year!

Request for Input - Company Education Programs on Equity Compensation. Several companies and venture capital firms have asked me how they can best educate their new hires on their equity compensation programs. I’d like to ask for your input so that I can share a list of best practices. Would you please take a moment to send me your ideas and experiences?

I’m curious to hear:

How have companies educated you on your stock options, RSUs, etc.?

Have you had access to live Q&A sessions? On-demand video trainings? Online calculators?

What has worked well? Not worked?

Who presented training sessions and answered your questions? The finance team? The legal team? Outside consultants?

Have company equity portals, such as Carta or Shareworks, included educational content? Was it helpful? How could it have been improved?

What would make a top-of-the-line employee equity education program?

Please send me any feedback you have! I’m at info@stockoptioncounsel.com.

Many thanks in advance for your input. I really love being part of this community, and hearing back from members of this mailing list means a lot to me.

Thanks for a Great Year. I'd like to thank our clients, blog readers and newsletter subscribers for a great year. Thank you!

I'm looking forward to 2022 to continue our mission of empowering individuals to make the most of their startup equity opportunities.

Happy Holidays and Cheers to 2022!

Best,

Mary

Mary Russell | Attorney and Founder

Stock Option Counsel, P.C. | Legal Services for Individuals

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

SPAC Wonderland - Winter Newsletter - Stock Option Counsel, P.C.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Hello Startup Community!

Happy New Year! Before we move on from 2020, I wanted to answer some FAQs on SPACs as they relate to startup employee equity.

SPACs. The special-purpose acquisition company - or SPAC - has become a popular path to liquidity for venture capital startups. Virgin Galactic, DraftKings and Nikola Motor Co. (among many others) have gone public via SPAC, and there are many other such deals in the pipeline for 2021. If you're looking for more information on the phenomenon, I would suggest the WSJ's article Why Finance Executives Choose SPACs: A Guide to the IPO Rival.

In addition, I've answered some questions frequently asked by employee equity holders at startups on the SPAC acquisition process:

Q: If my company is going public through a SPAC, when can I sell my shares?

Some companies provide an opportunity for immediate liquidity at the closing of the transaction. This is known as a secondary offering or tender offer, and will allow you to sell some portion (say, 10%) of your holdings as the merger closes and the company's shares become publicly traded. This sale is to a designated buyer at a designated price.

If your company's SPAC is not designed to include such a tender offer, you will have to wait until the lockup on sales expires to sell your shares.

Q: Why can't I sell all my shares if the SPAC deal makes the company's stock publicly traded?

When you accepted your stock options or purchased your shares, you agreed that you would be bound by a lockup for some period following the company's public offering. This is a standard term in private company stock documents. It is designed to ease the company's path to the public markets by limiting the quantity of shares available to the public after the company's shares become publicly traded.

Q: When will I be able to sell my shares?

After the lockup expires. The traditional lockup length is 180 days. However, SPAC transactions often have a variation to this standard. Some require employee stockholders to agree to a longer term, such as one year. Others have eased the traditional 180 day period by allowing for earlier sales if the company's stock achieves a targeted price for a certain period within that 180 day period.

Q: What should I do to prepare for the SPAC?

Think of it just as you would an IPO. If you have any questions about your legal rights to your shares or options or the terms of a tender offer, reach out to your attorney. If you are making option exercise or stock sale decisions, reach out to your accountant and/or financial planner. You're always welcome to reach out to Stock Option Counsel for guidance.

Podcast. Thank you to Aaron Phillips of the Green Financial Planner Podcast for having me as a guest this month. The episode - Top Priorities To Consider When

Stock Option Counsel, P.C. - Legal Services for Individuals. Thank you for your enthusiasm for my practice and blog. You can learn more - including testimonials - on the website.

“Mary is a great resource and was very easy to work with. She was very thorough and helped me negotiate my worth. I recommend that any potential startup employee (at any level) work with Stock Option Counsel to make sure they understand their contracts and offers. ”

— Kevin Beauregard, Vice President - Engineering, Equity Offer Counsel

Please keep in touch!

Best,

Mary

Mary Russell | Attorney and Founder

Stock Option Counsel, P.C. | Legal Services for Individuals

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

The Increasing Burden on Startups to Convince Good Candidates to Join - Q4 Newsletter - Stock Option Counsel, P.C.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Happy New Year, Startup Community!

Here's our latest update from the world of startup equity on a new service from Stock Option Counsel and excerpts from a fascinating discussion at Hacker News on the increasing burden on startups to convince good candidates to join.

Tell Your Boss. We now offer on-site programs at later-stage startups to help employees and executives plan for future liquidity. Our CPA and financial planning partners present in groups or individual power sessions. This is a huge help to startup HR and finance executives who are restricted from providing individual advice to their employees and executives. Let them know this service is available so they can offer it as a benefit to you!

Startups' Increasing Burden in Hiring Top Talent. We counsel individuals on negotiating their startup job offers. We see on a daily basis that startups have to make meaningful and well-designed equity offers to recruit talent from big tech. Here's some excerpts from a fascinating conversation on this topic at Hacker News:

Waving a fraction of a percent in equity in front of candidates simply does not work anymore. … Coming into 2020, I think startups’ best bet is to [be] transparent and honest with candidates about all risks involved when joining a startup and factoring all this into the amount of equity they offer which should be something considerable. - Zain Amro, a software engineer based in Berkeley, California, from his blog

I believe [Zain's] post does a very good job of bringing the elephant in the room into the discussion. The current structure of equity compensation for early-stage startup companies is simply not enticing enough to get people to choose that over the salary and predictable path of BigTechCos. ... We should ... give more equity to early employees and have favorable terms around vesting for these employees and better timing around the loss of options after leaving a company. … Ensuring your early employees will be taken care of means they'll work harder for your company and this will increase the chance you'll survive long enough to see an event that makes anyone a return on their investment. - Grimm1 at Hacker News

This is easy. Offer relatively competitive TC with a real potential upside to the equity package and a work environment that's attractive. BigCorp is mired in politics and decision-making that's grounded in risk mitigation. Do something legitimately interesting and folks will come. Give them some agency and the ability to really get things done and they'll stay. - halbritt at Hacker News

What’s a more democratic funding model to spread net innovation? - bhl at Hacker News

There are already 372 comments in the discussion. I hope it grows in 2020!

Stock Option Counsel, P.C. - Legal Services for Individuals. Thank you for all your enthusiasm for my practice and for the Stock Option Counsel Blog. It's been another great year. I will continue to send quarterly updates on important topics in the market for startup equity for individual founders, executives and employees. Please keep in touch and have a very happy 2020!

Best,

Mary

Mary Russell | Attorney and Founder

Stock Option Counsel, P.C. | Legal Services for Individuals

(650) 326-3412 | mary@stockoptioncounsel.com

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Fall 2018 Newsletter - Stock Option Counsel®

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Hello Startup Community!

Here's the big news in the world of startup equity.

Leaked Compensation Data for Startup Executives from Andreessen Horowitz. Business Insider has published a database of startup executive compensation data leaked from Andreessen Horowitz. It was sourced from executive search firms and is searchable by fundraising stage. This data may be valuable to startup executives negotiating their compensation and interesting to anyone curious to know how much executives in the startup world earn in cash and equity.

How to Use the Data. The data reveals that the level defined for a role can dramatically affect the compensation offer. For example, the difference between the compensation for a CMO and a VP of Marketing at a Series A company would be significant in both cash and equity. In counseling individuals on their compensation negotiations, I see the most significant increases in cash and equity from successful re-leveling arguments. Read more on my blog about how to use leveling to negotiate the right startup offer or contact me for information on my services.

Pay Gap for Startup Equity. I was recently interviewed by Bloomberg for an article on the gender pay gap for startup equity. They featured a study by Carta which found that women "make up 35 percent of equity-holding employees, but hold only 20 percent of the employee equity," and, further, that women make up "13 percent of founders but hold 6 percent of founder equity." I noted that one reason for the gap may be a lack of willingness to push for information necessary to evaluate a startup equity offer: "Equity is information asymmetry squared. You have to have the confidence to put the responsibility on the company to give you enough information."

Closing the Information Gap. It's up to individuals to educate themselves on equity and negotiate for the right number of shares to balance the risk of joining a startup. The purpose of my practice is to be available to those who need guidance in this process. See my website for more information.

Stock Option Counsel, P.C. - Legal Services for Individuals. Thank you for your enthusiasm for my practice and for the Stock Option Counsel Blog! I will continue to send quarterly updates on important topics in the market for startup equity for individual founders, executives and employees. Please keep in touch.

Best,

Mary

Mary Russell | Attorney and Founder

Stock Option Counsel, P.C. | Legal Services for Individuals

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

In the News: Startup Employees in the Dark on Equity

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

“Mary Russell, an attorney who founded Stock Option Counsel to help employees evaluate their equity compensation, says the first step is for employees to make sure any equity is theirs to keep. Some companies have repurchase rights in their equity agreements that give them a right to buy back shares and options from any employee who leaves; and some give founders or investors broad latitude to change the terms.

“If the company can take back employee shares it dramatically limits the value of those shares,” says Ms. Russell. “It’s the sort of thing an employee needs to know about when they go into a job.” She says it’s as simple as asking whether the company can take back vested shares.”

See Katie Benner's full article, Startup Employees in the Dark on Equity. The Information is a subscription publication for professionals who need the inside scoop on technology news and trends.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Links - Best Web Content on Startup Employee Stock

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.Here's links to the best web content on startup employee stock:

1. Risk/Reward

Calculating percentage ownership and understanding fully diluted capital, #1-2 of The 14 Crucial Questions About Stock Options, Andy Rachleff, the Wealthfront Blog

How to use the company's VC valuation to evaluate your equity offer, Video, Stock Option Counsel Blog

How to ask about valuation, #11-13 of The 14 Crucial Questions About Stock Options, Andy Rachleff, the Wealthfront Blog

How preferred stock rights make common stock less valuable, Stock Option Counsel Blog

Knowing your market rate with regards to startup equity, #3-4 of The 14 Crucial Questions About Stock Options, Andy Rachleff, the Wealthfront Blog

How to know how much is enough equity for a pre-Series A startup, Stock Option Counsel Blog

Four factors of how startups decide your salary and equity Mary Russell & Boris Esptein on the Stock Option Counsel Blog

Four factors of how startup decide your equity offer VIDEO Mary Russell & Boris Esptein on the Stock Option Counsel Blog

2. Vesting

Acceleration upon change of control, Gil Silberman on Quora

When acceleration upon change of control does not make sense, Gil Silberman on Quora

What is vesting; what is acceleration upon change of control? #5 & #8 of 14 Crucial Questions about Stock Options, Andy Rachleff, Wealthfront Blog

Does my vesting make sense? Stock Option Counsel Blog

3. Ownership

Can the company take back my vested shares if I leave?, #6 of The 14 Crucial Questions About Stock Options, Andy Rachleff, the Wealthfront Blog

How Skype's repurchase rights gave certain employees $0 of $8.5 billion acquisition payouts, Felix Salmon at Wired

4. Tax Benefits

Three Ways to Avoid Tax Problems When You Exercise Options, Bob Guenley, Wealthfront Blog

Ensuring company compliance with tax rules - and your tax rights - when negotiating an offer, #9-10 of 14 Crucial Questions About Stock Options, Andy Rachleff on the Wealthfront Blog

Incentive stock options, Michael Gray, CPA

Non-qualified employee stock options Michael Gray, CPA

5. Overview

The 14 Crucial Questions About Stock Options, Andy Rachleff, the Wealthfront Blog

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Negotiating Equity @ a Startup – Stock Option Counsel Tips

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Negotiating an offer from a startup? Here's some tips.

1. Know How Much Equity You Want

For employees early in their careers, the only negotiable terms for equity are the number of shares of stock and, possibly, the vesting schedule. The company will already have defined the form in which you will earn those shares, such as stock options, restricted stock units or restricted stock.

Your task in negotiating equity is to know how many shares would make the offer appealing to you or better than your other offers. If you don’t know what you want for equity, the company will be happy to tell you that you don’t want much.

Your desired number of shares should be the result of thoughtful consideration of the equity offer. There is no simple way to evaluate equity, but understanding the concepts and playing with the numbers should give you the power to decide how many shares you want.

One way to compare offers and evaluate equity is to find the current VC valuation of the preferred shares in the company. If a VC has recently paid $10 per share for the company’s stock, and you have been offered 10,000 shares, you can use $100,000 to compare to other offers. If another company has offered you 20,000 shares, and a VC has recently paid $5 for their shares, you could use those numbers to compare the offers. For more info on finding VC valuations, see: Startup Valuation Basics or contact Stock Option Counsel.

Remember that the purpose of this exercise is not to have a precise dollar value for the offer, but to answer these questions: How does this offer compare to other offers or my current position? What salary and number of shares at this company would make this a stable, sustainable relationship for me? In other words, will this keep me happy here for some time? If not, it is in nobody’s best interest to come to a deal on that package.

For more information on negotiating equity, see our video: Negotiate the Right Stock Option Offer or our blog with Boris Epstein of BINC Search: Negotiate the Right Job Offer.

2. Look for Tricky Legal Terms That Limit Your Shares' Value

There are some key legal terms that can diminish the value of your equity grant. Pay careful attention to these, as some are harsh enough that it makes sense to walk away from an equity offer.

If you receive your specific equity grant documents before you are hired, such as the Equity Incentive Plan or Stock Option Plan, you can ask an attorney to read them.

If you don’t have the documents, you will have to wait until after you are hired to study the terms. But you can ask some general questions during the negotiation to flush out the tricky terms. For example, will the company have any repurchase rights or forfeiture rights for vested shares? Does the equity plan limit the kinds of exit events in which I can participate? What happens to my equity if I leave the company?

3. Evaluate the Equity’s Potential

Evaluate the company to know how many shares would make the equity offer worth your time. You can start by asking the company some basic questions on their expectations for future growth and the exit timeline.

The higher your rank in the company and the stronger your emphasis on these matters, the more likely you are to speak to the CEO, CFO or someone else at the company who can answer these questions. If you want more resources to help you think like a startup investor, there are great online resources on valuation, dilution and exits for startups.

But don’t place too much weight on the company’s predictions of the equity’s potential value, especially if those values are based on an early-stage company’s Discounted Cash Flows (DCF). Even the experts know that the only thing early stage startups know about financial projections is that they are wrong.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Stock Option Counsel Tip #1

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Use @angellist to research "market" equity for your company size. https://angel.co/jobs #equity #negotiation #startup

From The Daily Muse

Attorney Mary Russell, Founder of Stock Option Counsel based in San Francisco, advises that anyone receiving equity compensation should evaluate the company and offer based on his or her own independent analysis. This means thoughtfully looking at the company’scapitalization and valuation.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Thanks Ji Eun (Jamie) Lee for the mention in The Daily Muse!

“Is This the Right Company?

Investors buy equity in a company with money, but you’ll be earning it through your investment of time and effort. So it’s important to think rationally, as an investor would, about the growth prospects of your start-up.

Attorney Mary Russell, Founder of Stock Option Counsel based in San Francisco, advises that anyone receiving equity compensation should evaluate the company and offer based on his or her own independent analysis. This means thoughtfully looking at the company’s capitalization and valuation. ”

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Negotiation Rhythms #3: Sales & Threats

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Mary Russell counsels individual employees and founders to negotiate, maximize and monetize their stock options and other startup stock. She is an attorney and the founder of Stock Option Counsel. You are welcome to contact Stock Option Counsel at info@stockoptioncounsel or (650) 326-3412.

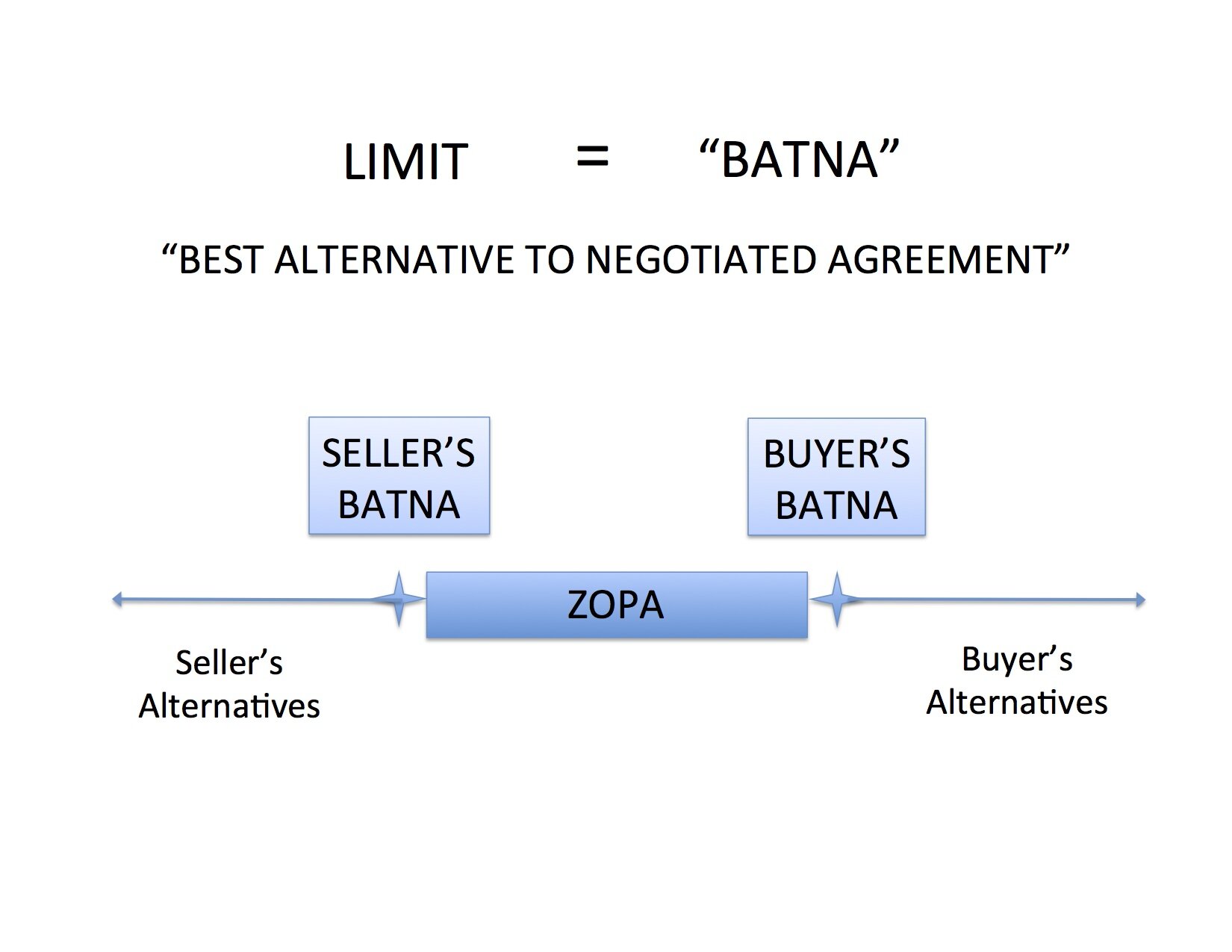

There are two ways to increase or decrease another party’s limit in a negotiation – sales and threats.[1] The picture above takes some of the mystery out of the salesman and the thug -- they're both just working as negotiators to change the perception of the current offer in comparison to the other party's BATNA – Best Alternative to Negotiated Agreement.

Selling improves the perception of the quality of the present offer so that the outside alternatives are unattractive by comparison. Threats decrease the attractiveness of outside offers or the possibility of making no deal and sticking with the status quo.

Threats

An ongoing employment lawsuit over no-hire agreements among Silicon Valley companies featuring Steve Jobs provides a strangely relevant example of the power of threats.

Edward Colligan, former CEO of Palm, has said in a statement that Jobs was concerned about Palm’s hiring of Apple employees and that Jobs “proposed an arrangement between Palm and Apple“ [2] to prohibit either party from recruiting the others' employees.

That would have been a simple offer of an agreement (however illegal that arrangement might have been) if Colligan had access to the undisturbed alternative of not participating and keeping the status quo.

But Colligan has said that Jobs’ next negotiation move was to make the alternative of nonparticipation very unappealing with the threat of patent lawsuits that would cost Palm and Apple a great deal of money. Jobs followed this threat with a reminder of just how unpleasant such litigation would be for Palm, considering the fact that Apple had vast resources to endlessly pursue the lawsuits: "I’m sure you realize the asymmetry in the financial resources of our respective companies …."

Even though most of us don’t use threats in a negotiation, it’s part of the logic of negotiation rhythms.

Selling

Selling is the more common (and generally legal) way to address the fact that the other party has choices outside the present negotiation. As we discussed in the prior posts, a party's price or terms limits are defined by his or her best alternative outside of making an agreement in the present negotiation. Selling moves the limit when it can make the present offer more appealing than what had been perceived as an outside alternative.

Many people resist “selling themselves” in a salary negotiation because they are embarrassed to discuss their “value.” The logic of BATNA and negotiations provides some relief from this embarrassment, for it reframes “selling” from bluffing and puffing to describing and distinguishing one’s past experience and intended role in the organization.

Since the employer’s limit is not defined by an individual’s value, but by the employee’s differentiation from the field of candidates, the task of negotiating becomes more fact-based and less fear-driven. This logic encourages progress from the attitude of “Oh, they see who I am and hate me,” toward the sales approach of “Oh, it seems they need more information about what I offer in terms of my past experience and my role going forward.”

As an employee’s offer of services becomes distinguishable from the employer’s alternatives, the employer’s perception of the BATNA will change.

Consider an employer who believes there’s an equal candidate available for $120,000 and is entertaining another’s proposal to perform the role for $140,000. Without “selling” the offer of one’s services, the employer has no information with which to make a distinction between the two alternatives. The process of selling oneself to the employer is not to prove one’s inner worthiness at $140,000, but to show and tell that the employer is choosing between two distinguishable candidates.

(For those still interested in threats, distinguishing one’s skills is a form of a threat when it comes to negotiating with a current employer. Every element of the description one’s current performance and ongoing role is a threat of what the employer would have to work without or try to replace.)

What an employer would have once considered a better alternative – such as another equal offer for $120,000 – loses its appeal in light of the truth (sales pitch) of the $140,000 offer. If they are no longer equal in the mind of the employer, he or she must consciously decide if the other candidate at the lower price is still a better alternative. While there is no guarantee that the employer will prefer to pay more, the process of selling pushes the employer to the choice based on the true distinctions in the qualities of the candidates.

[1] Roger Fisher, William Ury and Bruce Patton, Getting to Yes: Negotiating Agreement Without Giving In. Gerald B. Wetlaufer, The Rhetorics of Negotiation (posted to SSRI).

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Negotiation Rhythms #2: Best Alternative to Negotiated Agreement

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

We know we want to push beyond our limits to capture as much value as possible in a negotiation. But how do we define those limits? It takes a five-word phrase to bring this concept into focus: Best Alternative to Negotiated Agreement (“BATNA”).

The BATNA for a car buyer might be the same car at a nearby dealership for $20,000. The BATNA for a home seller might be an offer from another party for $1 million. The BATNA for a child trading baseball cards might be to hold onto his favorite cards and enjoy looking at them rather than to trade them away.

Any agreement below (or, for a maximum limit, above) a BATNA would leave the negotiator worse off than in the absence of that particular agreement. Said another way, the negotiator would be better off with some other option – their BATNA – than accepting an agreement on those terms.

To properly identify a BATNA, we must do a lot of calculating, daydreaming, and going out in the world to test alternatives. But this creative process is necessary. When we believe that the only alternative is the one at hand, our negotiation position is dangerously weak. It is also dangerously ineffective because it leads to an arrangement that does not, in fact, make the negotiator better off than without it. And any deal that is not in both parties’ best interests is unstable and likely to collapse after it is made.

Countless factors go into naming and ranking one’s alternatives to arrive at a BATNA, and even then it is impossible to do so clearly as those factors cannot all be outlined in numerical format. A better offer might be less certain of being completed, so it might be more advantageous to make an agreement on less favorable terms today. For example, the other job offer might not be certain even though it appears it would be more advantageous if it were finalized. This is the old saying that a bird in the hand is better than two in the bush, and this can be dangerous for those who optimistically negotiate as if their imaginary alternatives are already in the hand. In the other extreme, this is very limiting for those who are very fearful of uncertainty, as they will accept disadvantageous terms for the simple purpose of having certain terms when a bit of risk in pursuit of a better alternative could have led to greater results.

Timing is important in other ways as well, as a negotiator with more time to come to an agreement will have more chances to find alternatives to the agreement at hand. "Wait and see" becomes a BATNA in itself. The opposite of this would be a party who must have resolution today, which would, of course, limit the alternatives.

Beyond hard limits on time, some people do not enjoy the back and forth process of negotiating. They might prefer to take this deal, and even to accept much less of the middle than is possible to capture, than to continue to seek alternatives or negotiate deals. For these people, the process itself inhibits the growth of BATNAs.

We’ll see in the next post – Negotiation Rhythms #3: Sales & Threats – how brainstorming or eliminating BATNAs changes the ZOPA and improves or weakens our force in negotiation.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Startup Stock: Particles and Waves. Casinos and Creativity.

Photo: Bobby Mikul

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

What is a corporation? Finance pros and justice types present two very different answers to that question.

On the finance side, a corporation is a casino-style financial arrangement between those who own stock. It divides up the rights to a financial return on capital. It emphasizes balance sheets and stock prices and risk and return to support the view that each corporation is a table in a casino that investors approach to place their investment bets and seek a financial return.

On the human advocacy side, a corporation is a living body made up of creative individuals. The liveliness of the group – defined to include investors, managers, employees, and, perhaps, the community or the earth – is the purpose of the corporation. They make comparisons to slavery, define externalities and articulate their values to support their view that a corporation is a living body that could not be owned.

Like a ray of light, which is at once a wave and a group of particles, the corporation is both a casino game for investors and a living, creative body. Evidence will always appear on both sides of this truth.

In choosing a career path and negotiating compensation, we use both perspectives. We find a place that has some life to it, to which our creative contribution can add life. But we tune into the casino view as well and seek compensation for the risk we take in joining the enterprise. This requires the eye of an investor who would look at the risks of the bet and the size of the possible return from every angle with the help of professionals in law, finance, technology, etc.

It would be distasteful to take this view of our work every day, but it must be done at some time. And it is best done with Stock Option Counsel. This blog will introduce the Stock Option Counsel perspective on the risk / investment that employees take / make in accepting stock options or other equity as compensation. It should be helpful to those evaluating their compensation and also reveal the points in time in which Stock Option Counsel can add value in this process.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.