VIDEO Startup Stock Options: Negotiate the Right Startup Stock Option Offer

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Fall 2018 Newsletter - Stock Option Counsel®

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Hello Startup Community!

Here's the big news in the world of startup equity.

Leaked Compensation Data for Startup Executives from Andreessen Horowitz. Business Insider has published a database of startup executive compensation data leaked from Andreessen Horowitz. It was sourced from executive search firms and is searchable by fundraising stage. This data may be valuable to startup executives negotiating their compensation and interesting to anyone curious to know how much executives in the startup world earn in cash and equity.

How to Use the Data. The data reveals that the level defined for a role can dramatically affect the compensation offer. For example, the difference between the compensation for a CMO and a VP of Marketing at a Series A company would be significant in both cash and equity. In counseling individuals on their compensation negotiations, I see the most significant increases in cash and equity from successful re-leveling arguments. Read more on my blog about how to use leveling to negotiate the right startup offer or contact me for information on my services.

Pay Gap for Startup Equity. I was recently interviewed by Bloomberg for an article on the gender pay gap for startup equity. They featured a study by Carta which found that women "make up 35 percent of equity-holding employees, but hold only 20 percent of the employee equity," and, further, that women make up "13 percent of founders but hold 6 percent of founder equity." I noted that one reason for the gap may be a lack of willingness to push for information necessary to evaluate a startup equity offer: "Equity is information asymmetry squared. You have to have the confidence to put the responsibility on the company to give you enough information."

Closing the Information Gap. It's up to individuals to educate themselves on equity and negotiate for the right number of shares to balance the risk of joining a startup. The purpose of my practice is to be available to those who need guidance in this process. See my website for more information.

Stock Option Counsel, P.C. - Legal Services for Individuals. Thank you for your enthusiasm for my practice and for the Stock Option Counsel Blog! I will continue to send quarterly updates on important topics in the market for startup equity for individual founders, executives and employees. Please keep in touch.

Best,

Mary

Mary Russell | Attorney and Founder

Stock Option Counsel, P.C. | Legal Services for Individuals

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

New Blog on Change of Control Terms - New Videos - Summer 2018 Newsletter - Stock Option Counsel, P.C

New video for individuals negotiating startup equity offers explaining the difference between startup valuation and 409A valuation.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.Hello Startup Community!

Here's the latest on startup equity for individual founders, executives and employees.

Negotiating Change of Control Protections for Unvested Shares. See my newest post on the four categories of change of control terms, from the worst of the worst - cancellation plans - to the best of the best - single trigger acceleration. It also provides current market info on which terms executives, employees and founders can reasonably expect to negotiate in their offers.

Liquidation Preferences Make the News. FanDuel's $465 million acquisition deal reported by Legal Sports Report shows the power of liquidation preferences. Ordinary shares will receive $0 in the deal because of preferred shares' $543 million liquidation preference. See this post for more info on liquidation preferences and this post on how startup executives consider these in negotiating their offers.

New Videos! Check out new videos on:

Stock Option Counsel, P.C. - Legal Services for Individuals. Thank you for your enthusiasm for my practice and for the Stock Option Counsel Blog! I will continue to send quarterly updates on important topics in the market for startup equity for individual founders, executives and employees. Please keep in touch.

Best,

Mary

Mary Russell | Attorney and Founder

Stock Option Counsel, P.C. | Legal Services for Individuals

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Repurchase Rights are "Horrible" for Employees

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

“As an aside, some companies now write in a repurchase right on vested shares at the current common price when an employee leaves. It’s fine if the company wants to offer to repurchase the shares, but it’s horrible for the company to be able to demand this.”

What can you do about it? Ask before you join:

“Can the company take back my vested shares?”

For more from Sam Altman, see his post, Employee Equity. For more on repurchase rights on vested shares, see Clawbacks for Startup Stock - Can I Keep What I think I Own? For more on questions to ask to make sure you have true startup equity, see our post, Startup Equity Standards - A Guide for Employees.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Negotiation Rhythms #2: Best Alternative to Negotiated Agreement

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

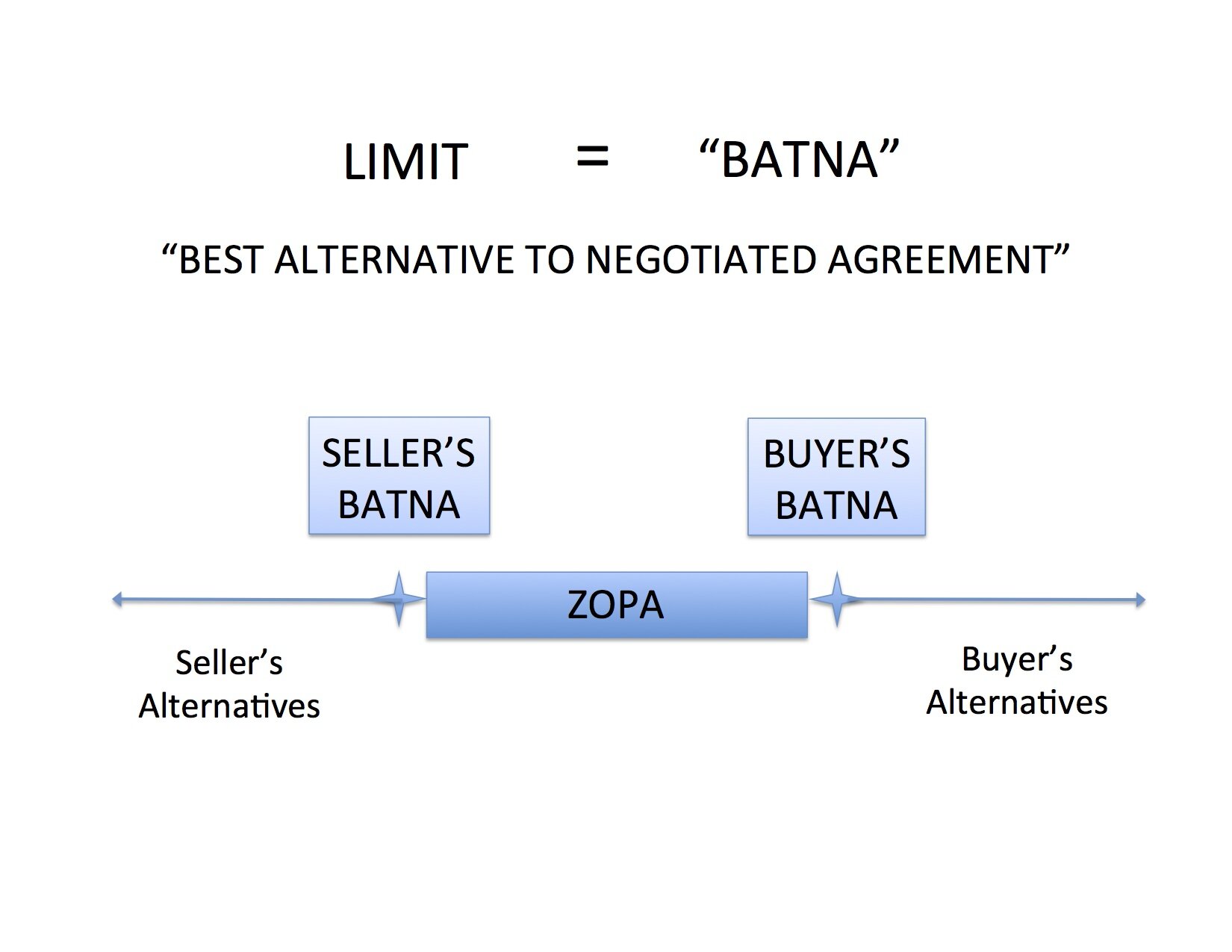

We know we want to push beyond our limits to capture as much value as possible in a negotiation. But how do we define those limits? It takes a five-word phrase to bring this concept into focus: Best Alternative to Negotiated Agreement (“BATNA”).

The BATNA for a car buyer might be the same car at a nearby dealership for $20,000. The BATNA for a home seller might be an offer from another party for $1 million. The BATNA for a child trading baseball cards might be to hold onto his favorite cards and enjoy looking at them rather than to trade them away.

Any agreement below (or, for a maximum limit, above) a BATNA would leave the negotiator worse off than in the absence of that particular agreement. Said another way, the negotiator would be better off with some other option – their BATNA – than accepting an agreement on those terms.

To properly identify a BATNA, we must do a lot of calculating, daydreaming, and going out in the world to test alternatives. But this creative process is necessary. When we believe that the only alternative is the one at hand, our negotiation position is dangerously weak. It is also dangerously ineffective because it leads to an arrangement that does not, in fact, make the negotiator better off than without it. And any deal that is not in both parties’ best interests is unstable and likely to collapse after it is made.

Countless factors go into naming and ranking one’s alternatives to arrive at a BATNA, and even then it is impossible to do so clearly as those factors cannot all be outlined in numerical format. A better offer might be less certain of being completed, so it might be more advantageous to make an agreement on less favorable terms today. For example, the other job offer might not be certain even though it appears it would be more advantageous if it were finalized. This is the old saying that a bird in the hand is better than two in the bush, and this can be dangerous for those who optimistically negotiate as if their imaginary alternatives are already in the hand. In the other extreme, this is very limiting for those who are very fearful of uncertainty, as they will accept disadvantageous terms for the simple purpose of having certain terms when a bit of risk in pursuit of a better alternative could have led to greater results.

Timing is important in other ways as well, as a negotiator with more time to come to an agreement will have more chances to find alternatives to the agreement at hand. "Wait and see" becomes a BATNA in itself. The opposite of this would be a party who must have resolution today, which would, of course, limit the alternatives.

Beyond hard limits on time, some people do not enjoy the back and forth process of negotiating. They might prefer to take this deal, and even to accept much less of the middle than is possible to capture, than to continue to seek alternatives or negotiate deals. For these people, the process itself inhibits the growth of BATNAs.

We’ll see in the next post – Negotiation Rhythms #3: Sales & Threats – how brainstorming or eliminating BATNAs changes the ZOPA and improves or weakens our force in negotiation.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.