Newsletter! Request for Feedback: What Makes a Great Company Education Program on Startup Employee Equity

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Hello Startup Community!

Here’s your quarterly update on startup equity from Stock Option Counsel, P.C. Thanks for a great year!

Request for Input - Company Education Programs on Equity Compensation. Several companies and venture capital firms have asked me how they can best educate their new hires on their equity compensation programs. I’d like to ask for your input so that I can share a list of best practices. Would you please take a moment to send me your ideas and experiences?

I’m curious to hear:

How have companies educated you on your stock options, RSUs, etc.?

Have you had access to live Q&A sessions? On-demand video trainings? Online calculators?

What has worked well? Not worked?

Who presented training sessions and answered your questions? The finance team? The legal team? Outside consultants?

Have company equity portals, such as Carta or Shareworks, included educational content? Was it helpful? How could it have been improved?

What would make a top-of-the-line employee equity education program?

Please send me any feedback you have! I’m at info@stockoptioncounsel.com.

Many thanks in advance for your input. I really love being part of this community, and hearing back from members of this mailing list means a lot to me.

Thanks for a Great Year. I'd like to thank our clients, blog readers and newsletter subscribers for a great year. Thank you!

I'm looking forward to 2022 to continue our mission of empowering individuals to make the most of their startup equity opportunities.

Happy Holidays and Cheers to 2022!

Best,

Mary

Mary Russell | Attorney and Founder

Stock Option Counsel, P.C. | Legal Services for Individuals

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Founders' Stock Red Flags - Keep Your Law Firm on Your Side

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

I help founders protect their personal equity interests, from incorporation through financing and exit events. Lately, I’ve seen startup law firms yielding founder rights to future investors by proposing incorporation documents that are detrimental to founder interests. These choices are being made by company counsel and signed by founders before a company has investors.

Here are some of the red flag terms I call out for my clients:

Requiring board approval for transfer of shares;

Adding Company repurchase rights for vested founder shares upon termination of employment;

Using stock option structure rather than restricted stock at founding;

Setting the purchase price of shares higher than necessary;

Adopting a stock plan for future employee grants that has off-market, anti-employee terms;

Failing to provide for any vesting acceleration related to a change of control, or limiting double trigger acceleration of change of control to apply only if the termination event is within 6 or 12 months of the change of control rather than at any time after it; or

Adding Company rights to terminate unvested shares or options at the time of a change of control.

I’ve seen some of these terms even from classic Big Law startup-focused firms in recent months. Limits on founder shares are often negotiated between founders and investors at the time of financing – not before. This is usually done through a stockholders agreement, such as a ROFR Agreement or Voting Agreement. It is premature for founders to restrict themselves – or for a company’s law firm to restrict founders – by adding pro-investor terms to the incorporation documents.

The founder’s task is to communicate to company counsel that they want standard, pro-founder terms in the incorporation documents and provide feedback if they see that company counsel has added pro-investor terms have been included before negotiation with investors.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

*Thank you to JD McCullough for edits to this post. JD is a health tech entrepreneur, interested in connecting and improving businesses, products, and people.*

Considerations for founder restricted stock purchase agreements.

Negotiation Rhythms #2: Best Alternative to Negotiated Agreement

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

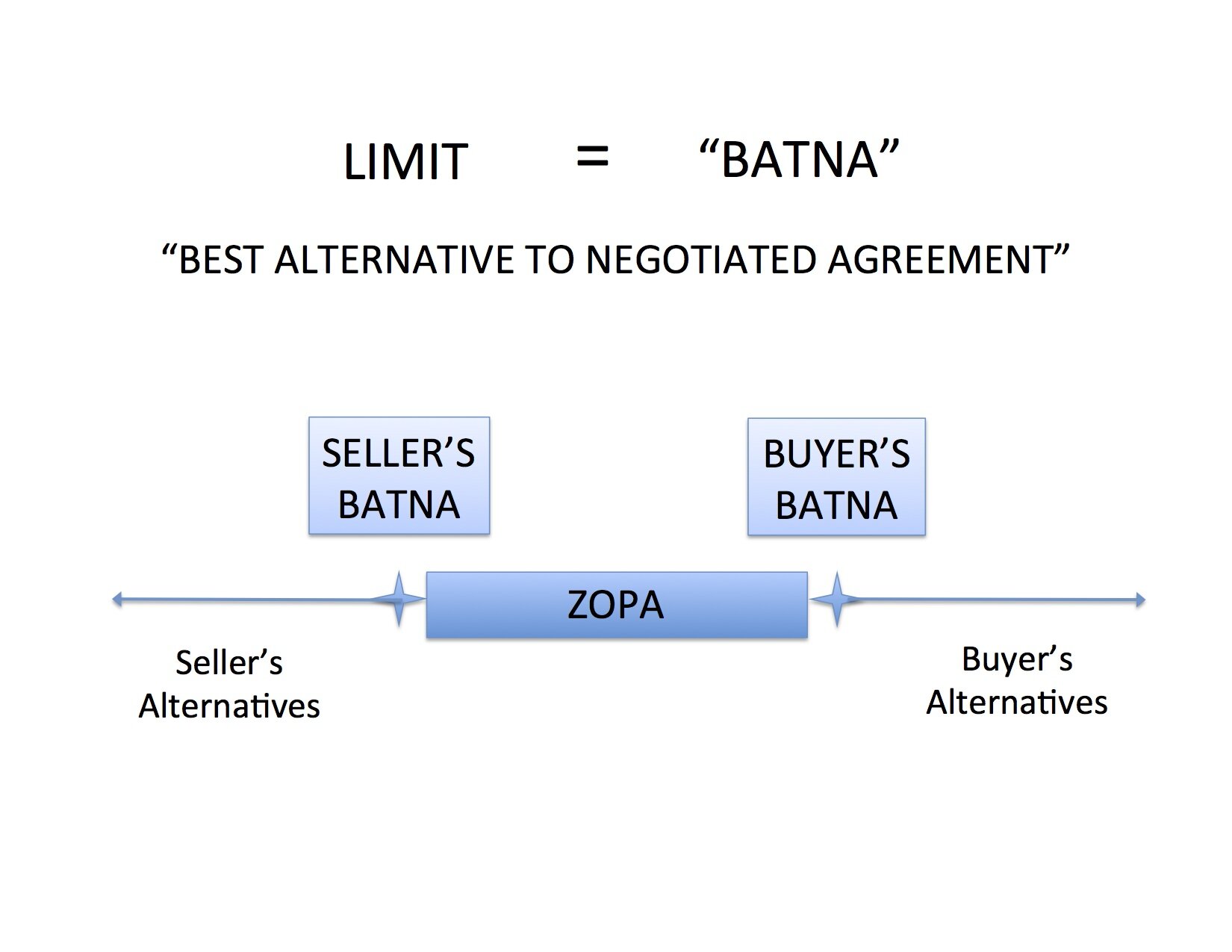

We know we want to push beyond our limits to capture as much value as possible in a negotiation. But how do we define those limits? It takes a five-word phrase to bring this concept into focus: Best Alternative to Negotiated Agreement (“BATNA”).

The BATNA for a car buyer might be the same car at a nearby dealership for $20,000. The BATNA for a home seller might be an offer from another party for $1 million. The BATNA for a child trading baseball cards might be to hold onto his favorite cards and enjoy looking at them rather than to trade them away.

Any agreement below (or, for a maximum limit, above) a BATNA would leave the negotiator worse off than in the absence of that particular agreement. Said another way, the negotiator would be better off with some other option – their BATNA – than accepting an agreement on those terms.

To properly identify a BATNA, we must do a lot of calculating, daydreaming, and going out in the world to test alternatives. But this creative process is necessary. When we believe that the only alternative is the one at hand, our negotiation position is dangerously weak. It is also dangerously ineffective because it leads to an arrangement that does not, in fact, make the negotiator better off than without it. And any deal that is not in both parties’ best interests is unstable and likely to collapse after it is made.

Countless factors go into naming and ranking one’s alternatives to arrive at a BATNA, and even then it is impossible to do so clearly as those factors cannot all be outlined in numerical format. A better offer might be less certain of being completed, so it might be more advantageous to make an agreement on less favorable terms today. For example, the other job offer might not be certain even though it appears it would be more advantageous if it were finalized. This is the old saying that a bird in the hand is better than two in the bush, and this can be dangerous for those who optimistically negotiate as if their imaginary alternatives are already in the hand. In the other extreme, this is very limiting for those who are very fearful of uncertainty, as they will accept disadvantageous terms for the simple purpose of having certain terms when a bit of risk in pursuit of a better alternative could have led to greater results.

Timing is important in other ways as well, as a negotiator with more time to come to an agreement will have more chances to find alternatives to the agreement at hand. "Wait and see" becomes a BATNA in itself. The opposite of this would be a party who must have resolution today, which would, of course, limit the alternatives.

Beyond hard limits on time, some people do not enjoy the back and forth process of negotiating. They might prefer to take this deal, and even to accept much less of the middle than is possible to capture, than to continue to seek alternatives or negotiate deals. For these people, the process itself inhibits the growth of BATNAs.

We’ll see in the next post – Negotiation Rhythms #3: Sales & Threats – how brainstorming or eliminating BATNAs changes the ZOPA and improves or weakens our force in negotiation.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Startup Stock: Particles and Waves. Casinos and Creativity.

Photo: Bobby Mikul

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

What is a corporation? Finance pros and justice types present two very different answers to that question.

On the finance side, a corporation is a casino-style financial arrangement between those who own stock. It divides up the rights to a financial return on capital. It emphasizes balance sheets and stock prices and risk and return to support the view that each corporation is a table in a casino that investors approach to place their investment bets and seek a financial return.

On the human advocacy side, a corporation is a living body made up of creative individuals. The liveliness of the group – defined to include investors, managers, employees, and, perhaps, the community or the earth – is the purpose of the corporation. They make comparisons to slavery, define externalities and articulate their values to support their view that a corporation is a living body that could not be owned.

Like a ray of light, which is at once a wave and a group of particles, the corporation is both a casino game for investors and a living, creative body. Evidence will always appear on both sides of this truth.

In choosing a career path and negotiating compensation, we use both perspectives. We find a place that has some life to it, to which our creative contribution can add life. But we tune into the casino view as well and seek compensation for the risk we take in joining the enterprise. This requires the eye of an investor who would look at the risks of the bet and the size of the possible return from every angle with the help of professionals in law, finance, technology, etc.

It would be distasteful to take this view of our work every day, but it must be done at some time. And it is best done with Stock Option Counsel. This blog will introduce the Stock Option Counsel perspective on the risk / investment that employees take / make in accepting stock options or other equity as compensation. It should be helpful to those evaluating their compensation and also reveal the points in time in which Stock Option Counsel can add value in this process.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.