Negotiating Equity @ a Startup – Stock Option Counsel Tips

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Negotiating an offer from a startup? Here's some tips.

1. Know How Much Equity You Want

For employees early in their careers, the only negotiable terms for equity are the number of shares of stock and, possibly, the vesting schedule. The company will already have defined the form in which you will earn those shares, such as stock options, restricted stock units or restricted stock.

Your task in negotiating equity is to know how many shares would make the offer appealing to you or better than your other offers. If you don’t know what you want for equity, the company will be happy to tell you that you don’t want much.

Your desired number of shares should be the result of thoughtful consideration of the equity offer. There is no simple way to evaluate equity, but understanding the concepts and playing with the numbers should give you the power to decide how many shares you want.

One way to compare offers and evaluate equity is to find the current VC valuation of the preferred shares in the company. If a VC has recently paid $10 per share for the company’s stock, and you have been offered 10,000 shares, you can use $100,000 to compare to other offers. If another company has offered you 20,000 shares, and a VC has recently paid $5 for their shares, you could use those numbers to compare the offers. For more info on finding VC valuations, see: Startup Valuation Basics or contact Stock Option Counsel.

Remember that the purpose of this exercise is not to have a precise dollar value for the offer, but to answer these questions: How does this offer compare to other offers or my current position? What salary and number of shares at this company would make this a stable, sustainable relationship for me? In other words, will this keep me happy here for some time? If not, it is in nobody’s best interest to come to a deal on that package.

For more information on negotiating equity, see our video: Negotiate the Right Stock Option Offer or our blog with Boris Epstein of BINC Search: Negotiate the Right Job Offer.

2. Look for Tricky Legal Terms That Limit Your Shares' Value

There are some key legal terms that can diminish the value of your equity grant. Pay careful attention to these, as some are harsh enough that it makes sense to walk away from an equity offer.

If you receive your specific equity grant documents before you are hired, such as the Equity Incentive Plan or Stock Option Plan, you can ask an attorney to read them.

If you don’t have the documents, you will have to wait until after you are hired to study the terms. But you can ask some general questions during the negotiation to flush out the tricky terms. For example, will the company have any repurchase rights or forfeiture rights for vested shares? Does the equity plan limit the kinds of exit events in which I can participate? What happens to my equity if I leave the company?

3. Evaluate the Equity’s Potential

Evaluate the company to know how many shares would make the equity offer worth your time. You can start by asking the company some basic questions on their expectations for future growth and the exit timeline.

The higher your rank in the company and the stronger your emphasis on these matters, the more likely you are to speak to the CEO, CFO or someone else at the company who can answer these questions. If you want more resources to help you think like a startup investor, there are great online resources on valuation, dilution and exits for startups.

But don’t place too much weight on the company’s predictions of the equity’s potential value, especially if those values are based on an early-stage company’s Discounted Cash Flows (DCF). Even the experts know that the only thing early stage startups know about financial projections is that they are wrong.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Best of Blogs: How to Value and Negotiate Startup Stock Options

NOTE: Updated February 23, 2016.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

We have suggested the following free resources to Stock Option Counsel clients to help them master this area and gain confidence in negotiating their stock options and other employee stock.

1. Leo Polovet's' Analyzing AngelList Job Postings, Part 1: Basic Stats & Part 2: Salary and Equity Benchmarks

2. Venture Hacks' I have a job offer at a startup, am I getting a good deal?

3. Andy Payne's Startup Equity for Employees

4. Mary Russell's Startup Equity Standards: A Guide for Employees

5. Wealthfront's Startup Salary and Equity Compensation Calculator (This is very general but people find it helpful.) And Wealthfront's The Right Way to Grant Equity to Your Employees.

6. Patrick McKenzie of Kalzumeus Software's Salary Negotiation: Make More Money, Be More Valued

7. Piaw Na's Negotiating Compensation, from An Engineer's Guide to Silicon Valley Startups

8. mystockoptions.com's How does a private company decide on the size of a stock grant? (You may have to create a login)

9. Michelle Wetzler's How I Negotiated My Startup Compensation

10. Mary Russell's Video Negotiate the Right Startup Stock Option Offer, based on Mary Russell and Boris Epstein's Bull's Eye: Negotiate the Right Job Offer

11. Mary Russell's Joining An Early Stage Startup? Negotiate Your Salary and Equity with Stock Option Counsel Tips

12. Robby Grossman's Negotiating Your Startup Job Offer

13. John Greathouse's What The Heck Are My Startup Stock Options Worth?! Seven Questions You Should Ask Before Joining A Startup

14. David Weekly's An Introduction to Stock & Options for the Tech Entrepreneur or Startup Employee

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Negotiation Rhythms #2: Best Alternative to Negotiated Agreement

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

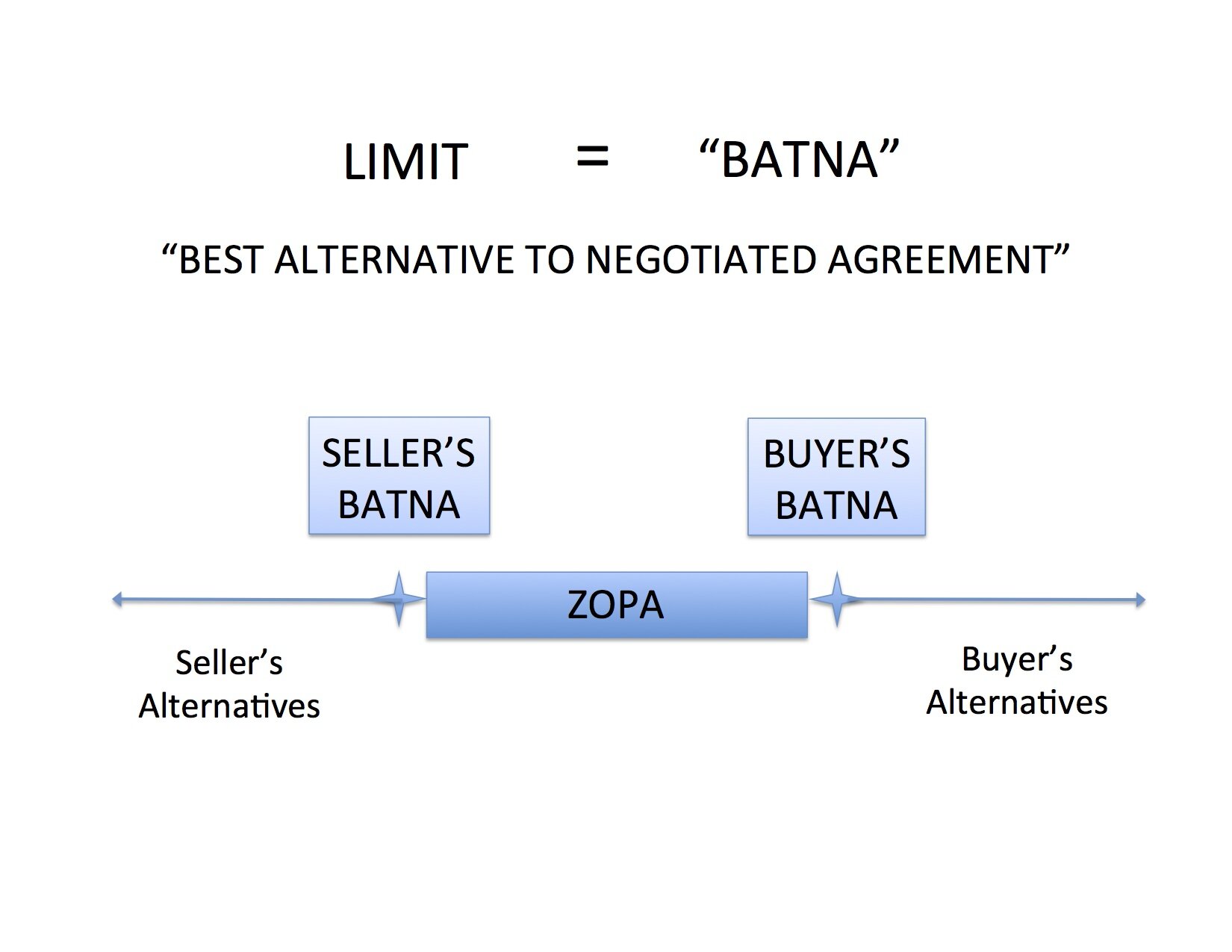

We know we want to push beyond our limits to capture as much value as possible in a negotiation. But how do we define those limits? It takes a five-word phrase to bring this concept into focus: Best Alternative to Negotiated Agreement (“BATNA”).

The BATNA for a car buyer might be the same car at a nearby dealership for $20,000. The BATNA for a home seller might be an offer from another party for $1 million. The BATNA for a child trading baseball cards might be to hold onto his favorite cards and enjoy looking at them rather than to trade them away.

Any agreement below (or, for a maximum limit, above) a BATNA would leave the negotiator worse off than in the absence of that particular agreement. Said another way, the negotiator would be better off with some other option – their BATNA – than accepting an agreement on those terms.

To properly identify a BATNA, we must do a lot of calculating, daydreaming, and going out in the world to test alternatives. But this creative process is necessary. When we believe that the only alternative is the one at hand, our negotiation position is dangerously weak. It is also dangerously ineffective because it leads to an arrangement that does not, in fact, make the negotiator better off than without it. And any deal that is not in both parties’ best interests is unstable and likely to collapse after it is made.

Countless factors go into naming and ranking one’s alternatives to arrive at a BATNA, and even then it is impossible to do so clearly as those factors cannot all be outlined in numerical format. A better offer might be less certain of being completed, so it might be more advantageous to make an agreement on less favorable terms today. For example, the other job offer might not be certain even though it appears it would be more advantageous if it were finalized. This is the old saying that a bird in the hand is better than two in the bush, and this can be dangerous for those who optimistically negotiate as if their imaginary alternatives are already in the hand. In the other extreme, this is very limiting for those who are very fearful of uncertainty, as they will accept disadvantageous terms for the simple purpose of having certain terms when a bit of risk in pursuit of a better alternative could have led to greater results.

Timing is important in other ways as well, as a negotiator with more time to come to an agreement will have more chances to find alternatives to the agreement at hand. "Wait and see" becomes a BATNA in itself. The opposite of this would be a party who must have resolution today, which would, of course, limit the alternatives.

Beyond hard limits on time, some people do not enjoy the back and forth process of negotiating. They might prefer to take this deal, and even to accept much less of the middle than is possible to capture, than to continue to seek alternatives or negotiate deals. For these people, the process itself inhibits the growth of BATNAs.

We’ll see in the next post – Negotiation Rhythms #3: Sales & Threats – how brainstorming or eliminating BATNAs changes the ZOPA and improves or weakens our force in negotiation.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.