Bull’s Eye: Negotiating the Right Job Offer

Boris Epstein is the founder of BINC Search, a next-generation recruiting startup that helps Silicon Valley companies hire technical talent at the scale they need.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

You’re negotiating your salary and equity. You know there is a right answer – a bull’s eye where the final offer should land. But where is it?

The company is deciding what to offer you. They know there is a right answer, and they’ll get there using these four factors:

1. Past Comp – your salary and equity in current and past jobs

2. Peer Comp – the salary and equity of others in your peer group within this company

3. Desired Comp – what you want to get paid, regardless of other indicators

4. Market Comp – your competitive offers in the market

The right offer for you is the bull’s eye at the center of these possible offers. You can maximize your final offer by thoughtfully using these factors in your negotiation.

Past Comp

The company may ask you to disclose your compensation in your previous positions – your Past Comp.

If you disclose these numbers, be sure to include detail or “color” on the numbers to show the true value of your Past Comp. Do you believe your salary was lower than it should have been because of difficult financial circumstance at the company? Are you overdue for a review and raise? Does your company have valuable equity or a bonus structure that should be included to accurately describe your Past Comp? Are you expecting to continue vesting or receive additional stock option grants that you would forfeit by leaving your company?

A thoughtful discussion of your Past Comp may be more effective than following the lore that you should never disclose this information. You can use your answer to the question to guide the company to the right offer.

Peer Comp

The company also considers your Peer Comp – the range this company is already paying employees in similar positions. You start shaping this number during your interview as you discuss roles, levels and opportunities and present information to help the company understand where you fit to add the most value to the team.

For a company with a thoughtful system of leveling, there will be names or labels for each position and a range of salaries and equity packages they offer within each level. Your negotiation work is to distinguish yourself and show that you are a peer of those being paid at the highest end of the range for your level based on your unique skill set or experience.

The more unique your position, the less experience a startup will have in defining your Peer Comp. If you are a first-hire designer, physician or other leadership or expert role, you may have to help the company understand who your peers will be. This is especially important in early-stage startups, where the hiring team might not understand that your new role should be considered a peer of, for example, vice presidents rather than junior engineers.

Desired Comp

The company also considers your Desired Comp – what you want to get paid. This is highly relevant to the right offer.

Desired Comp is especially important in equity packages, where your evaluation of the company’s equity may vary greatly from another candidate’s evaluation of that package. If you’ve been hoping for a home run exit during your career, you’ll be looking for an equity package that could get you there. If you’re strapped for cash and looking to maximize salary, you will have less desire for an equity-heavy final offer.

There may be some tradeoffs, of course, but the right offer will be centered on your Desired Comp. So do your self-reflection homework and know what you want.

Market Comp

Companies take into account Market Comp and need to know what they will have to offer to stay competitive. While companies have a general idea of what is “market” for each position, your personal Market Comp is unique and driven by your efforts to identify alternative offers. The only way to use the right Market Comp in your negotiation is to go out to the market, derive that information and communicate it to the company.

Once you have competitive offers, evaluate the equity packages and make thoughtful comparisons between them. For example, based on your appetite for risk and financial considerations, would you prefer options to purchase 1% of a Series A startup with a company valuation of $5 million or 5,000 RSUs of a public company with a current market price per share of $10? How many more stock options would the Series A startup have to offer you to equate to the public company offer? The company cannot make this estimation for you any more than they can decide which company is the best fit for your personality. When you own this process, you can confidently and effectively communicate to your company what is “market” for your equity offer.

Market Comp is also relevant after hire, as the startup job market can shift dramatically over time and new opportunities are always surfacing. As you continually find new information about opportunities, you can continually communicate with your company about what is “market” in defining the right salary and equity for your position.

Bull’s Eye: The Right Offer

With thoughtful attention to these four factors, you can use your negotiation to guide the company to the bull’s eye – the right offer for you. If you see the company using the wrong data, you can bring the conversation back to the truth as you see it and work toward the right outcome.

For more help on these preparations, you are welcome to read the full text of our interview here: The Right Offer – Long Form Q&A Between Stock Option Counsel and BINC Search

Boris Epstein is the founder of BINC Search, a next-generation recruiting startup that helps Silicon Valley companies hire technical talent at the scale they need.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Learn how startups determine the right equity stake offer for new hires.

Negotiating the Right Job Offer – Long Form Q&A Between Stock Option Counsel and BINC Search

Read the full Q&A between Mary Russell and Boris Epstein. It’s full of insights on how to negotiate the right compensation offer from a startup.

Mary Russell counsels individual employees and founders to negotiate, maximize and monetize their stock options and other startup stock. She is an attorney and the founder of Stock Option Counsel.

Boris Epstein is the founder of BINC Search, a next-generation recruiting startup that helps Silicon Valley companies hire technical talent at the scale they need.

Thanks for reading our shorter blog post: Bull's Eye - Negotiating the Right Job Offer. This is the full Q&A between Mary Russell and Boris Epstein. It’s long, but it’s full of lots of insights on how to negotiate the right compensation offer from a company.

Boris Epstein is the founder of BINC Search, a next-generation recruiting startup that helps Silicon Valley companies hire technical talent at the scale they need.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Mary Russell, Attorney @ Stock Option Counsel: Welcome, Boris. I’ve always enjoyed our discussions on compensation negotiations because you seem to believe that a candidate and a company can discover a “right offer.” Employees who come to me for Stock Option Counsel want to get to that “right offer” for salary and equity, and I’m happy you’ve joined us to share your perspective on how to get there.

Boris Epstein, Founder @ BINC Search: Thank you. I think there is a right offer in a compensation negotiation, and companies and candidates arrive there by identifying four data points:

1. The candidate’s Past Comp

2. The Peer Comp of the candidate’s level within the company

3. The candidate’s Desired Comp and

4. The Market Comp or competitive scenarios in the market

The epicenter of all the different data points would be what they would arrive at to get a right offer. So if all four numbers align, it’s really easy. If the four numbers are divergent in some way, then someone’s going to have to make tradeoffs and concessions. If the person’s making $100,000 but then they want $200,000, and market’s $150,000, someone’s going to have to make a tradeoff somewhere to arrive at the right package.

Stock Option Counsel: Let’s talk about each of those numbers.

BINC Search: For Past Comp, the company will look at the person’s situation to figure out what the offer would realistically have to be in order for it to be correct or acceptable. For Peer Comp, usually a company will look at internal equity, the peer class that the person would fall within at the company. Desired Comp would be what the person wants. Regardless of all the other indicators – it’s the “this is what I want” number. Market Comp would be the company’s understanding of what’s “market” for this type of individual and this person’s competitive scenarios or other offers.

Stock Option Counsel: Thanks. I think that gives candidates some information to broaden their sell and build their negotiation beyond a single data point. I’ve seen candidates who fear that their weakest points – their Past Comp as current salary or their Market Comp as lack of other offers – will define their final offer. But this conversation is a great reminder that there are many relevant numbers and many ways candidates can sell themselves. Let’s go on into the details of how the company finds the right offer.

Past Comp

Stock Option Counsel: On Past Comp, candidates often want to stick to the rule of, “Don’t reveal your current salary.” How can a candidate communicate Past Comp without starting out at a disadvantage?

BINC Search: I think a candidate should be stating their Past Comp up front when asked. This would be at the beginning of a process, if and when asked by the company. And then if and when asked by the company they should be divulging their either desired range or at least expectations for comp up front as well. And then it doesn’t need to be discussed until both parties know they want to work together. So I don’t agree with that rule of thumb about not divulging comp up front.

Stock Option Counsel: So how does Past Comp go into the company’s calculation? Are they just going to say, “Oh, you’re making that. So we’ll pay you a little bit more than that”?

BINC Search: Sometimes, yes. It’s a data point, that’s an important kind of measurement of you – you who are asking to be priced – was previously priced. That’s exactly what your Past Comp is. It’s a data point that tells a company how you were previously priced. That then becomes an indicator for how to determine your next package.

My recommendation to candidates is to be open and transparent with regards to comp. I’ve had debates with candidates about this and the common reason to not share comp is because that might hurt their ability to derive an offer. Whereas a company would typically look at someone who did not want to divulge comp as a candidate hiding something. So that that then surfaces as a different red flag that then becomes another topic of discussion – “What’s the person hiding? And why doesn’t the person want to share. Everyone else shares. What should I now be concerned about that I wasn’t previously concerned about?”

Stock Option Counsel: Is it really seen that negatively?

BINC Search: I’ve seen companies not extend offers to candidates who didn’t want to disclose comp.

Stock Option Counsel: So assuming the person is going to disclose it and fears it will lower their final offer from the company, what’s the way to make the case for why that data point is no longer the key relevant data point?

BINC Search: I think the means by which it is shared is the exact way to do it. Let’s say you worked at a company for ten years and you got an initial offer for $100,000 and then you didn’t get a raise for ten years. So then the company says your potential future employer says, “Hey, what’s your Past Comp?” And you say, “Well, it was $100,000. But I should let you know that I was offered this salary ten years ago and I haven’t gotten a raise in ten years. My understanding would be that market has shifted a little bit in the last ten years and that part of this process is to kind of figure out to what degree that has actually happened. So I’d just like you to know that wherever you’re taking these notes, that this was an offer that was given to me ten years ago. And now we can use it for whatever purpose you guys want to use it for.”

Stock Option Counsel: Can you think of any other ways to build the case that the Past Comp should not determine the right offer for the new position?

BINC Search: Whatever color you could add to the picture I think would be a helpful addition. That’s what the company’s looking for when they ask for Past Comp. They’re looking for some sort of data point to help them get to a decision. They’re not trying to screw you. They’re not trying to make a case to like drill you down or whatever. They’re trying to figure out the right offer so it’s helping them for a candidate to add color to it. Sometimes people add color like, “My current salary was $100,000, but I was given that a year and a half ago. I’m up for review in six months. I’m anticipating a raise to $110,000 – my manager promised me I swear – so I’m at $100,000 now but I’ll probably be at $110,000 in six months. Take that for whatever you want to take it for. That’s my comp history.”

Stock Option Counsel: That sounds really useful in using spin to avoid being tied to an otherwise disadvantageous Past Comp number. From a Stock Option Counsel perspective, I would see a candidate’s spin of Past Comp should include their valuation of their equity stake in their current company, the value of upcoming vesting they would be sacrificing to take the position and even the value of upcoming increases in equity grants or liquidity opportunities.

Peer Comp

Stock Option Counsel: Do you have any thoughts on Peer Comp, as in what is the best way to position oneself in that regard during the interview process?

BINC Search: For Peer Comp, companies internally are going to say, “Ok, this person who I just interviewed is going to fit in at this level, and the other people within our org that are paid at this level are making about this much. So therefore, this is about the range within which this person should be paid here.”

A candidate should be making sure that they’re being connected to the right peer class. They do this by just asking for some perspective around where they’re being considered, like where they’re fitting within the organization and what the expectations are for that level of a person. If I’m a fresh college grad and I ask that question and the company is comparing me to people with ten years of experience, that’s good because if I do well I’m going to get paid like people with ten years of experience. But if not then I may be put into an inaccurate peer class. That’s an extreme example, but making sure you’re being compared to the right peer class is a data point.

Stock Option Counsel: I know people are very concerned when they come into a company that they’re being considered for a position that’s appropriate for them and where they want to be. What do you advise people when they’re concerned that they’re not being considered in the right peer class? Once that emerges, is it too late, or can they make the case later and say, “Hey, let’s reconsider where I would fit in here.”

BINC Search: You can, to whatever degree it’s reasonable to do that. Information is going to drive that, so whatever information the company has to help the candidate understand why and where they’re fitting in is going to be one side, and the other side is going to be whatever information the candidate has that can help the company understand kind of where and why they should be there. So that’ll just be kind of the natural progression of the conversation.

Stock Option Counsel: Where and why would it be reasonable to go back and do a better job of selling oneself?

BINC Search: Well, the company may say, “Well, we’ve interviewed you, and we think you’d be a great fit on this team and on this level.” And the person will say, “Oh, that’s really nice. One thing that I wanted to bring up is that I heard about this team and this opportunity and I thought that might be a good place for me to fit potentially. That seems interesting.” So that would be the way a natural dialogue might go. Depending on what side and to what openness the company might say, “That’s good that you think that, but this is where we think you should be and why.” And the candidate will say either, “I’m open to both,” or they’ll say, “It’s nice that you think that, but this is where I want to be.” And there will be a discussion around it.

Stock Option Counsel: Do you have any advice for people on how to talk themselves up in an appropriate way and in a true way? This would be necessary to align themselves with the right peer group in the company and get themselves put in the right place for who they are and what they offer. I think that the worst thing would be to take an offer where you’re not valued and then just be stuck there for a while and then leave.

BINC Search: Yah, but then think about the other worst case of being leveled too high. And then having an inappropriate amount of expectation put on you that you’re not ready for. And you got that because you negotiated really well and sold yourself high, but now you’re in this job that you can’t do essentially. Right? So that’s the other side of the coin for like negotiating too high or for or asking for too big of a job.

I’d argue that the right resolution is to fight for clarity and understanding of roles and levels and opportunities and just be pretty true about where you can fit and add the most value. And try to be as eloquent and clear about that as you can be. So I’ve seen both sides, people who are under-leveled and then have to be popped up quicker and then people over-leveled and then it being a negative experience for both sides.

Stock Option Counsel: If someone’s selling themselves into a higher spot and the company settles on a lower spot, is it fair for the company to say, “We’ll reevaluate in six months or a year”?

BINC Search: That’s a reasonable concession that could be made. Like, “Hey, I understand that you want to be at this level. Our evaluation has not helped us believe that you’re there right now. But I appreciate your confidence. Why don’t we start you here, and in six months we can reevaluate you and if what you say is correct, then we should all have no problem helping you get to that level.”

Stock Option Counsel: Excellent. We’ll talk more later about how to approach those raise or promotion conversations.

Desired Comp

Stock Option Counsel: Can you give some examples of professional ways to communicate Desired Comp?

BINC Search: Usually it’s in the form of a conversation. Like the company will say, “Hey, what are you making right now?” And the person will say, “I’m making this.” And then the company will say, “What do you want to be making in your next job?” And the person will say, “This is what I want to be making.” And then if there’s alignment from an expectations perspective, then everyone thanks each other and moves on to the next topic.

That’s the way it should go. I don’t know how it always goes. Some companies never ask, and then sometimes it works out at the end and sometimes they get surprised and then that’s not a good thing. Sometimes candidates offer the information if the company doesn’t ask. And the company will thank them for it and then move on. Sometimes candidates will share this information or it will be discussed and then the company will decide to not move forward based on a misalignment. I guess those are a few scenarios that could take place.

Stock Option Counsel: You’ve mentioned that it’s difficult when a candidate doesn’t know what their Desired Comp is – when they’re at the end of the road and still don’t know what it is that they want. And Desired Comp is a big part of my Stock Option Counsel practice as a thoughtful, high-level understanding of the company’s equity helps candidates identify what equity offer they want to see. What do you suggest to help people identify that Desired Comp number?

BINC Search: There’s two points where Desired Comp is important. Up front in the beginning of a process you want to at least have an idea. It’s difficult for a candidate to know exactly what they want up front. Because their market experience is going to influence what they should want. So be up front before a candidate goes through an interview process if they’re making $100,000, it’s difficult to say I want $115,000. Some say, “This is what I want.” But then that’s immaterial because when they go through an interview process market is going to influence that potentially.

Whereas at the end after they’ve done a reasonable amount of due diligence on the opportunities they are considering, they should be able to start putting price tags on different opportunities should they work out. That’s the natural exercise that candidates should be going through. “Okay, this is starting to get close to home, what would they need to offer for me to accept? What would this package need to look like? What would it realistically take for me to leave my job?” It’s when things start to get realistic that they should start to be narrowing down to a Desired Comp.

Stock Option Counsel: So would you say that Desired Comp question would be “What does it take for you to leave your current job?”

BINC Search: Everyone has a “what’s this worth to me” scenario. They just need to understand kind of what it is. So Desired Comp is like, “What it would take for someone to not do something and in exchange for doing something?” So if someone’s making $100,000 a year now at a crappy job, and then they interview with a really good job, then the theory should say that for an equal amount of money they would rather be doing a better job than a worse job. That’s like a simple stupid way to come up with a Desired Comp.

Stock Option Counsel: Stupid is good. Go on.

BINC Search: If they’re at a job that they absolutely love and they’re making $100,000, and they interview with a job that is slightly less desirable, that slightly less desirable job would probably have to pay them. Let’s say the slightly undesirable job said, “We’ll pay you $200,000 a year.” Then the candidate says “Wow, okay, I’ll be doing something I like less, but I’ll be getting paid more. Therefore, that equation makes sense for me and my lifestyle. It’s now worth it for me to move forward.” So both are extreme situations, so in this instance in the case of coming up with a Desired Comp, it’s “What’s it worth to me to do this job?” And that’s as kind of pure and simple as a candidate should think about it given whatever circumstances exist in the world.

Stock Option Counsel: Do you have any examples of people who make that decision and are happy with it in that analysis? Or people you’ve seen overvaluing the salary or comp and not thinking enough about the position? Or people who were eventually unhappy because they were thinking too much about the position and not enough about the comp?

BINC Search: I generally recommend that people separate the money from the job when they’re going through their consideration process. Offers and comp packages confuse interest in job. So I always recommend that a candidate evaluate the job first, figure out the job they actually want, stack rank their options, and then start including comp into the equation. If they get the best job at the best comp, it becomes a no brainer. If they get the best job at a reduced comp, they have to make a tradeoff. But at least it’s clear. It’s like a separate kind of line item that they could evaluate.

You also asked about times when candidates have made mistakes. This is where market and transparency and chatter becomes a thing because the candidate feels they did a great job in-- let’s say-- negotiating an offer and then they hear that someone who seems to be a peer or close to their regard is getting something more than they are getting. There is that kind of look over the fence sort of a thing that goes down. They ask, “Hey, how did you get that? Why didn’t I get that?” I try to recommend that candidates don’t go down that route once it’s past decision point. If it’s past decision point, it’s difficult for a candidate to do much about it. It really just causes angst. But it’s a hyper-transparent market. So you do the best you can given the information you have and you should be at peace with your decisions until the next time.

Stock Option Counsel: I agree on separating the desire for the compensation from the desire for the job so that the compensation issue gets the full attention it requires. That’s especially important with equity compensation. There’s quite a lot of risk in accepting private company equity, and my Stock Option Counsel clients who take the time to thoughtfully evaluate their equity comp offer can find out: “Is this number of options or shares enough to inspire me to feel really, really good about taking those risks? If not, what would they have to offer to get me to that good feeling?” It’s a lot easier to negotiate from a position of confidence about what you desire and why.

Market Comp

Stock Option Counsel: How do you suggest candidates avoid being in the position where they’re looking over the fence and seeing that their neighbors are earning more than they are?

BINC Search: Well, you can’t avoid it. At the pace that this market is moving, there are always going to be better options, there are always going to be new options that surface that didn’t exist two days ago when you had to make a decision. It’s just generally going to happen. That’s why time of employment has started to go down. It used to be five years, then it was three years, now we see companies being open to hiring someone on a full time basis knowing that in a year or a year and a half they’ll reevaluate their options. That’s just what’s happening with the market. So companies make decisions based on the information they have, and so do candidates. There’s nothing you can do to not go through that experience.

Stock Option Counsel: Do you have a feeling on how quickly that shift in time of employment has happened?

BINC Search: Seven to ten years ago, five years used to be good tenure at a company. Then five to seven years ago, three to five years was a reasonable length of time. Now I think two to three years would be considered – not reasonably long term – but the reasonable expectation by which a candidate makes their employment decisions. While companies would love for their employees to retire with them and be with them in ten years, I think a lot of companies have a hard time knowing where they will be in five years or ten years or whatever time frame it is they want their employees to be with them. So I think everyone is in constant reevaluation. Everyone – companies and candidates – are in a perpetual evaluation of their situation mode, which generally makes for a great dynamic market in my opinion. It puts everybody in a place of accountability. Employers for their ability to employ and retain, and employees for their ability to perform and deliver, which is I think correct.

Stock Option Counsel: Interesting. Time of employment is also very relevant to equity compensation. If candidates are accepting four-year vesting terms in their stock options or are receiving stock options with high exercise prices, they need to be aware that they may not be vesting the full grant before departure and that if they leave the company they may have to come up with the cash to cover the exercise price and tax bill.

Going back to the question of Market Comp, do you have any thoughts on the best way to approach a current employer to reevaluate comp or talk about a raise?

BINC Search: Reevaluation of package? I think that the truth is that anytime there’s new data to be presented is a reasonable time and opportunity to have a conversation around comp. So the way this tends to infuse itself in the world most commonly is a candidate gets employed by company with the belief that he’s going to be there for three years. And then six months into it someone happens to call him and offer him a job for double the price. And then the person all of a sudden is victim to this huge offer and now wants to “do right” by this situation they’re in. So this person goes to their boss and says, “Hey, I didn’t mean to do this, but I have an offer for twice my salary now because this happened. So I just wanted to tell you.” So then the current employer says, “Oh, let us see if there’s something we can do to help.” And then there goes the counteroffer situation. That’s natural and what happens pretty regularly in today’s market. So anytime a new data point surfaces that would be worth reopening a comp conversation would be when it should happen.

Stock Option Counsel: The classic relationship wisdom is that you’re bound to be stuck in a bad relationship if you don’t have the courage to say along the way, “Hey, you know this or that isn’t working for me.” Do you think that those people who fail to keep bringing the data points forward to their employer end up angry and frustrated with their low comp?

BINC Search: Yah, there are people who don’t feel comfortable sharing this information and then kind of perpetuate the misery that they’re in or perpetuate the unhappiness that they are in. Yah, there are definitely people who are in that boat.

Stock Option Counsel: Do you want to talk more about that?

BINC Search: No, I honestly don’t really. People should do whatever they feel is right to do. For some people it’s worth it for them to keep their mediocre job with mediocre comp because that’s what’s fitting for their lifestyle. And then other people feel the need to go maximize their opportunity. I think it all evens out in the end. I don’t think people must go and chase top comp. I don’t think people must always be benchmarked to top of market.

Stock Option Counsel: How do employees make the case for what is Market Comp for their contribution? Generally, how do you describe Market Comp to your candidates?

BINC Search: This is a tough one. Market is when you usually derive competitive situations. That would be like a “market rate.”

If you go interview with five companies and all five companies extend you an offer for $150,000, it could be argued that your market value is priced somewhere around $150,000. If you’re making $100,000 now and all five companies offer you $250,000, regardless of what you’re Past Comp is, your market value is about $250,000. So whatever you’re able to kind of able to get from the market is about what market rate is for you.

Stock Option Counsel: Do you want to flush out what a market is?

BINC Search: Literally a market is like, picture an old world market where you walk from stall to stall and every stall is selling something. So if you have a product, and the product is a Snickers bar. And you walk around to 20 different stalls and say, “How much would you pay for this, how much would you pay for this?” And everybody says, “I’ll pay you a dollar.” Then that Snickers bar is worth a dollar. That’s “market” for that Snickers bar.

If you walk around to 20 different companies and ask every company, “How much would you pay me to work here?” And every company says $150,000, your market is $150,000. You may not like it, but that’s what market is for that person.

Stock Option Counsel: Of course that wouldn’t be realistic, as $150,000 is not going to come from every company. So how does it work in the real world now where there’s a lot of variation.

BINC Search: I don’t think there’s as much variation as people perceive there to be. I think the variation comes from the mis-bucketing of market points. So seed funded startups tend to pay pretty consistently. A-round funded startups tend to pay pretty consistently. And down the line to B-round funded startups, etc. So depending on the size and maturity of a company, there tends to be a reasonable amount of consistency with those types of companies. So if you interview with ten big companies you’re going to find there to be some reasonable level of consistency with that bucket of companies. There could be companies that are out of market for what a big company pays this type of individual. But there is a market for a type of person within a type of company.

Stock Option Counsel: I’ve heard employers argue that there is no such thing as market or that this is too subjective of a number to discuss. Can you talk about how the employees can identify what those points are? How do they know they have it right?

BINC Search: How do they know what market is? The only way to know is to actually go to the market and try to derive that information. They either have to collect that by going out and getting offers themselves or they have to collect data from their friends who got offers. But they should take that with a grain of salt because they are not their friends. That is a way to do it. Some people will go look at comp calculators online. I advise against using that as fact, but it is a data point. I don’t use any of them or endorse any of them. It’s not something that I would use to help determine any of this. But a candidate can to get some kind of idea of what some type of job is paying.

If a candidate interviews in the dark, then they don’t know what the market is. They wouldn’t know what it is. They may ask the recruiter what market is. They may ask another professional, like yourself, what market is. Getting some sort of sense of market is the only way they can get that data.

Stock Option Counsel: That’s great. What are you thoughts on equity comp and market? When you have a candidate who is interviewing and comparing equity comp, what kind of thoughts do you share with them on what’s appropriate for which stage of company? What do you say when someone asks you, “Is this right, is this fair, is this market for equity comp at this stage of company?”

BINC Search: In the position that we’re in, we have the luxury of being pretty connected to market. So we can give a candidate a pretty good idea of how on target – low on target or high something is in comparison to their position in the type of company. Same would go true for equity. We can recognize that and then advise accordingly.

How would a candidate figure that out? They would have go to through the same exercise. They have to use their Past Comp, if they have historically received certain sized grants or option packages from different companies, then that should be an indicator. They should be educated by the company around how the company benchmarks their level internally for that piece of the comp package for the Peer Comp. And then they should do their market homework.

Stock Option Counsel: I think Market Comp and comparing offers is where Stock Option Counsel and thoughtful attention to equity are essential. One percent of a Series A company and ten percent of a Series A company could be of equal value – “Market Comp.” I advise clients to take the time to evaluate and compare the equity offers and really own this process, because the companies are not able to make these evaluations for them any more than they can choose the right job for a candidate.

Do you have any final thoughts that you’d like to share?

BINC Search: I don’t know if I offered enough magic bullets. I don’t know if the goal of this is to have a magic bullet or to just perpetuate the conversation.

Stock Option Counsel: I think the goal is just to talk about things that are true. There’s much fear in compensation negotiations and people seem to feel they’re working against a secret formula or system that’s being used against them. It’s good to hear some truths about that system from someone who deals with this every day and say, “This is how to approach it and stand on the ground to be true and honest and effective.”

For the concise version of this conversation, see Bull’s Eye: Negotiating the Right Job Offer.

Boris Epstein is the founder of BINC Search, a next-generation recruiting startup that helps Silicon Valley companies hire technical talent at the scale they need.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Negotiating Equity @ a Startup – Stock Option Counsel Tips

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Negotiating an offer from a startup? Here's some tips.

1. Know How Much Equity You Want

For employees early in their careers, the only negotiable terms for equity are the number of shares of stock and, possibly, the vesting schedule. The company will already have defined the form in which you will earn those shares, such as stock options, restricted stock units or restricted stock.

Your task in negotiating equity is to know how many shares would make the offer appealing to you or better than your other offers. If you don’t know what you want for equity, the company will be happy to tell you that you don’t want much.

Your desired number of shares should be the result of thoughtful consideration of the equity offer. There is no simple way to evaluate equity, but understanding the concepts and playing with the numbers should give you the power to decide how many shares you want.

One way to compare offers and evaluate equity is to find the current VC valuation of the preferred shares in the company. If a VC has recently paid $10 per share for the company’s stock, and you have been offered 10,000 shares, you can use $100,000 to compare to other offers. If another company has offered you 20,000 shares, and a VC has recently paid $5 for their shares, you could use those numbers to compare the offers. For more info on finding VC valuations, see: Startup Valuation Basics or contact Stock Option Counsel.

Remember that the purpose of this exercise is not to have a precise dollar value for the offer, but to answer these questions: How does this offer compare to other offers or my current position? What salary and number of shares at this company would make this a stable, sustainable relationship for me? In other words, will this keep me happy here for some time? If not, it is in nobody’s best interest to come to a deal on that package.

For more information on negotiating equity, see our video: Negotiate the Right Stock Option Offer or our blog with Boris Epstein of BINC Search: Negotiate the Right Job Offer.

2. Look for Tricky Legal Terms That Limit Your Shares' Value

There are some key legal terms that can diminish the value of your equity grant. Pay careful attention to these, as some are harsh enough that it makes sense to walk away from an equity offer.

If you receive your specific equity grant documents before you are hired, such as the Equity Incentive Plan or Stock Option Plan, you can ask an attorney to read them.

If you don’t have the documents, you will have to wait until after you are hired to study the terms. But you can ask some general questions during the negotiation to flush out the tricky terms. For example, will the company have any repurchase rights or forfeiture rights for vested shares? Does the equity plan limit the kinds of exit events in which I can participate? What happens to my equity if I leave the company?

3. Evaluate the Equity’s Potential

Evaluate the company to know how many shares would make the equity offer worth your time. You can start by asking the company some basic questions on their expectations for future growth and the exit timeline.

The higher your rank in the company and the stronger your emphasis on these matters, the more likely you are to speak to the CEO, CFO or someone else at the company who can answer these questions. If you want more resources to help you think like a startup investor, there are great online resources on valuation, dilution and exits for startups.

But don’t place too much weight on the company’s predictions of the equity’s potential value, especially if those values are based on an early-stage company’s Discounted Cash Flows (DCF). Even the experts know that the only thing early stage startups know about financial projections is that they are wrong.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Stock Option Counsel Tip #1

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Use @angellist to research "market" equity for your company size. https://angel.co/jobs #equity #negotiation #startup

Exercising an Incentive Stock Option (ISO)? Should You Hold the Stock?

This is a guest post from Michael Gray CPA. He counsels individuals on their employee stock option tax questions. For more employee stock option tax resources, see Michael Gray, CPA's Option Alert at StockOptionAdvisors.com.

When you have decided to exercise an incentive stock option (ISO) and consider the federal alternative minimum tax (AMT) and the net investment income tax, the benefits of holding stock after exercising an incentive stock option are reduced. The "brass ring" of having the gain from the sale of the stock eligible for long-term capital gains rates (15% or 20%) seems attractive, but the 28% alternative minimum tax rate applies

for the excess of the fair market value of the stock at exercise over the option price ("spread") when the option is exercised. (California also has a 7% alternative minimum tax. Find out the rules for your state.) The minimum tax credit for this tax "prepayment" is hard for many taxpayers to recover, because they are already subject to the AMT, due to deductions disallowed for the AMT computation, including state income taxes, real estate taxes and miscellaneous itemized deductions. That means the "spread" at exercise is probably

going to be taxed at a 28% federal tax rate when the dust settles.

In addition, long-term capital gains are subject to the 3.8% net investment income tax when the taxpayer has high adjusted gross income. That means the total federal tax rate for the initial spread would be 31.8%, versus a maximum federal tax rate of 39.6%. Is an 8% tax benefit worth the risk of exposure to market volatility of the stock? It could fall much more than that.

The main time it makes sense to hold the stock is when the "spread" is low and the option price is low. Then you can probably afford to pay for the stock and AMT (if any) and to take the risk that the value of the stock could fall. When you do this, you forgo the "time value premium" for the option. If you have the alternative of just buying the stock for about the same price without exercising the option, you will probably be in a better position by doing that, because you will still have the options to exercise if the value of the stock increases with no downside risk for the options.

An alternative is to exercise the option and immediately sell the stock, provided the stock is publicly traded or there is a "liquidity event" such as a sale of the employer company. In that case, the gain will be taxed as additional wages, subject to federal tax rates up to 39.6%, but exempt from employment

taxes such as social security and medicare taxes.

These are general comments. You really should meet with a tax professional familiar with incentive stock options (that's our business!) to discuss your individual situation and have tax planning computations done. To make an appointment with Michael Gray, call Dawn Siemer at (408)918-3162 on Mondays,

Wednesdays, Thursdays or Fridays.

This article was published in the September 24, 2014 Option Advisor Alert. Republished with permission.

From The Daily Muse

Attorney Mary Russell, Founder of Stock Option Counsel based in San Francisco, advises that anyone receiving equity compensation should evaluate the company and offer based on his or her own independent analysis. This means thoughtfully looking at the company’scapitalization and valuation.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Thanks Ji Eun (Jamie) Lee for the mention in The Daily Muse!

“Is This the Right Company?

Investors buy equity in a company with money, but you’ll be earning it through your investment of time and effort. So it’s important to think rationally, as an investor would, about the growth prospects of your start-up.

Attorney Mary Russell, Founder of Stock Option Counsel based in San Francisco, advises that anyone receiving equity compensation should evaluate the company and offer based on his or her own independent analysis. This means thoughtfully looking at the company’s capitalization and valuation. ”

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Skype Repurchase Rights = Vampire Capitalism

I agree that it is unethical as it goes against the expectation of employees as to how their contributions are valued. If they don't know about it before they choose the company, they are making a choice without an essential term of the deal.

And it goes against the most idealistic ethic of Silicon Valley – that capitalism should be used by groups to organize and cultivate their own creative efforts rather than as a tool of vampires.

But it is not illegal. And I've seen worse in my Stock Option Counsel practice (twice this month alone). Congratulations on paying attention.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Quora Question:

What does it say about a company that has a Skype-like repurchase right in their stock option agreement? The company that I work for has a stock option agreement that has a Skype-like repurchase clause (See: Upgrading Skype and Silver Lake to Evil), basically allowing them to buy back exercise stocks at 1.5x FMV within 90days following the employee's end date/exercise date. I have never seen anything like this, is this to protect them/screw ex-employees? It basically mean my vested stocks can be easily bought back at 1.5x? Isn't it unethical?

Stock Option Counsel Answer:

I agree that it is unethical as it goes against the expectation of employees as to how their contributions are valued. If they don't know about it before they choose the company, they are making a choice without an essential term of the deal.

And it goes against the most idealistic ethic of Silicon Valley – that capitalism should be used by groups to organize and cultivate their own creative efforts rather than as a tool of vampires.

But it is not illegal. And I've seen worse in my Stock Option Counsel practice (twice this month alone). Congratulations on paying attention.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Best of Blogs: How to Value and Negotiate Startup Stock Options

NOTE: Updated February 23, 2016.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

We have suggested the following free resources to Stock Option Counsel clients to help them master this area and gain confidence in negotiating their stock options and other employee stock.

1. Leo Polovet's' Analyzing AngelList Job Postings, Part 1: Basic Stats & Part 2: Salary and Equity Benchmarks

2. Venture Hacks' I have a job offer at a startup, am I getting a good deal?

3. Andy Payne's Startup Equity for Employees

4. Mary Russell's Startup Equity Standards: A Guide for Employees

5. Wealthfront's Startup Salary and Equity Compensation Calculator (This is very general but people find it helpful.) And Wealthfront's The Right Way to Grant Equity to Your Employees.

6. Patrick McKenzie of Kalzumeus Software's Salary Negotiation: Make More Money, Be More Valued

7. Piaw Na's Negotiating Compensation, from An Engineer's Guide to Silicon Valley Startups

8. mystockoptions.com's How does a private company decide on the size of a stock grant? (You may have to create a login)

9. Michelle Wetzler's How I Negotiated My Startup Compensation

10. Mary Russell's Video Negotiate the Right Startup Stock Option Offer, based on Mary Russell and Boris Epstein's Bull's Eye: Negotiate the Right Job Offer

11. Mary Russell's Joining An Early Stage Startup? Negotiate Your Salary and Equity with Stock Option Counsel Tips

12. Robby Grossman's Negotiating Your Startup Job Offer

13. John Greathouse's What The Heck Are My Startup Stock Options Worth?! Seven Questions You Should Ask Before Joining A Startup

14. David Weekly's An Introduction to Stock & Options for the Tech Entrepreneur or Startup Employee

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Panel Tonight! 500 Startups, Jimeo, Inc., Shea & Company, Gunderson Dettmer, 137 Ventures & Stock Option Counsel

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Thanks for a great event!

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Negotiation Rhythms #3: Sales & Threats

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Mary Russell counsels individual employees and founders to negotiate, maximize and monetize their stock options and other startup stock. She is an attorney and the founder of Stock Option Counsel. You are welcome to contact Stock Option Counsel at info@stockoptioncounsel or (650) 326-3412.

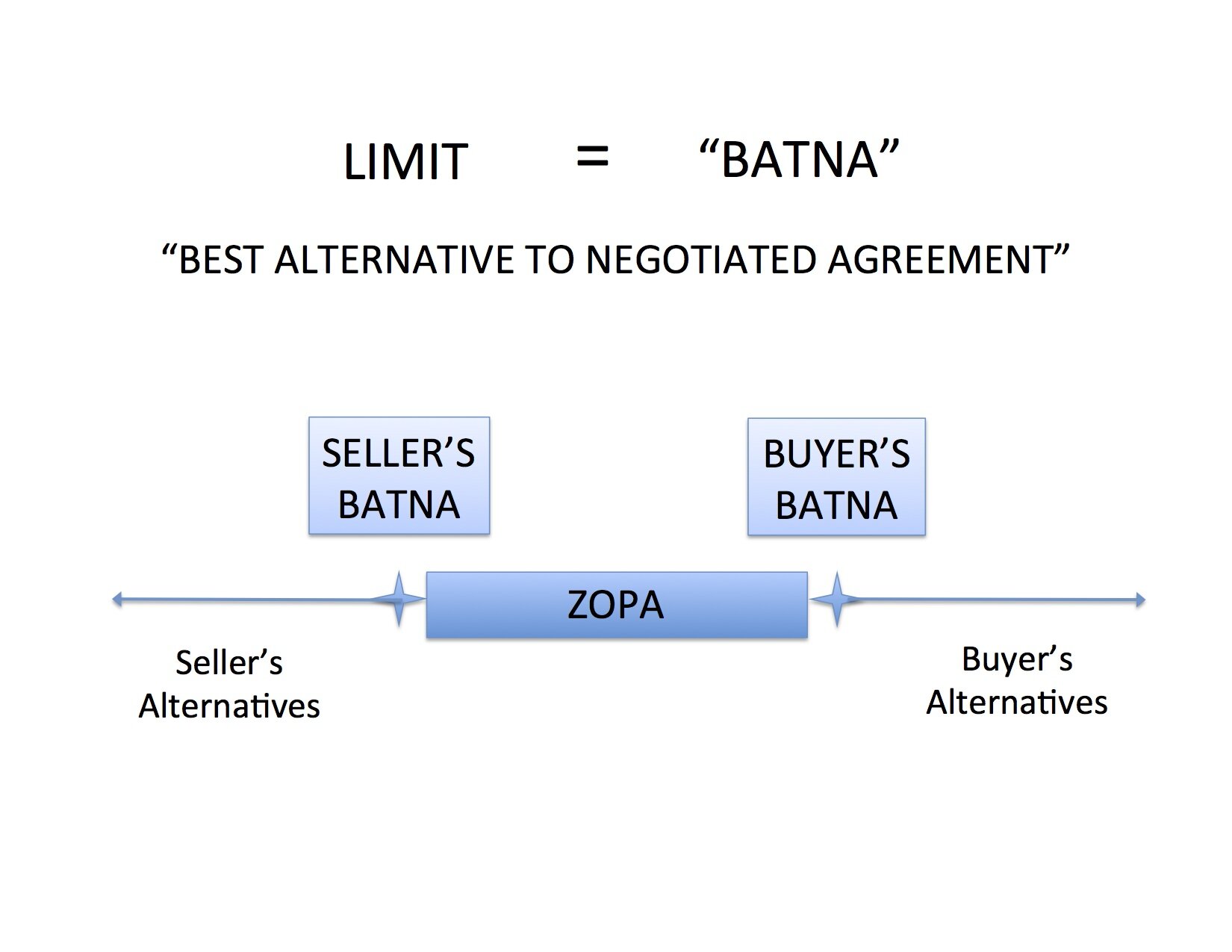

There are two ways to increase or decrease another party’s limit in a negotiation – sales and threats.[1] The picture above takes some of the mystery out of the salesman and the thug -- they're both just working as negotiators to change the perception of the current offer in comparison to the other party's BATNA – Best Alternative to Negotiated Agreement.

Selling improves the perception of the quality of the present offer so that the outside alternatives are unattractive by comparison. Threats decrease the attractiveness of outside offers or the possibility of making no deal and sticking with the status quo.

Threats

An ongoing employment lawsuit over no-hire agreements among Silicon Valley companies featuring Steve Jobs provides a strangely relevant example of the power of threats.

Edward Colligan, former CEO of Palm, has said in a statement that Jobs was concerned about Palm’s hiring of Apple employees and that Jobs “proposed an arrangement between Palm and Apple“ [2] to prohibit either party from recruiting the others' employees.

That would have been a simple offer of an agreement (however illegal that arrangement might have been) if Colligan had access to the undisturbed alternative of not participating and keeping the status quo.

But Colligan has said that Jobs’ next negotiation move was to make the alternative of nonparticipation very unappealing with the threat of patent lawsuits that would cost Palm and Apple a great deal of money. Jobs followed this threat with a reminder of just how unpleasant such litigation would be for Palm, considering the fact that Apple had vast resources to endlessly pursue the lawsuits: "I’m sure you realize the asymmetry in the financial resources of our respective companies …."

Even though most of us don’t use threats in a negotiation, it’s part of the logic of negotiation rhythms.

Selling

Selling is the more common (and generally legal) way to address the fact that the other party has choices outside the present negotiation. As we discussed in the prior posts, a party's price or terms limits are defined by his or her best alternative outside of making an agreement in the present negotiation. Selling moves the limit when it can make the present offer more appealing than what had been perceived as an outside alternative.

Many people resist “selling themselves” in a salary negotiation because they are embarrassed to discuss their “value.” The logic of BATNA and negotiations provides some relief from this embarrassment, for it reframes “selling” from bluffing and puffing to describing and distinguishing one’s past experience and intended role in the organization.

Since the employer’s limit is not defined by an individual’s value, but by the employee’s differentiation from the field of candidates, the task of negotiating becomes more fact-based and less fear-driven. This logic encourages progress from the attitude of “Oh, they see who I am and hate me,” toward the sales approach of “Oh, it seems they need more information about what I offer in terms of my past experience and my role going forward.”

As an employee’s offer of services becomes distinguishable from the employer’s alternatives, the employer’s perception of the BATNA will change.

Consider an employer who believes there’s an equal candidate available for $120,000 and is entertaining another’s proposal to perform the role for $140,000. Without “selling” the offer of one’s services, the employer has no information with which to make a distinction between the two alternatives. The process of selling oneself to the employer is not to prove one’s inner worthiness at $140,000, but to show and tell that the employer is choosing between two distinguishable candidates.

(For those still interested in threats, distinguishing one’s skills is a form of a threat when it comes to negotiating with a current employer. Every element of the description one’s current performance and ongoing role is a threat of what the employer would have to work without or try to replace.)

What an employer would have once considered a better alternative – such as another equal offer for $120,000 – loses its appeal in light of the truth (sales pitch) of the $140,000 offer. If they are no longer equal in the mind of the employer, he or she must consciously decide if the other candidate at the lower price is still a better alternative. While there is no guarantee that the employer will prefer to pay more, the process of selling pushes the employer to the choice based on the true distinctions in the qualities of the candidates.

[1] Roger Fisher, William Ury and Bruce Patton, Getting to Yes: Negotiating Agreement Without Giving In. Gerald B. Wetlaufer, The Rhetorics of Negotiation (posted to SSRI).

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Negotiation Rhythms #2: Best Alternative to Negotiated Agreement

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

We know we want to push beyond our limits to capture as much value as possible in a negotiation. But how do we define those limits? It takes a five-word phrase to bring this concept into focus: Best Alternative to Negotiated Agreement (“BATNA”).

The BATNA for a car buyer might be the same car at a nearby dealership for $20,000. The BATNA for a home seller might be an offer from another party for $1 million. The BATNA for a child trading baseball cards might be to hold onto his favorite cards and enjoy looking at them rather than to trade them away.

Any agreement below (or, for a maximum limit, above) a BATNA would leave the negotiator worse off than in the absence of that particular agreement. Said another way, the negotiator would be better off with some other option – their BATNA – than accepting an agreement on those terms.

To properly identify a BATNA, we must do a lot of calculating, daydreaming, and going out in the world to test alternatives. But this creative process is necessary. When we believe that the only alternative is the one at hand, our negotiation position is dangerously weak. It is also dangerously ineffective because it leads to an arrangement that does not, in fact, make the negotiator better off than without it. And any deal that is not in both parties’ best interests is unstable and likely to collapse after it is made.

Countless factors go into naming and ranking one’s alternatives to arrive at a BATNA, and even then it is impossible to do so clearly as those factors cannot all be outlined in numerical format. A better offer might be less certain of being completed, so it might be more advantageous to make an agreement on less favorable terms today. For example, the other job offer might not be certain even though it appears it would be more advantageous if it were finalized. This is the old saying that a bird in the hand is better than two in the bush, and this can be dangerous for those who optimistically negotiate as if their imaginary alternatives are already in the hand. In the other extreme, this is very limiting for those who are very fearful of uncertainty, as they will accept disadvantageous terms for the simple purpose of having certain terms when a bit of risk in pursuit of a better alternative could have led to greater results.

Timing is important in other ways as well, as a negotiator with more time to come to an agreement will have more chances to find alternatives to the agreement at hand. "Wait and see" becomes a BATNA in itself. The opposite of this would be a party who must have resolution today, which would, of course, limit the alternatives.

Beyond hard limits on time, some people do not enjoy the back and forth process of negotiating. They might prefer to take this deal, and even to accept much less of the middle than is possible to capture, than to continue to seek alternatives or negotiate deals. For these people, the process itself inhibits the growth of BATNAs.

We’ll see in the next post – Negotiation Rhythms #3: Sales & Threats – how brainstorming or eliminating BATNAs changes the ZOPA and improves or weakens our force in negotiation.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Negotiation Rhythms #1: Zone of Possible Agreement

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

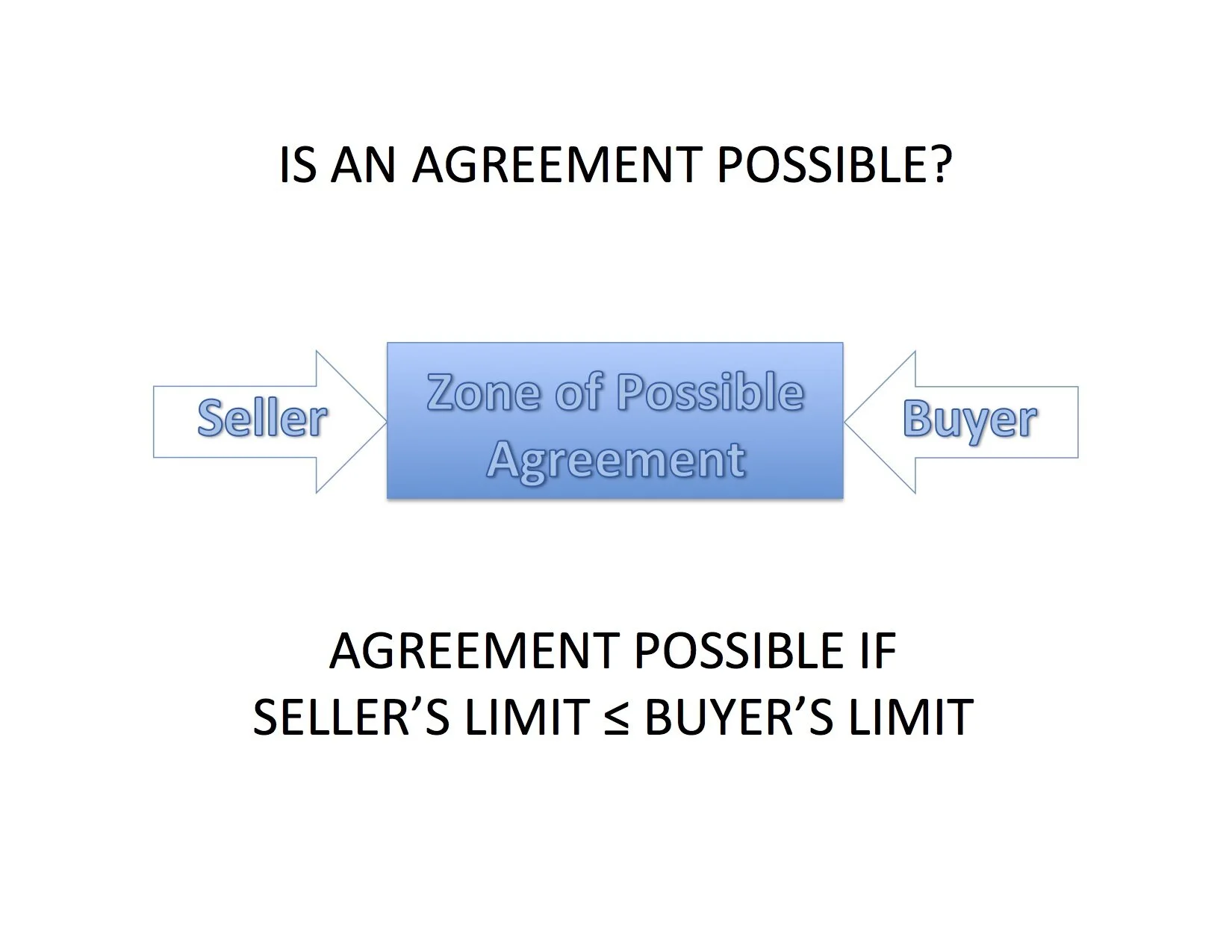

Each party will enter a negotiation with the knowledge of their limits and the desire to make as favorable a deal as possible.

We begin our illustration of the basic negotiation rhythms with the fundamental negotiation question from Harvard Negotiation Project’s classic Getting to Yes[1]: Is there a Zone of Possible Agreement (“ZOPA”) between the limits set by each party?

An agreement is possible if the seller's limit is lower than the buyer's limit. Here's an example:

If an engineer is willing to work for a salary of $100K and a company recruiting that engineer is willing to pay $120K, there would be a ZOPA between $100K and $120K.

However, there would be no ZOPA if the amounts were reversed and the company would not offer more than $100K and the engineer would not accept less than $120K.

Capturing the ZOPA

Presuming that there is a ZOPA, the seller will want to sell for as much over the seller’s minimum as possible, and the buyer will want to buy for as much below the buyer’s maximum as possible.

It would be best for the seller to settle on a price at buyer’s maximum and for buyer to settle on a price at seller’s minimum.

Each is free to try to capture as much of the amount within the ZOPA as possible, especially if they do not know one another’s limits.

Hiding the ZOPA

The danger comes when one or more parties push so hard to settle on an agreement well above their minimum or below their maximum that they fail to discover that there is a ZOPA between the parties.

For example, the engineer would be at an advantage in the first example above if she convinced the company that she would not accept a salary below $120K. By pushing for $120K, she might end up with the maximum possible salary available from the company. However, she would end up with no deal at all – and have missed the chance to make a desirable agreement at somewhere between $100K and $120K – if she convinced the company she would take no less than $125K.

The opposite is also true. If the company convinced the engineer that they could offer no more than $95K, they would have convinced the engineer that there was no ZOPA and killed the deal.

ZOPA Conclusion

Each party has two conflicting goals in a negotiation:

1. Transparency: To discover a possible point of agreement, if one exists. This requires each party to be transparent enough about their limits that the parties can identify whether there is a ZOPA. If the parties kill the deal, they will have sacrificed the value of a beneficial agreement.

2. Ambiguity: To settle on a price that is as close to the other party’s limit as possible. This requires each party to be ambiguous in communicating their limits to encourage the opposing party to believe the ZOPA and their potential gain are smaller than they actually are. If a party settles at their limit, they will have sacrificed the benefit they could have captured by pushing to settle closer to the other party's limit.

Our next post, #2: Best Alternatives to Negotiated Agreement, illustrates how negotiators set their limits. Post #3: Sales & Threats shows the flexibility of the pattern by illustrating how negotiators use sales techniques to change the other party’s limit.

[1] Roger Fisher, William Ury and Bruce Patton, Getting to Yes: Negotiating Agreement Without Giving In.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

Negotiation Rhythms

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

We’ve all heard plenty of advice about negotiating.

The business world directs us to stay rationally focused, rely on exhaustive preparation, think through alternatives, spend less time talking and more time listening and asking questions, and let the other side make the first offer.[1]

The psych world counsels us to listen first, sit down, find common ground, move in, keep cool, be brief, forget neutrality, avoid empty threats, and don’t yield.[2]

These tips don’t have much meaning without knowing the underlying principles of negotiations, and studying tips alone is about as meaningful as learning dance steps without ever hearing the music.

The following three-part series presents the rhythm of negotiations as described in the Harvard Negotiation Project’s Getting to Yes: Negotiating Agreement Without Giving In.[3] It should be useful for those first learning to hear this rhythm and for those who have been dancing since the bazaars of their youth who may need to go back to basics to learn some tricky new steps.

Read on!

#1: Zone of Possible Agreement

#2: Best Alternatives to Negotiated Agreement

#3: Sales & Threats

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

[1] Take It Or Leave It: The Only Guide to Negotiating You Will Ever Need http://www.inc.com/magazine/20030801/negotiation.html via @Inc

[2] The Art of Negotiation | Psychology Today http://www.psychologytoday.com/articles/200701/the-art-negotiation

[3] Roger Fisher, William Ury and Bruce Patton, Getting to Yes: Negotiating Agreement Without Giving In.

Startup Stock: Particles and Waves. Casinos and Creativity.

Photo: Bobby Mikul

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.

What is a corporation? Finance pros and justice types present two very different answers to that question.

On the finance side, a corporation is a casino-style financial arrangement between those who own stock. It divides up the rights to a financial return on capital. It emphasizes balance sheets and stock prices and risk and return to support the view that each corporation is a table in a casino that investors approach to place their investment bets and seek a financial return.

On the human advocacy side, a corporation is a living body made up of creative individuals. The liveliness of the group – defined to include investors, managers, employees, and, perhaps, the community or the earth – is the purpose of the corporation. They make comparisons to slavery, define externalities and articulate their values to support their view that a corporation is a living body that could not be owned.

Like a ray of light, which is at once a wave and a group of particles, the corporation is both a casino game for investors and a living, creative body. Evidence will always appear on both sides of this truth.

In choosing a career path and negotiating compensation, we use both perspectives. We find a place that has some life to it, to which our creative contribution can add life. But we tune into the casino view as well and seek compensation for the risk we take in joining the enterprise. This requires the eye of an investor who would look at the risks of the bet and the size of the possible return from every angle with the help of professionals in law, finance, technology, etc.

It would be distasteful to take this view of our work every day, but it must be done at some time. And it is best done with Stock Option Counsel. This blog will introduce the Stock Option Counsel perspective on the risk / investment that employees take / make in accepting stock options or other equity as compensation. It should be helpful to those evaluating their compensation and also reveal the points in time in which Stock Option Counsel can add value in this process.

Attorney Mary Russell counsels individuals on startup equity, including:

You are welcome to contact her at (650) 326-3412 or at info@stockoptioncounsel.com.